DIY Investor Magazine

|

June 2017

16

AN INTRODUCTION TO SOCIAL

RESPONSIBILITY INVESTING WITH ETFS

Dominique Riedl

CEO, justETF

Can our portfolio choices do the power of good to the

environment and society as well as our personal wealth?

SRI investors believe so...

If you like the idea of aligning your investments with your

values then take a look at Socially Responsible Investing

(SRI) ETFs.

SRI indices track firms that take a positive approach

to environmental, social and corporate governance

(ESG) issues. That can mean anything from firms

producing green tech or actively managing their carbon

footprint to favouring companies that promote ethical

and sustainable business practices. SRI indices are

also likely to exclude so-called sin stocks - firms up

to their neck in the alcohol, tobacco, arms, gambling,

pornography, fossil fuel and nuclear industries, among

others.

Although SRI is a fast-growing sector, the idea of

influencing society through investing is not new.

IN GOOD COMPANY

The Quakers are often credited as the original SRI

investors after they forbade their members to profit

from the slave trade in the 18th Century. Other religious

organisations have worried about ill-gotten gains too

and regularly used the pulpit to steer their flocks away

from vice like liquor and guns.

The Anti-Apartheid movement further hastened the

emergence of SRI. Strong financial players such as

universities, cities, pension funds and faith-based

institutions screened out South African companies from

their portfolios in a bid to ratchet up political pressure on

the regime.

The SRI sector has blossomed ever since as more funds

arrived enabling investors to direct their cash towards

green themes such as clean energy or water and,

increasingly, towards broad-market SRI ETFs.

According to UBS, around $20 trillion of ESG assets

were held by major financial institutions, venture

capitalists, high net-worth individuals and small

investors in 2014. That number is only likely to

increase as many market participants believe that ESG

companies are best placed to meet the challenges of

the future - think pension funds reducing their exposure

to fossil fuel firms, for example. There’s also evidence

that millennials and women are increasingly interested

in SRI too – Morgan Stanley found that 70% of females

and 84% of millennials believed that ESG factors were

important.

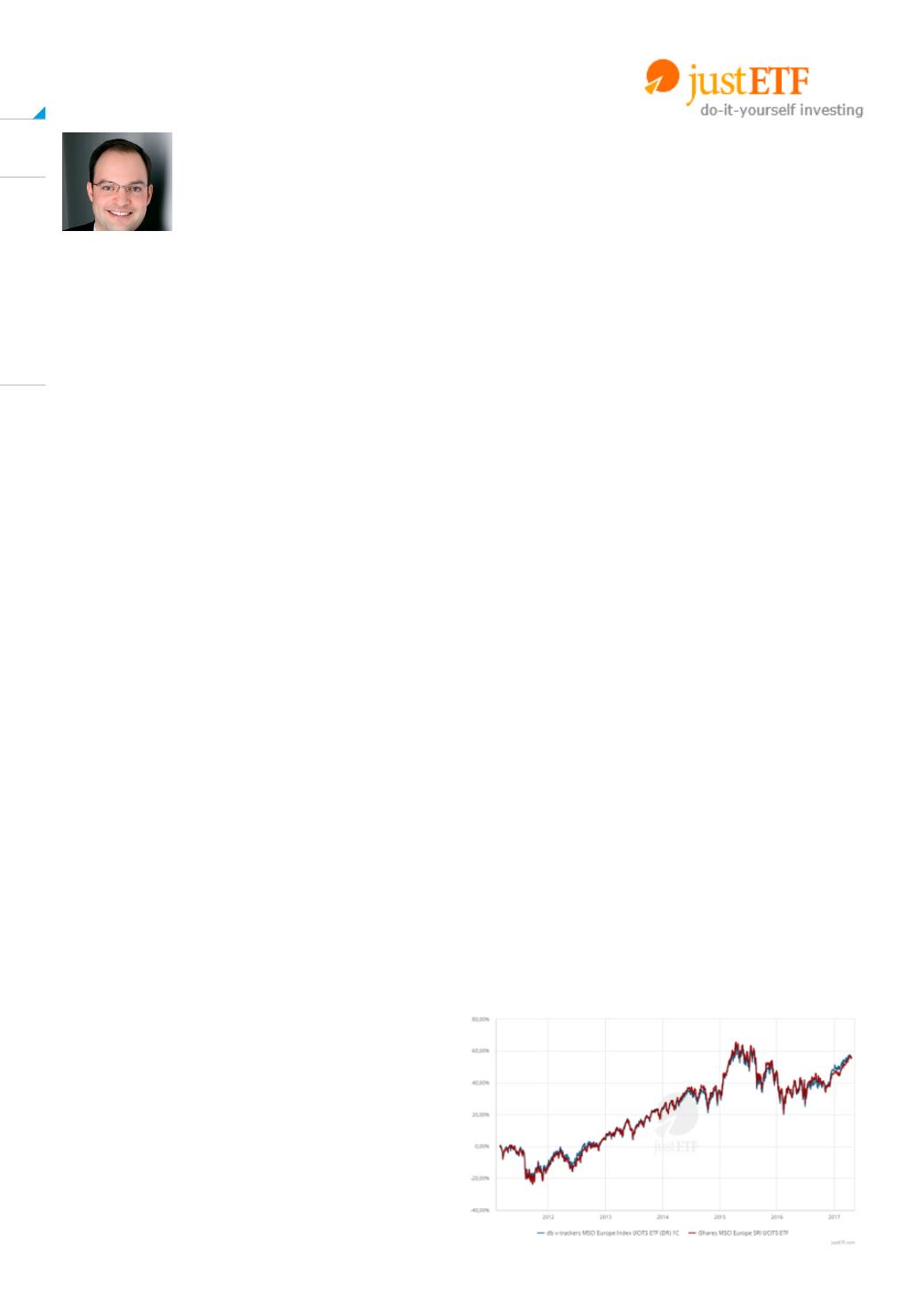

SRI PERFORMANCE

But is SRI too good to be true? Do you have to

compromise your principles for performance?

A number of studies have examined this question and

concluded that SRI funds largely perform on a par with

their conventional counterparts and can beat them.

How does good triumph over bad? Firms that are

sensitive to ESG factors often operate more efficiently.

That translates into better cashflows, a lower cost of

capital and ultimately superior performance. Such

companies are also better positioned to take advantage

of the opportunities afforded by sustainable business

practices.

MSCI EUROPE SRI VS MSCI EUROPE