DIY Investor Magazine

|

June 2017

17

In the example above, you can see that

has been neck and neck wit

for the last 5 years. The

lead has changed hands many times but there is little in

it. It turns out that socially responsible investments can

be easy on your conscience and your portfolio.

HOW DO SRI INDICES WORK?

SRI indices vary so it’s important to make sure that your

chosen ETF tracks one that matches your concerns.

Often an SRI index starts as a clone of a well-known

parent index such as MSCI World. Firms that cross the

index’s red lines are shunned. MSCI World SRI knocks

out companies with their fingers in the following pies:

•

Alcohol

•

Gambling

•

Tobacco

•

Military weaponry

•

Civilian firearms

•

Adult entertainment

•

Genetically modified organisms

Many companies are conglomerates so they will be

red carded if their sin revenues top a certain size or if

they’re fundamentally involved as a producer, supplier

or distributor. Some indices will then upweight virtuous

equities that score highly against ESG criteria such as

strong environmental practices, respect for human rights

and positive employee relations.

The screening process means that an SRI index is

likely to be more concentrated than its amoral parent –

MSCI Europe has 446 constituents versus 113 for MSCI

Europe SRI.

But some indices will compensate by retaining their

parent’s regional and risk-return characteristics.

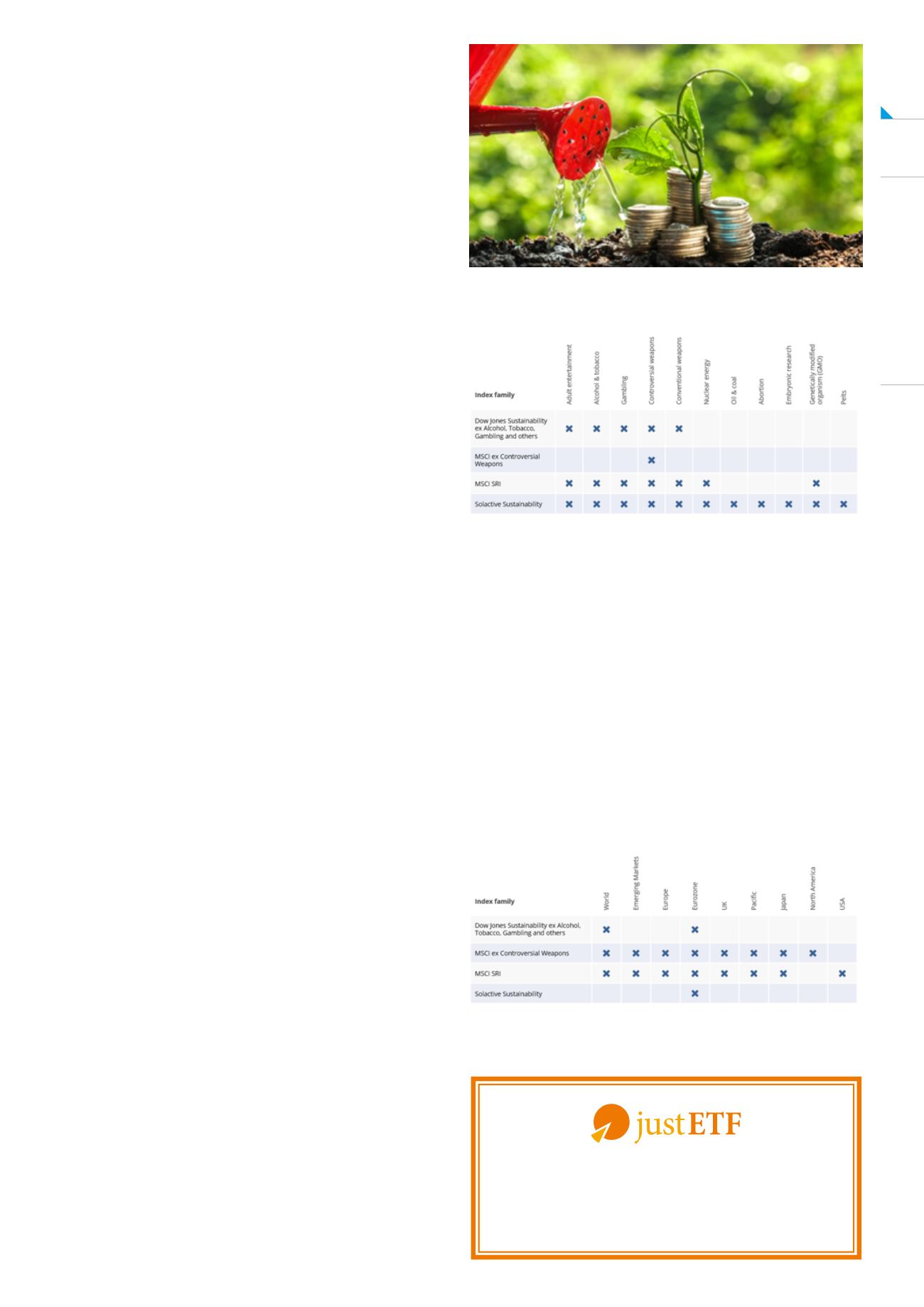

SRI ETF SELECTION

Naturally choice is the winner as the popularity of SRI

ETFs grows. You can responsibly invest in a global SRI

ETF; across regions like the Emerging Markets; within

single countries, or sustainable industries such as clean

energy. You can invest according to religious principles

too, as in

As you

probably suspect already, MSCI is the dominant index

family in SRI investing, although others exist too, each

with their own moral code

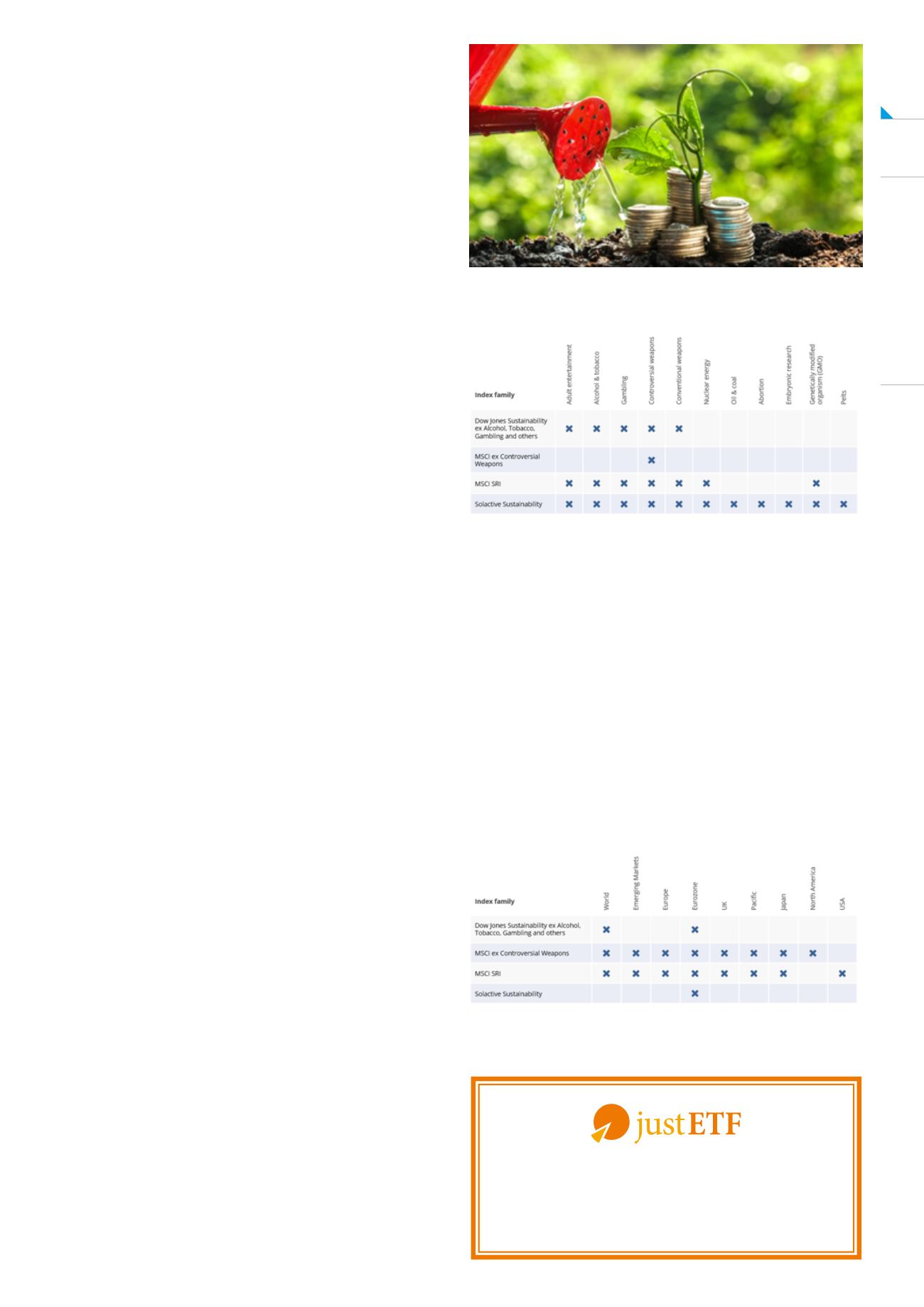

MORAL FOCUS OF SRI INDICES

REGIONAL FOCUS OF SRI INDICES

Source: justETF.com; Research

Source: justETF.com; Research

The other thing to know before you go off to polish

your halo is that many SRI ETFs have a relatively small

amount of assets under management. ETFs that fail

to grow in size run the risk of being closed by their

providers which could leave you sitting out of the market

until you’re able to redeploy your cash.

To find SRI ETFs searc

using the

filter social/environmental.