DIY Investor Magazine

/

December 2015

53

In this short video Ben Thompson, Director of Listed Products and Lyxor ETF describes the range of Exchange Traded Funds that

are available from Lyxor, and how you could use them to build a low cost, transparent and diversified investment portfolio.

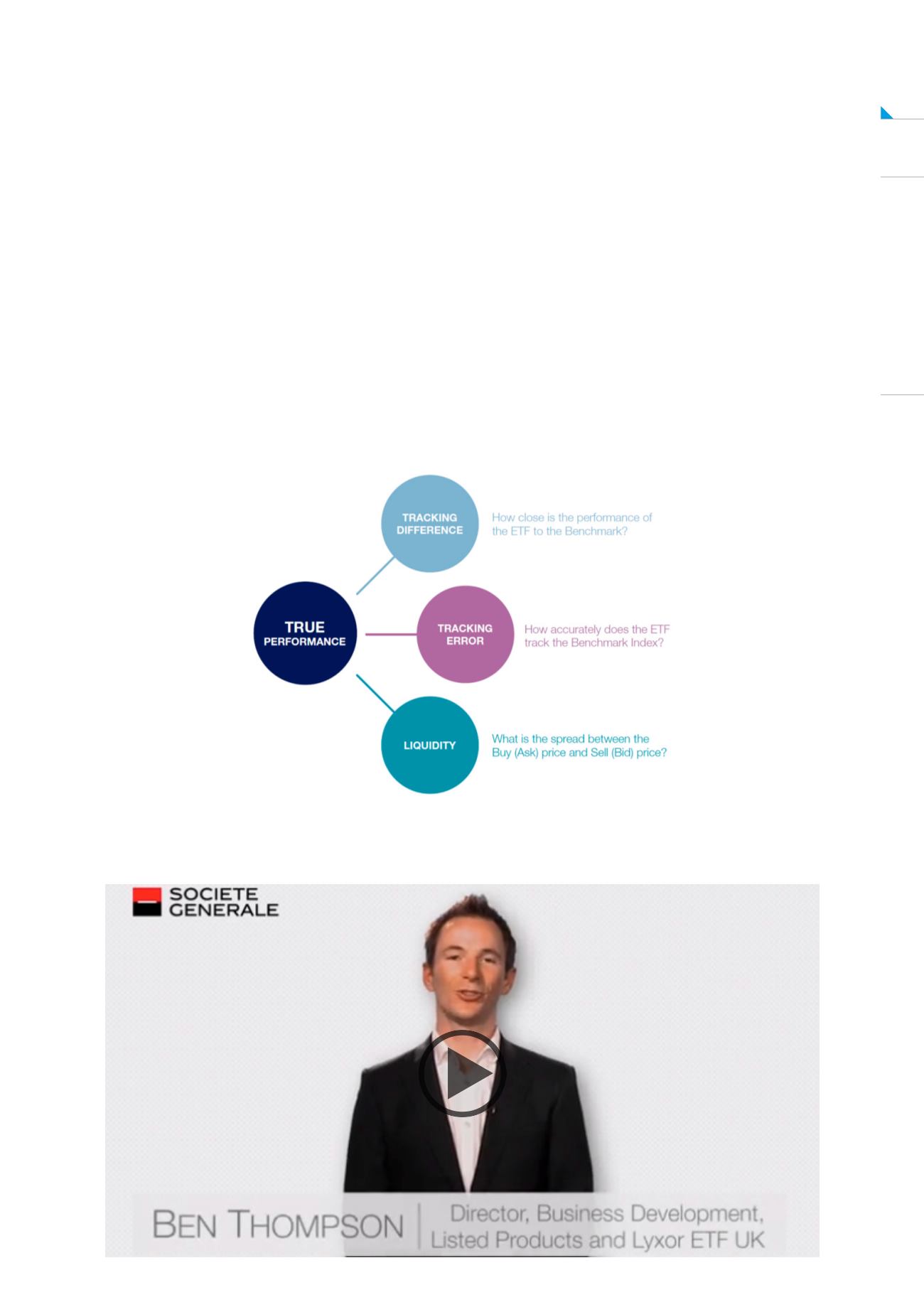

Tracking difference and tracking error are two

measures that describe how precisely and consistently

the ETF tracks its benchmark. As anything less than

the index performance is a cost to you, it is important

to look at these variables. The bid/ask spread will also

impact performance as the difference between buy

and sell price is key to your trading cost. As with any

investment product, ETFs carry a number of risks.

Most ETFs are index tracking funds, meaning the

performance of an ETF will rise and fall with the

underlying index which may be complex and/or volatile,

exposing investors to market risk. Investors’ capital is

at risk, and you may not get back the amount originally

invested.

Investors may be exposed to counter party risk

resulting from the use of securities lending in physical

ETFs, or from the use of an OTC performance swap

with an investment bank for synthetic ETFs. If the

index or the constituents of the index are denominated

in a currency different to that of the ETF, investors

are exposed to currency risk from exchange rate

fluctuations.