DIY Investor Magazine

/

December 2015

54

WHAT ARE SYNTHETIC ETFS FOR?

But synthetic ETFs don’t work this way often because

the markets they track are very hard to physically

recreate at a reasonable cost; a market may consist

of many small and illiquid securities that are very

expensive to trade or complexities of tax, time zones

and local laws may make it difficult to track some global

indices.

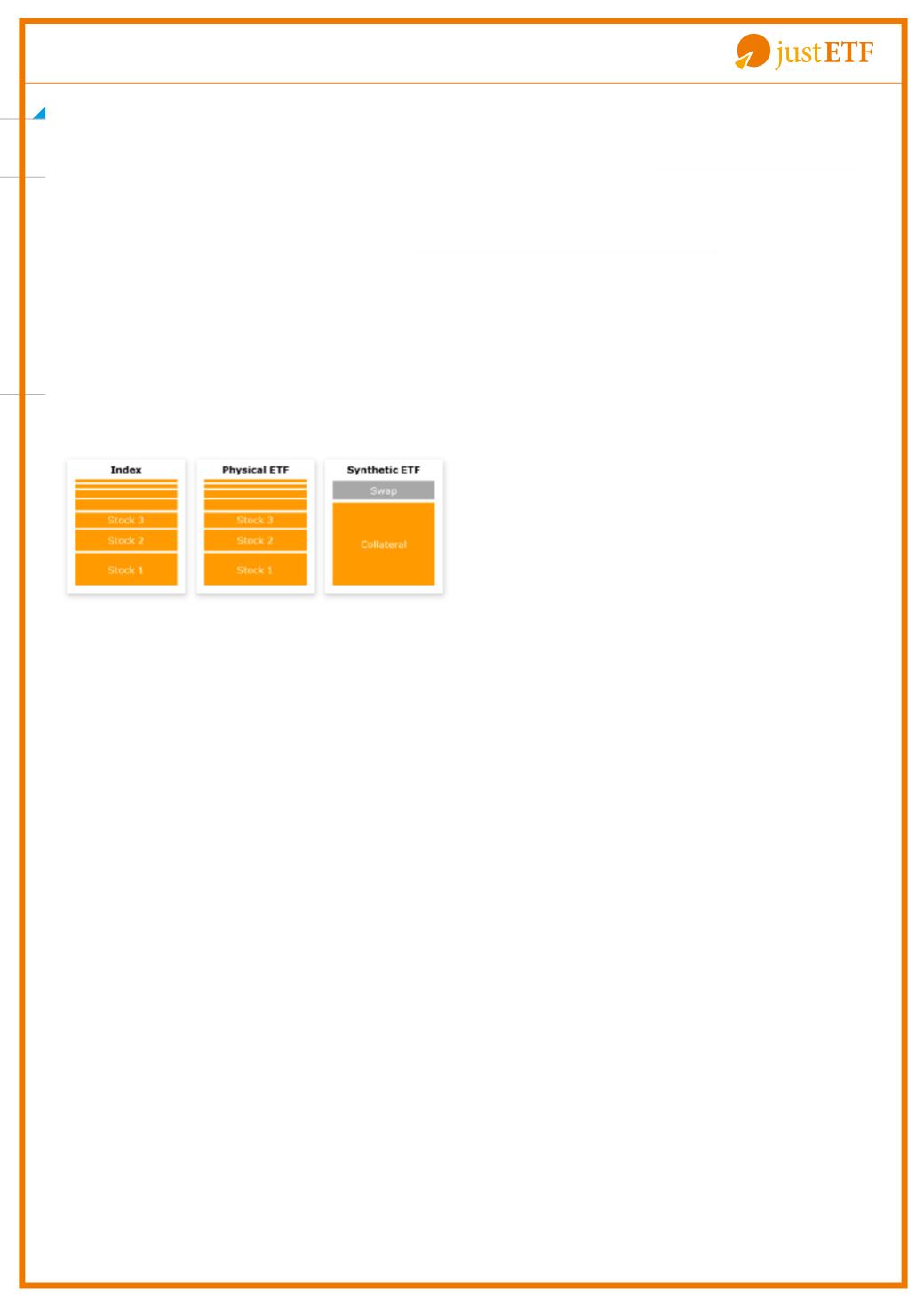

You would expect an index tracker to actually invest in the same holdings as its index. This is how a

physical ETF works and why it returns the same results as the market it mimics.

HOW A SYNTHETIC ETF REPLICATES ITS INDEX

In the case of commodities it would be inconceivable

to take delivery of thousands of cows because you

wanted to track livestock so a synthetic ETF uses a total

return swap instead of physical holdings to earn the

return of its index.

A total return swap is a derivative contract provided by

a counterparty such as a global bank or other large

financial institution whereby the counterparty pays the

ETF the return of the index it tracks including dividends

in exchange for a fee and the investment return of

collateral posted on behalf of the ETF.

Collateral is used to mitigate the possibility of investors

losing out if the counterparty defaults on its obligation

to pay, which exposes synthetic ETFs to some

counterparty risk which investors should understand.

Cash invested in the ETF secures a basket of securities

that form its collateral, and this would be sold and the

proceeds used to return the investor’s money if the

counterparty were to default.

Collateral is often held in securities completely

unrelated to the market the ETF follows - a FTSE All-

Share synthetic ETF may hold some of its collateral in

bonds or Japanese equities!

UCITS ETFs (those approved and regulated by EU

rules) are not allowed to expose more than 10% of

their Net Asset Value (NAV) to counterparty risk and

many providers apply even stricter criteria and ‘over

collateralise’ so that the ETF is protected by collateral

worth more than 100% of its NAV.

Synthetic ETFs have been subject to a great deal of

scrutiny from the media and regulators which has

led providers to spread the risk by using multiple

counterparties, increase the quality of collateral and

revalue it daily in order to ensure that it is 100% of NAV,

thereby reducing counterparty risk.

Synthetic ETFs have two main advantages over

physical versions.

Firstly, synthetics provide a low cost way to access

certain niche markets that would otherwise be off-limits

to most investors.

Secondly, they can sometimes undercut their physical

rivals in certain markets with lower Ongoing Charge

Figures (OCFs) and tracking error because they avoid

the complexities of trading the securities of the index.

Your broker should allow you to screen the products on

its platform by replication method, or you can use the

Screener at

your wealth is passively

invested for the long-term and keep yourself a small

speculative portfolio for your market call investing

ideas.

ETFS AT A GLANCE