DIY Investor Magazine

|

June 2017

12

JUNE MARKET

SEASONALITY EFFECTS AND ANOMALIES

The latest edition of Stephen Eckett’s fascinating reference book may have you scratching your

head in search of a rational explanation for what is presented, but one thing is for sure, you’ll

return to it again and again as 2017 unfolds.

THE UK STOCK MARKET ALMANAC 2017

MARKET PERFORMANCE THIS MONTH

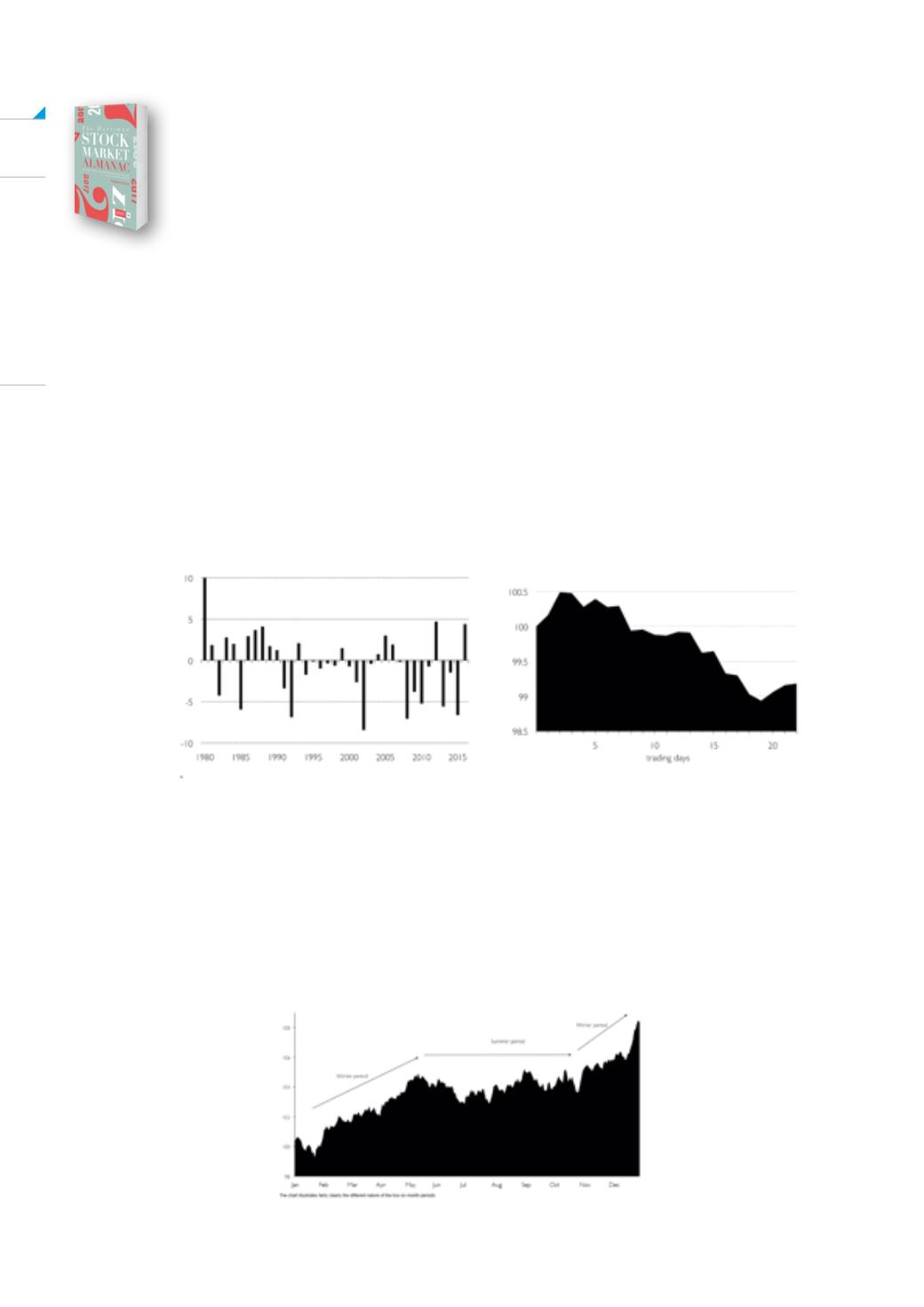

June is not a good month for shares; historically, the

May/June has been the weakest two-month period in

the year for the equity market. On average, the market

has fallen 0.9% in June and the probability of a positive

return in the month is a lowly 39% – ranking it 11th of all

months in the year.

Since 2000, the situation has been even worse with the

average return in the month -1.7%, and market falls can

be quite large; the market has fallen over 3% in June in

eight years since 1982.

In an average June the market starts strong, hitting

its month high on the second or third trading day, but

prices then drift down steadily for the rest of the month

(the third week is the second weakest of all weeks in

the year). The market does tend to end the month on a

positive note – the last trading day is the third strongest

in the year.

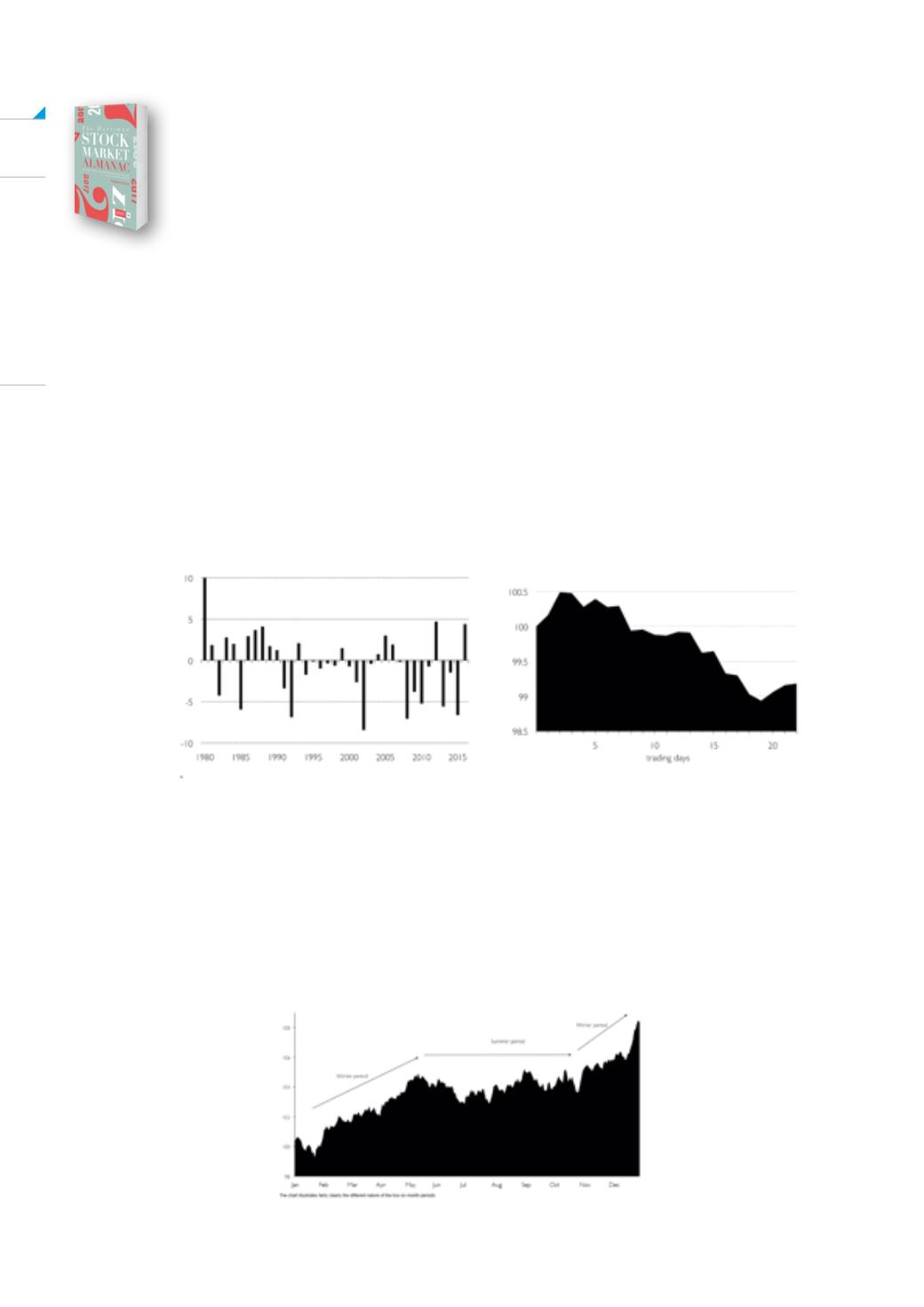

SELL IN MAY AND COME BACK... WHEN?

The original saying goes ‘sell in May and go away, don’t come back till St Leger Day – the last big event of the

UK horse-racing calendar and usually takes place in mid-September. A complementary anomaly, originating in

the US, is the ‘Halloween Effect’ which holds that stocks see the bulk of their gains in the six-month period 31st

October to 1st May. Somewhere along the line ‘sell in May’ and the Halloween Effect merged to become one, such

that the summer period of (relatively) poor returns ends on 31st October.