DIY Investor Magazine

/

March 2016

34

PORTFOLIO ANALYTICS

SHAPING THE NEXT GENERATION OF RETAIL TRADERS

By Gustav Pegers

Head of Sales

As a company Heckyl is known for its big data

capabilities finding, collecting, analysing and visualising

millions of data sources from around the world, to

provide actionable financial insight. This data can then

be provided to end users, such as retail traders to help

them make informed investment decisions.

However, valuable big data also resides within financial

institutions and if analysed and visualised in the right

way, can be even more powerful. This is the other side

of Heckyl’s approach - working with brokers to harness

the data they have internally, sometimes mixing it with

the external data we also collect.

The continued commoditisation of market data means

that retail traders can find share price and fundamental

data from a wide variety of sources. The challenge fac-

ing retail brokers in the UK market is differentiating their

platform and keeping clients engaged. Utilising some

of Heckyl’s external data sets such as sentiment and

twitter alerts is a good approach.

However there is a vast source of internal data that

Heckyl can help brokers analyse and visualise, to help

their end clients become better traders.

By analysing the clients trading details Heckyl is able to

build up a profile of the user and help them understand

their strengths and weaknesses, with the aim of making

them a more profitable trader.

Heckyl’s has recently deployed this new Portfolio

Analytics platform for a number of clients in India and

we believe it represents the next generation for trading

platforms. Deployed as a ‘black box’ within the broker’s

infrastructure, the system analyses a number of key

parameters to provide a 360-degree view.

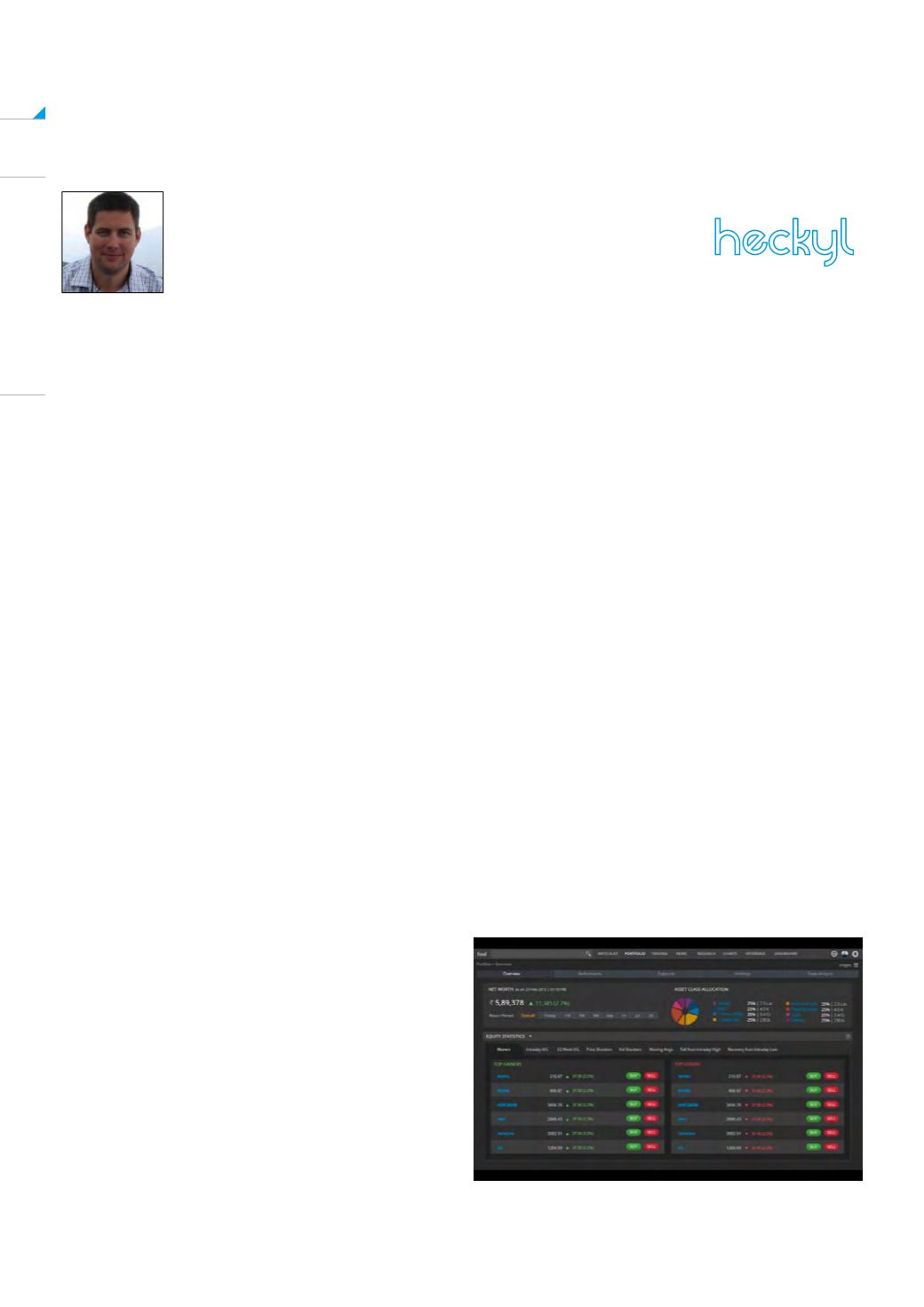

The system provides a number of views, providing key

details and analysis for the retail trader. The summary

screen offers a high level view of the users’ portfolio,

including asset allocation and top gainers and losers.

The performance view provides the key metrics to

help users understand their trading style. The system

analyses the users past and current trading to provide

a ranking with regard to:

•

Risk management

•

Trading performance

•

Experience

•

Timing

The charting allows a user to review their trading

performance over various timeframes, as well as

filtering based on realised and unrealised gains. An

overview is also provided of the users’ performance

over the last year along with their risk characteristics.

The portfolio holdings screen allows users to see their

entire holdings, with key metrics, as well as grouping

holdings based on sectors or market cap, also allowing

them to filter and analyse their holdings based on

personal parameters.

Fig 1 – Portfolio Holdings Screen