DIY Investor Magazine

|

June 2017

6

INVESTING FOR INCOME IN A

LOWER-FOR-LONGER WORLD

With interest rates close to record lows, investors

now need to cast the net wider than ever before in

their search for an attractive and sustainable level of

income. And investing in shares of investment trust

companies in order to receive enhanced dividends

can offer some compelling advantages for income-

seeking investors. We may now have entered a new era

of rate normalisation, but income remains a key factor

for investors around the world and will remain a major

component of total return for many portfolios.

Investments come with the power to generate a

reasonable income. They can also protect—or even

increase—capital value. Cash investments used to do

exactly that, back in the days of higher interest rates,

such as when the Bank of England held the base rate

at 4% or higher from February 2004 to October 2008.

But it’s getting harder for people to meet their income

needs from traditional investment sources, and that

includes cash. Parking savings in a bank account and

leaving them there, or investing in government bonds,

might seem like the “safe option”.

However, with income needs rising and interest rates so

low, keeping savings in a lower-risk investment like cash

could mean accepting an income that is much lower

than they need.

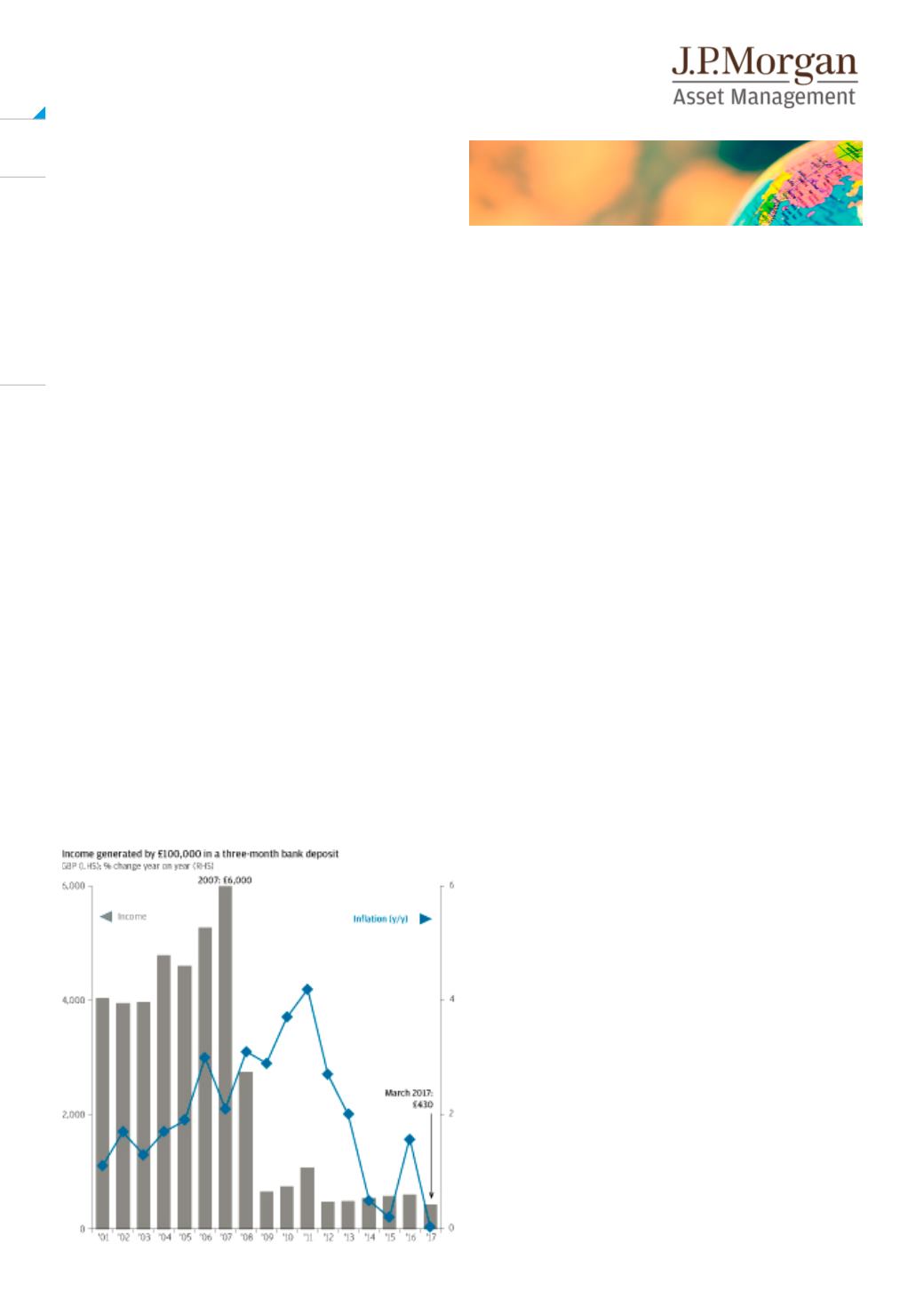

In fact, the chart below shows that investors that had

put £100,000 into a three-month bank deposit in 2000

would have made just £430 today.

Many forms of traditional fixed income have fared

little better, with gilts and UK corporate bonds barely

keeping up with consumer price inflation increases.

So if investors are planning on using that income to

reinvest for long-term growth, there is a real risk that

they will fall well behind their investment goals, forcing

them to take on more risk in the future to make up for

lost ground.

There’s no doubt that lower-risk investments, such

as government bonds and cash, still have their place

in income portfolios: after all, they can help to bring

greater stability over the longer term.

But in the current low interest rate environment, investors

in search of an income stream above the rate of inflation

need to move up the risk scale into higher-yielding

assets such as dividend-paying stocks.

ENHANCED DIVIDENDS HOLD AN INTUITIVE

APPEAL FOR INCOME INVESTORS

Dividend-paying stocks are providing an increasingly

popular way to generate a strong and sustainable

income. Dividends are linked to company earnings,

so they tend to keep up with inflation over time, while

dividend payers also tend to be large, financially stable

companies and so the income they produce can

be less vulnerable to economic cycles. Shares can

provide dividend income, but when company profits fall,

dividends may be at risk.

And many companies choose to reinvest profits for

future growth and share price gains, rather than pay

high dividends. Companies with a track record of paying

high dividends are not necessarily those with the best

potential for income growth in the future.