DIY Investor Magazine

/

December 2015

57

This article by Boost ETP looks at short and leveraged

products. Almost $61bn is invested in short and

leveraged ETPs which are traded on most of the major

global stock exchanges. With the combined features

of leverage and daily compounded returns, these are

trading instruments that need to be clearly understood

Exchange Traded Products (ETPs) the umbrella term for Exchange Traded Funds (ETFs), Exchange Traded Notes (ETNs) and

Exchange Traded Commodities (ETCs) provide exposure to all asset classes including equities, commodities, fixed income,

currencies and alternatives.

AN INTRODUCTION TO SHORT & LEVERAGED

EXCHANGE TRADED PRODUCTS

by an investor. However, once understood they can

be highly efficient tools, providing magnified long and

short exposure in an efficient product wrapper. In this

short video, CEO of Boost, Hector McNeil provides an

introduction to short and leveraged ETPs

Boost has education, transparency and thought

leadership at its core and herein considers eight key

things that it believes investors need to know about

short and leveraged ETPs, using its own products as

examples.

LEVERAGED RETURNS

Leveraged trading means getting exposure to an

underlying asset without paying the full cost. Anyone

who has bought a house with a mortgage has done

it. Consider an example where you buy a house worth

£300,000 with a deposit of £50,000 and a mortgage of

£250,000. For £50,000 you have exposure to an asset

worth £300,000.

Theoretically, if your house increases in value by 10%

to £330,000 you could sell it, pay back the bank and

pocket the remaining £80,000. That’s £30,000 more

than you invested, and a 60% profit from a 10% rise in

the house price. In investment terms we call this 6 times

gearing as your profit is 6 times greater than the move

in the underlying asset. Importantly, there is another

lesson to learn. Gearing works against you too. If the

house falls in value to £270,000, your equity would be

slashed to £20,000 as you still owe the bank £250,000.

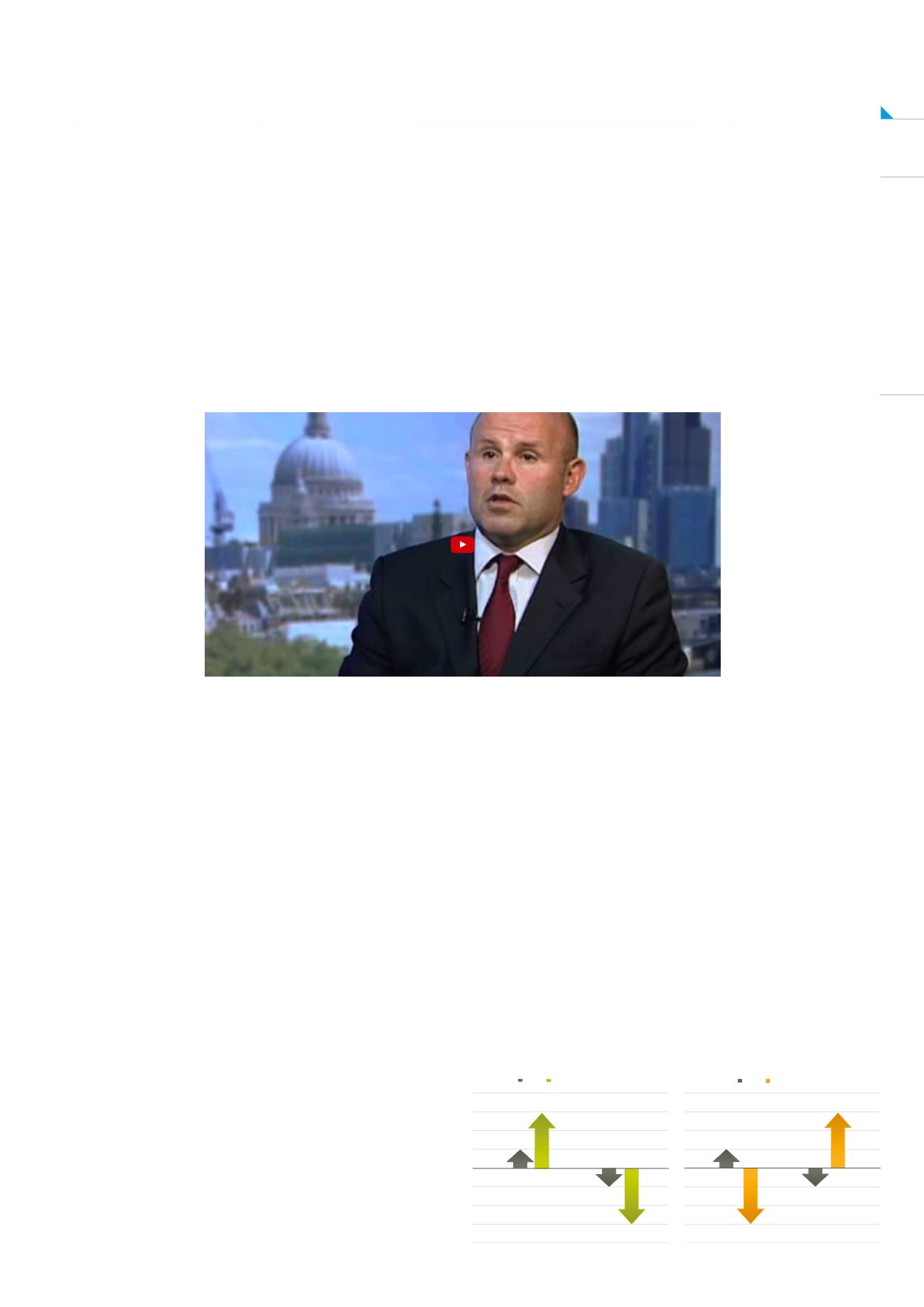

The charts below show that if the FTSE 100 rises

by 1% in a day, the Boost FTSE 100 3x Leverage

Daily ETP (3UKL) will rise by 3% (excluding fees and

adjustments). Conversely, if the FTSE 100 falls by 1%,

the Boost FTSE 100 3x Short Daily ETP (3UKS) will rise

by 3%. Leverage returns allow an investor to either use

less of their capital to achieve a similar investment (2/3

less in the case of 3x leverage) or to magnify returns

using the same amount of capital.

Index

Boost3x LeveragedDaily ETP

BOOST 3X LEVERAGED DAILY ETP

1%

3%

-

1%

-

3%

UPDAY FORTHE INDEX

DOWNDAY FORTHE INDEX

BOOST 3X SHORT DAILY ETP

Index

Boost3x ShortDaily ETP

1%

3%

-

1%

-

3%

UPDAY FORTHE INDEX

DOWNDAY FORTHE INDEX

(Source: Boost ETP LLP)