DIY Investor Magazine

/

March 2016

37

particular sector and each is ranked by industry body

the Investment Association; historical data will show

how this ranking has changed over time – whilst

past performance may be no guarantee of future

returns, it can be useful to know if the fund you are

considering is on the wax or the wane.

In addition to its fact sheet, investment trusts issue

regular, sometimes daily, updates as to the price of its

shares in comparison to its net asset values (NAV) – the

combined market value of its investments – which can

allow a would be investor to identify trusts that are

‘cheap’.

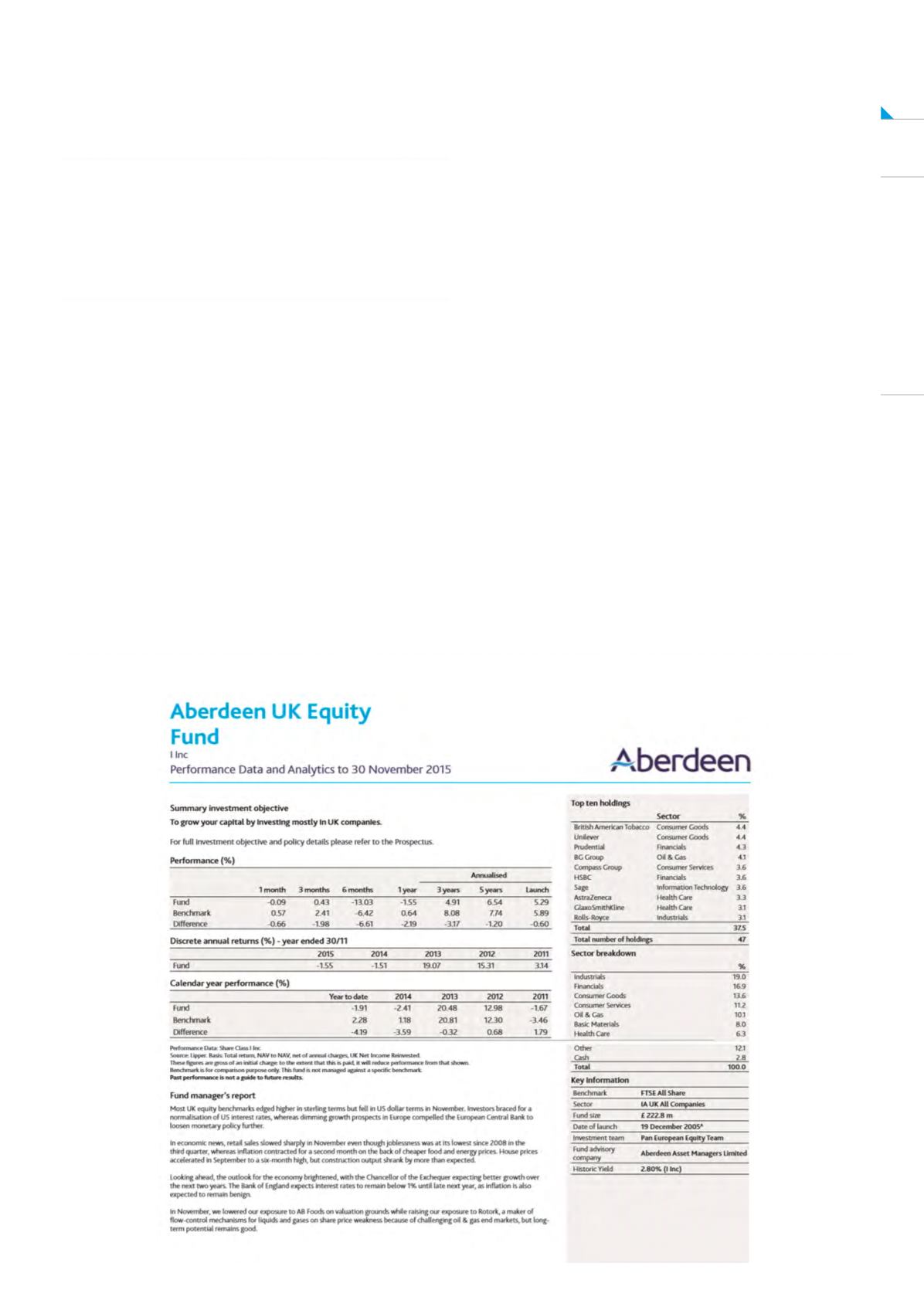

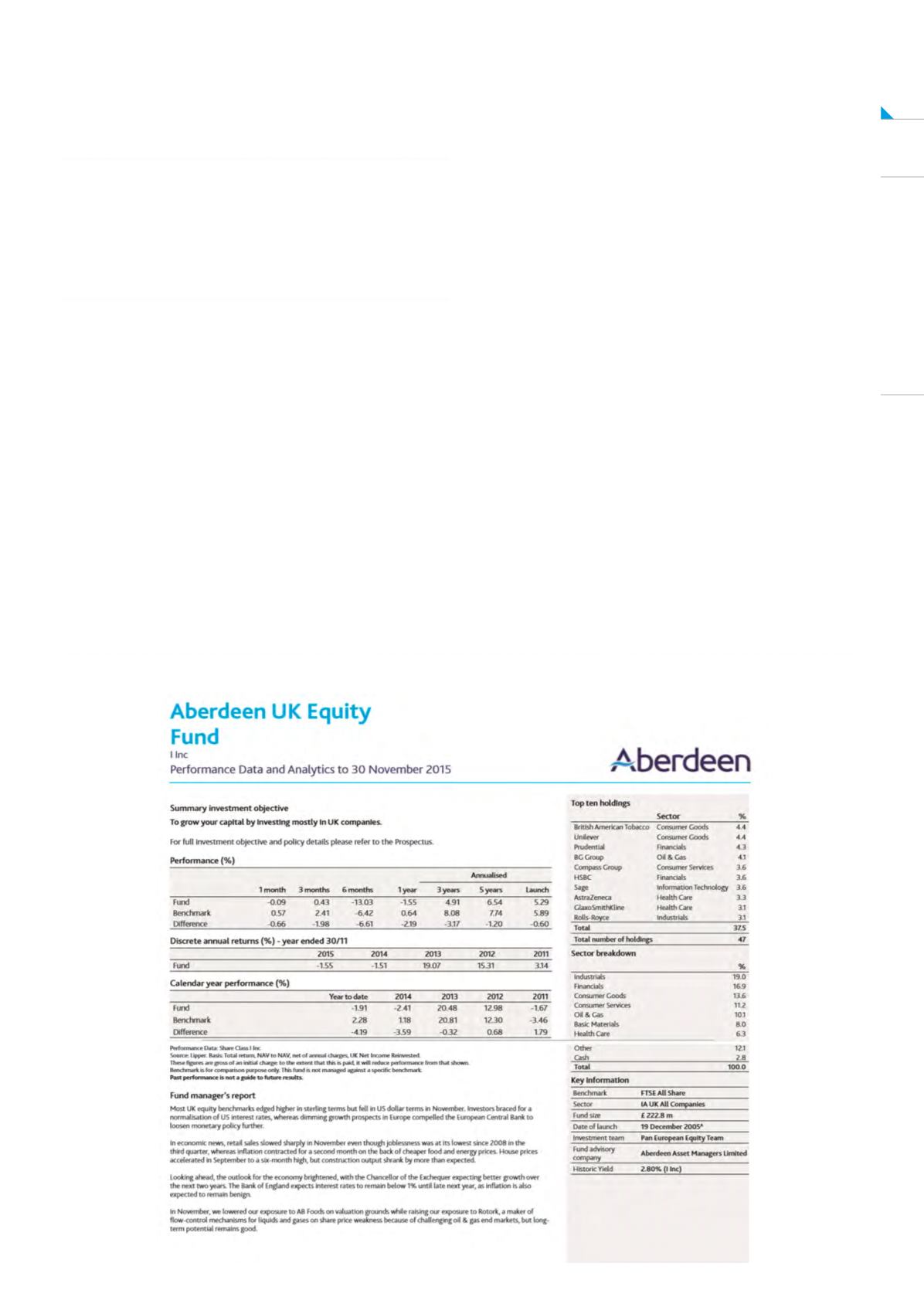

A FACT SHEET WILL ALSO SHOW HISTORICAL

PERFORMANCE DATA, USUALLY OVER ONE, THREE

AND FIVE YEARS AND THIS IS DELIVERED AS A ‘TOTAL

RETURN’ FIGURE’

Passive fund providers and platforms have selector

tools that allow the would-be investor to search for

exchange traded products to meet their individual

requirements; justETF

allows you to

search for products by asset class, geography and

strategy as well as its investment objective, total

expense ratio and its historical performance.

Many brokers publish lists of most traded products to

allow the investor to feel the mood of the market.

There are very many sources of information available

to assist the DIY investor and a little time becoming

familiar with the format of key documents and the type

of data contained therein will start to allow the investor

to make informed and objective investment decisions.

crowdfunding platforms