DIY Investor Magazine

/

December 2015

43

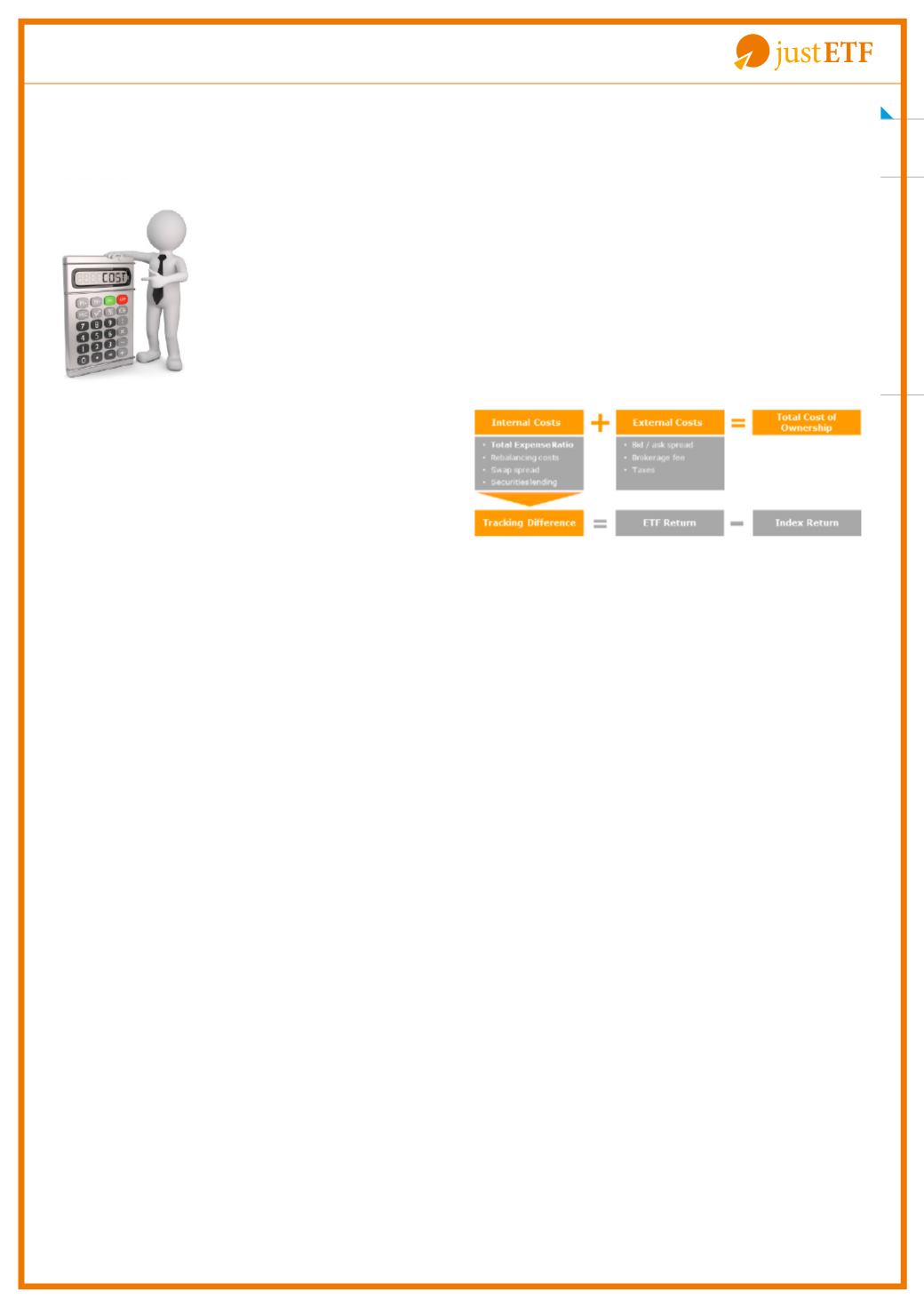

The total cost of owning an ETF isn’t completely

captured by the TER or its near identical twin, the

Ongoing Charge Figure (OCF).

These are the charges that you will see quoted on a

product’s website or in the Key Investor Information

Document (KIID) and are deducted pro rata from your

holdings on a daily basis; but it isn’t the full price you’ll

pay – for that we need to consider the Total Cost of

Ownership.

The TCO isn’t generally found on a website or factsheet

because, whilst the TER and OCF have been agreed

between the investment industry and the European

Union, there is no standard definition of the TCO.

Nevertheless, investors should consider the TCO when

selecting ETFs because the product with the cheapest

TER isn’t necessarily the cheapest product you can

buy.

The TER and OCF include the ETF’s annual

management charge plus various other expenses

including index licensing fees, legal fees,

administration, marketing, regulation and auditing.

The TCO captures extra internal costs that are missed

by the TER including dealing fees, spreads and taxes

or swap fees in case of synthetic replication that are

incurred on the ETF’s underlying holdings; gains from

security lending are also attributed to it.

One of the great advantages of

ETFs is that they are a cheap way

to invest; cost is a crucial factor

in determining your long-term

success, so consider the Total

Cost of Ownership (TCO) as well

as the Total Expense Ratio (TER).

On top of that come external costs that are more visible

to the investor which include platform charges, dealing

fees and the bid-offer spread you pay when you trade

the ETF. Total Cost of Ownership for an ETF investment

TOTAL COST OF OWNERSHIP FOR AN ETF

INVESTMENT

COST OF ETFS

Tracking difference is the discrepancy between an

ETF’s returns and the returns of the index it aims to

replicate and it helps to uncover any hidden internal

costs.

For example, if an index returns 10% and the ETF

returns 9% then the tracking difference is 1%; the

difference is effectively the TCO plus the costs

discussed above.

Tracking difference can actually be positive if an ETF

earns extra revenue from activities such as securities

lending or benefits from a more favourable tax regime

than is included in the calculation of the index return.

It may even be because the ETF’s composition

differs slightly from the index and this plays out to its

advantage.

If you compare the returns of several ETFs replicating

the same index, usually the one with the highest returns

- within several time periods - shows the lowest TCO.

ETFS AT A GLANCE