DIY Investor Magazine

/

Jan 2017

8

Dominique Riedl, CEO justETF

HOW TO EASILY DECIPHER ETF NAMES

ETF names can look complicated, but you’ll soon

decode them with our handy guide.

One of the longest ETF names in the justETF

database is the UBS ETF (LU) Barclays MSCI US

Liquid Corporates Sustainable UCITS ETF (hedged

to EUR) A-acc; nearly a tweet’s worth of terms and

abbreviations!

Cryptic names can be off-putting, but they are usually

based on a simple logic that can help you understand

whether an ETF is right for you; once you know how to

read ETF names you’ll be able to target your searches

more quickly.

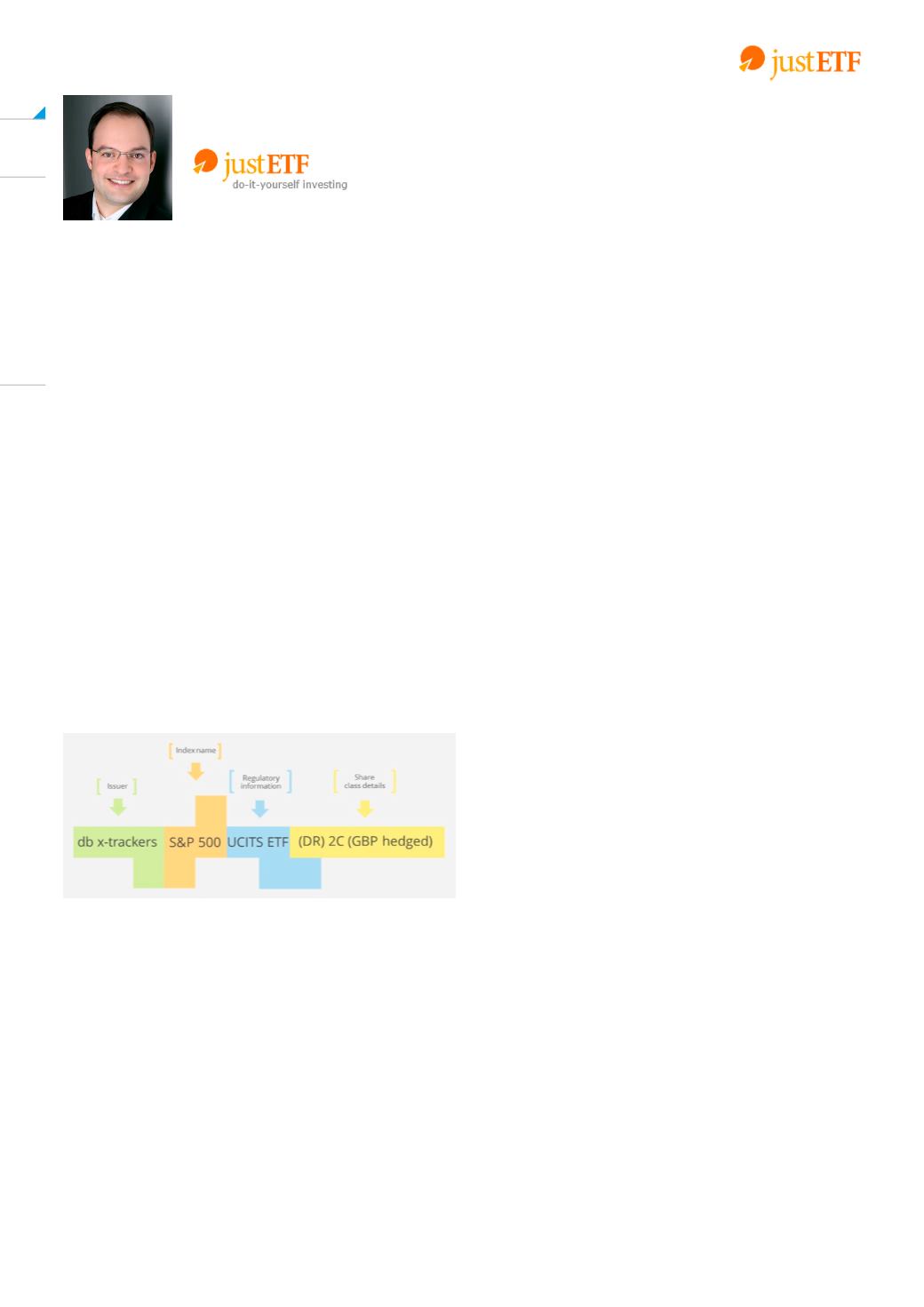

ETF names consist of five components

An ETF name is built from keywords that reveal the

product’s most important features. The basic structure

usually looks like this:

The keywords may occur in a different order, or

individual components may be missed out, but the

principle remains the same; some real-life examples of

ETF names help explain what the keywords tell you.

1. Provider: Who issued the ETF?

The ETF provider’s brand name usually comes first –

e.g.

iShares

Core FTSE 100 UCITS ETF (Dist). ETF

providers are commonly subsidiaries of large banks or

asset managers - iShares is part of the world’s largest

asset manager, BlackRock, while db X-trackers is the

ETF brand of Deutsche Bank.

A sub-brand, like

Core

in the example above, shows

that the ETF is part of a sub-group in the provider’s

product range; terms like Core are worth looking out for

because these products are usually very cost-effective

and generally based around key portfolio building

blocks like the FTSE 100 or MSCI World index.

2. Index: Where do you invest?

The second component is the index that the ETF

tracks - iShares Core

FTSE 100

UCITS ETF (Dist).

vendors such as MSCI, FTSE and S&P provide

independent verification of the indexes and licence them

to the ETF providers.

Often the index name reflects the region as well as

the number of stocks tracked and it pays to be aware;

the EURO STOXX 50 tracks the 50 largest companies

traded within the

Eurozone

, whereas the STOXX

Europe

600 is broader and includes Switzerland

and the UK. You may also see an index with a suffix

such as

NR

(Net Return),

TR

(Total Return) or

TRN

(Total Return Net); this tells you whether the index

performance is calculated before or after withholding

taxes on dividends, but it has no direct impact on the

performance of the ETF itself which will distribute any

dividends you are entitled to.

3. Regulatory information: Important for consumer

protection

Always look for the words UCITS in your ETF name -

iShares Core FTSE 100

UCITS

ETF (Dist). This means

the ETF is subject to European regulations specifically

designed to protect private investors. UCITS ETFs

must meet certain standards such as not holding more

than 20% of fund assets in any single security - which

helps diversify the product.

is also a regulatory

classification, distinguishing ETFs from other exchange-

traded products such as

(Exchange Traded

Commodities) or ETNs (Exchange Traded Notes) which

are not UCITS compliant and are subject to additional

risks.