DIY Investor Magazine

/

March 2016

30

The UK Stock Market Almanac 2016

SELL IN MAY;

SEASONALITY EFFECTS & ANOMALIES

When we last looked

at the latest edition

of Stephen Eckett’s

fascinating reference

work we learned about

the January effect, how

markets behave in US

presidential election

years, and what an

‘average’ month looks

like on the stock market.

This month we delve further into this engaging and

curious guide to the financial year and consider vital

information for all investors and traders looking for the

little edge that could make a big difference.

SELL IN MAY

An update on the strongest – and strangest

seasonality effect in the market.

When we look at historic time series of asset prices the

frequencies we use tend to be day, week, month or

year. But new patterns of behaviour might be revealed

by using other time frames.

In this case we are going to split the year into two six

month periods:

1.

Winter period – 1st November – 30th April

2.

Summer period – 1st May – 31st October

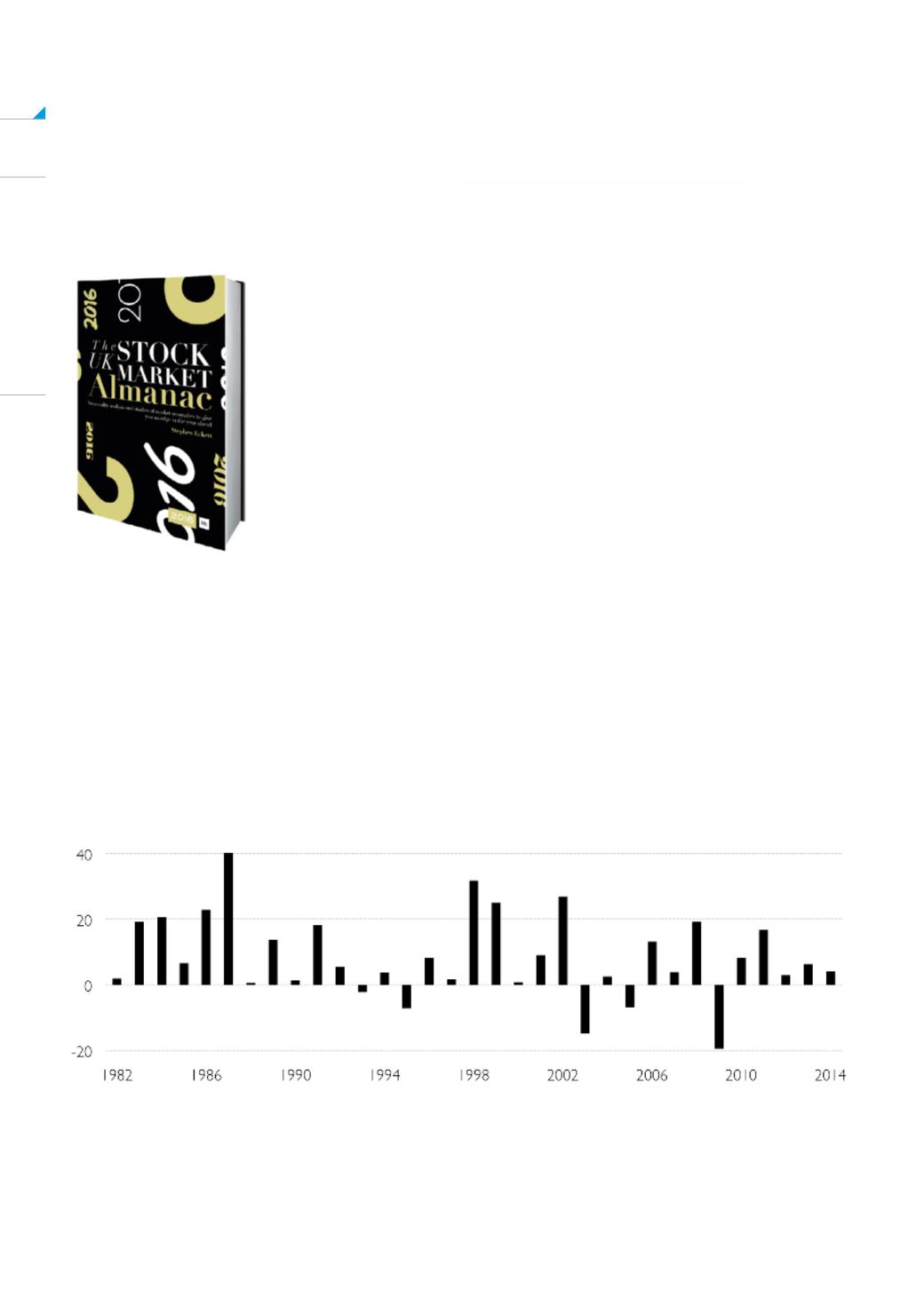

The following chart compares the performance from

1982 of the FTSE All-Share index for the next two

periods; each bar represents the out performance of

the winter period over the following summer period

For example, from 1st November 2013 to 30th April

2014 the index rose 1.0%, while during the following

period 1st May 2014 to 31st October 2014 the index fell

3.2%.

The difference in performance was therefore

4.2%, and that is the figure plotted on the chart for 2014

(the final bar in the chart).

The chart shows quite a remarkable thing, namely that

the market seems to perform much better in the six

month winter period than the summer period.

To quantify this outperformance:

•

In the 33 years since 1982, the winter period has

outperformed the summer period 28 times (84%).

•

The average annual outperformance since 1982

has been 8.6%!