DIY Investor Magazine

|

June 2017

15

country in terms of internet users (ahead of the US,

but behind China), with around 76% of internet users

in India accessing the internet through mobile data .

Given the fast pace of development, India has seen a

“leapfrogging” of technology, with consumers bypassing

fixed broadband and going directly to mobile internet.

Shift from physical to financial savings

Demonetisation has encouraged people to deposit

their cash reserves into the banking system, which

means that people are increasingly moving savings

from physical assets, such as property and gold, to

financial assets. Banks have seen a significant increase

in deposits, domestic mutual funds have seen record

inflows and life insurance sales were up 25% in January

and February, year on year.

Moreover, the government has recently launched

several digital infrastructure initiatives which means

that bank accounts can be linked directly to Aadhaar

biometric IDs, and accessed via mobile phone.

This will enable people to make payments – or indeed

take out insurance, apply for a loan or invest in a mutual

fund – with a fingerprint.

SUMMARY

The existence of even one of these factors would be

positive, so the convergence of all five factors means

that this is the most exciting long term investment

environment I have seen in my 22 years of investing in

India.

On the other hand, in the short term I anticipate there

will be some uncertainty due to demonetisation and

the impending implementation of GST, which may be

reflected through negative surprises in company results

announcements for the next two quarters.

It is naturally possible that markets will fall in reaction

to any negative news; there is also the potential that

domestic inflows of money into the stock market, which

have been very strong in recent months, will support

the market. Either way, I have reason to believe this is a

case of short term pain for long term gain.

I am therefore positive both on the long-term trajectory

of the Indian economy and on the profitability potential

of the businesses held by the Jupiter India Fund.

The fund invests in a single developing geographic area

and there is a greater risk of volatility due to political and

economic change, fees and expenses tend to be higher

than in western markets. These markets are typically

less liquid, with trading and settlement systems that are

generally less reliable than in developed markets, which

may result in large price movements or losses to the

fund.

This fund invests mainly in shares and it is likely to experience fluctuations in price which

are larger than funds that invest only in bonds and/or cash. The Key Investor Information

Document, Supplementary Information Document and Scheme Particulars are available

from Jupiter on request. For definitions please see the glossary at jupiteram.com.

This document is for informational purposes only and is not investment advice. Market and

exchange rate movements can cause the value of an investment to fall as well as rise, and

you may get back less than originally invested.

We recommend you discuss any investment decisions with a financial adviser, particularly

if you are unsure whether an investment is suitable. Jupiter is unable to provide investment

advice.

The views expressed are those of the author at the time of writing, are not necessarily those

of Jupiter as a whole and may be subject to change. This is particularly true during periods

of rapidly changing market circumstances.

Every effort is made to ensure the accuracy of any information provided but no assurances

or warranties are given.

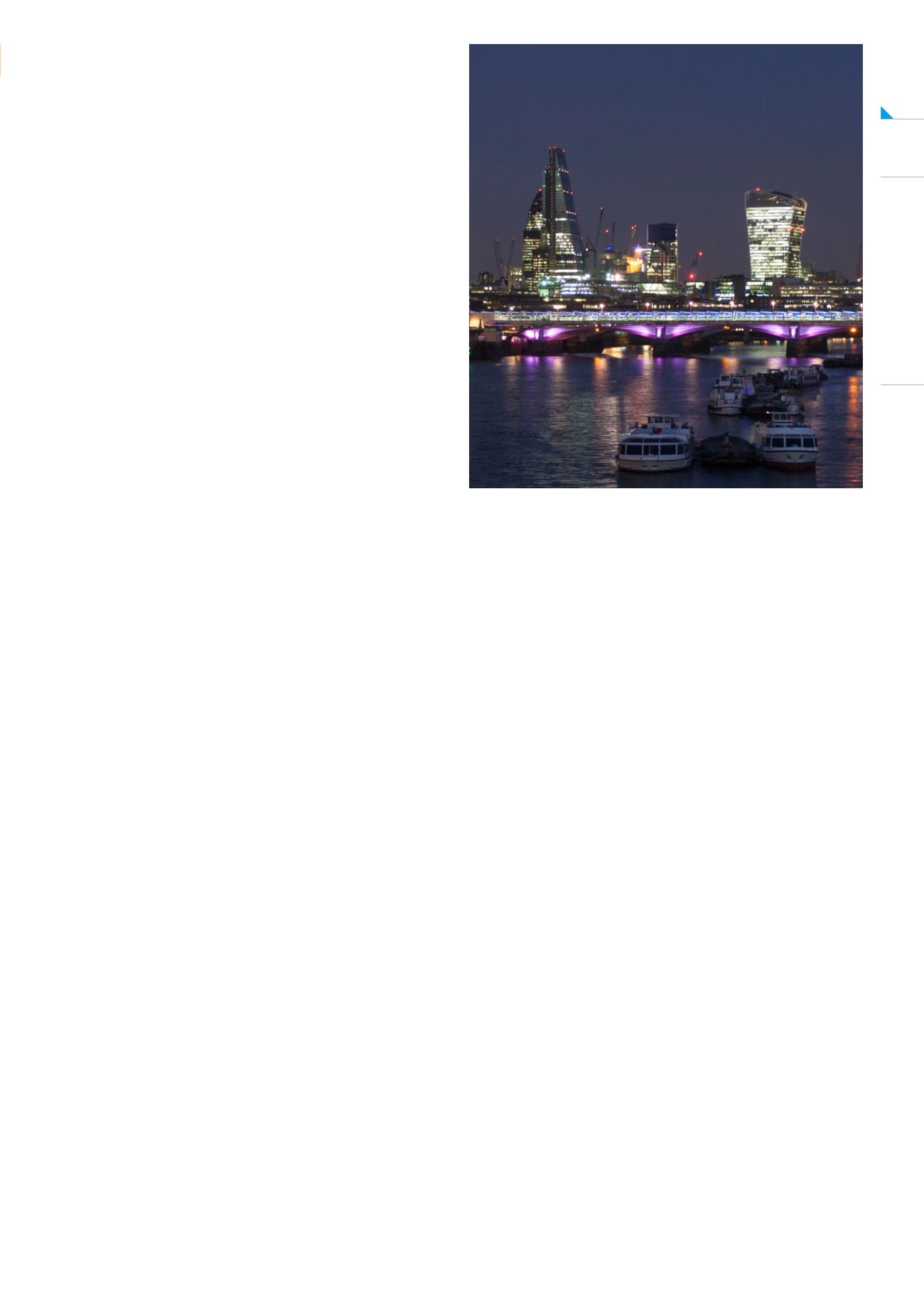

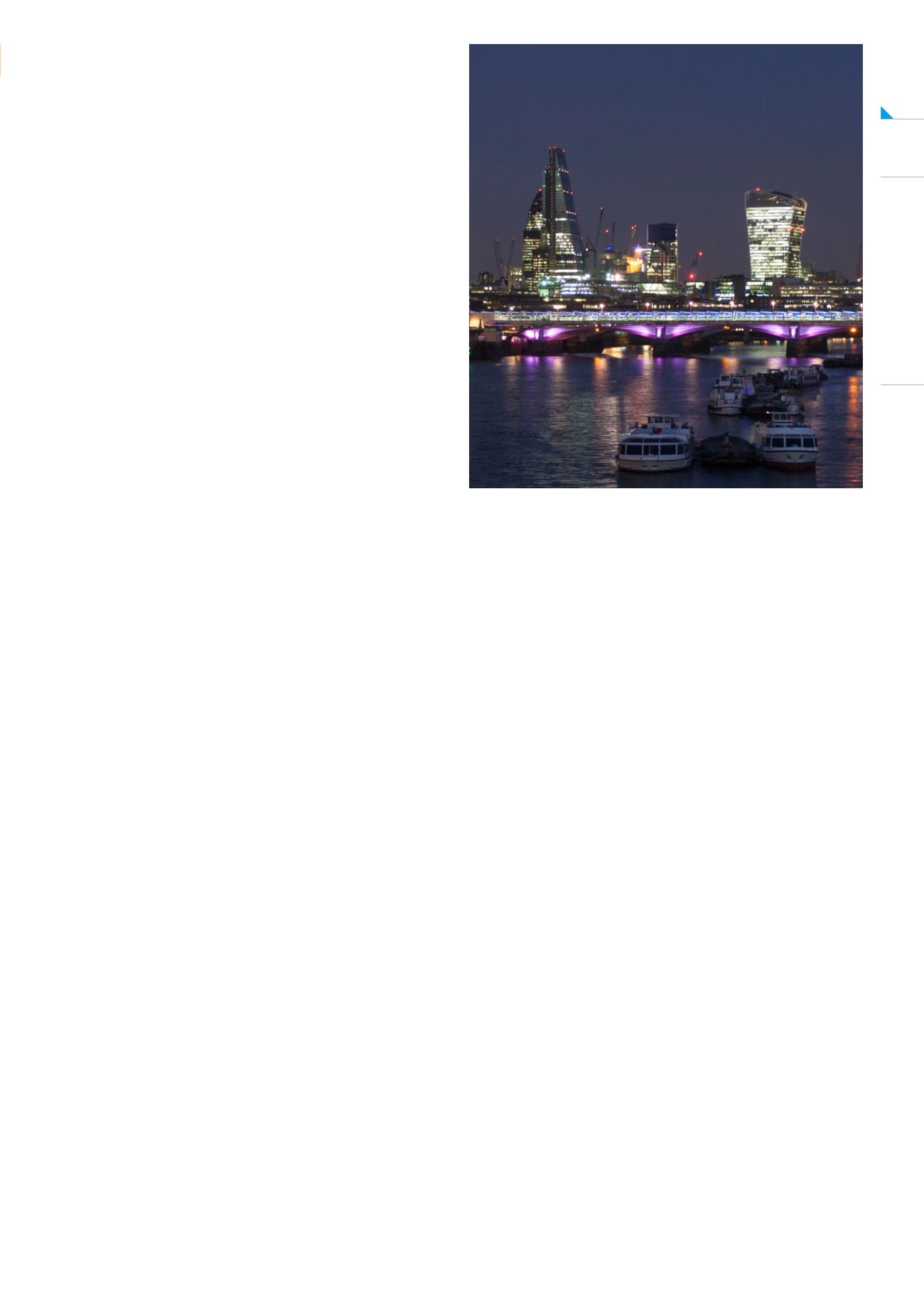

Jupiter Unit Trust Managers Limited (JUTM) and Jupiter Asset Management Limited (JAM),

registered address: The Zig Zag Building, 70 Victoria Street, London, SW1E 6SQ are

authorised and regulated by the Financial Conduct Authority.

No part of this document may be reproduced in any manner without the prior permission of

JUTM or JAM. 19727.