DIY Investor Magazine

/

Jan 2017

14

THE RETURN OF INFLATION IN 2017

WE HAVE BEEN WATCHFUL FOR THE RETURN OF INFLATION FOR SOME TIME NOW, WITH A HEALTHY SCEPTICISM

ABOUT THE “LOWER FOR LONGER …FOREVER” MANTRA.

Henderson Cautious Managed Fund

Managers Chris Burvill and Stephen Payne

That widely accepted viewpoint is now being questioned

as the evidence builds that the days of disinflation are

behind us. Inflation is beginning to come through in

developed economies and bond markets have been

quick to notice it.

Lower for Longer – no Longer

Deflationary forces have been significant in the global

economy over the last decade but these are now on the

wane, indeed even reversing in some cases.

The bargaining position of labour (the ability of workers

to negotiate better terms of employment/higher pay)

has been weak for many years. This has resulted in

widening income inequality, which has manifested itself

in the changing political landscape.

In the West, we have already seen the backlash

against the political establishment through the rise of

populism. Voters (ie. workers) have had enough. This

coincides with a tightening in labour markets, with falling

unemployment making it more difficult for firms to recruit

workers, which tends to push up wages.

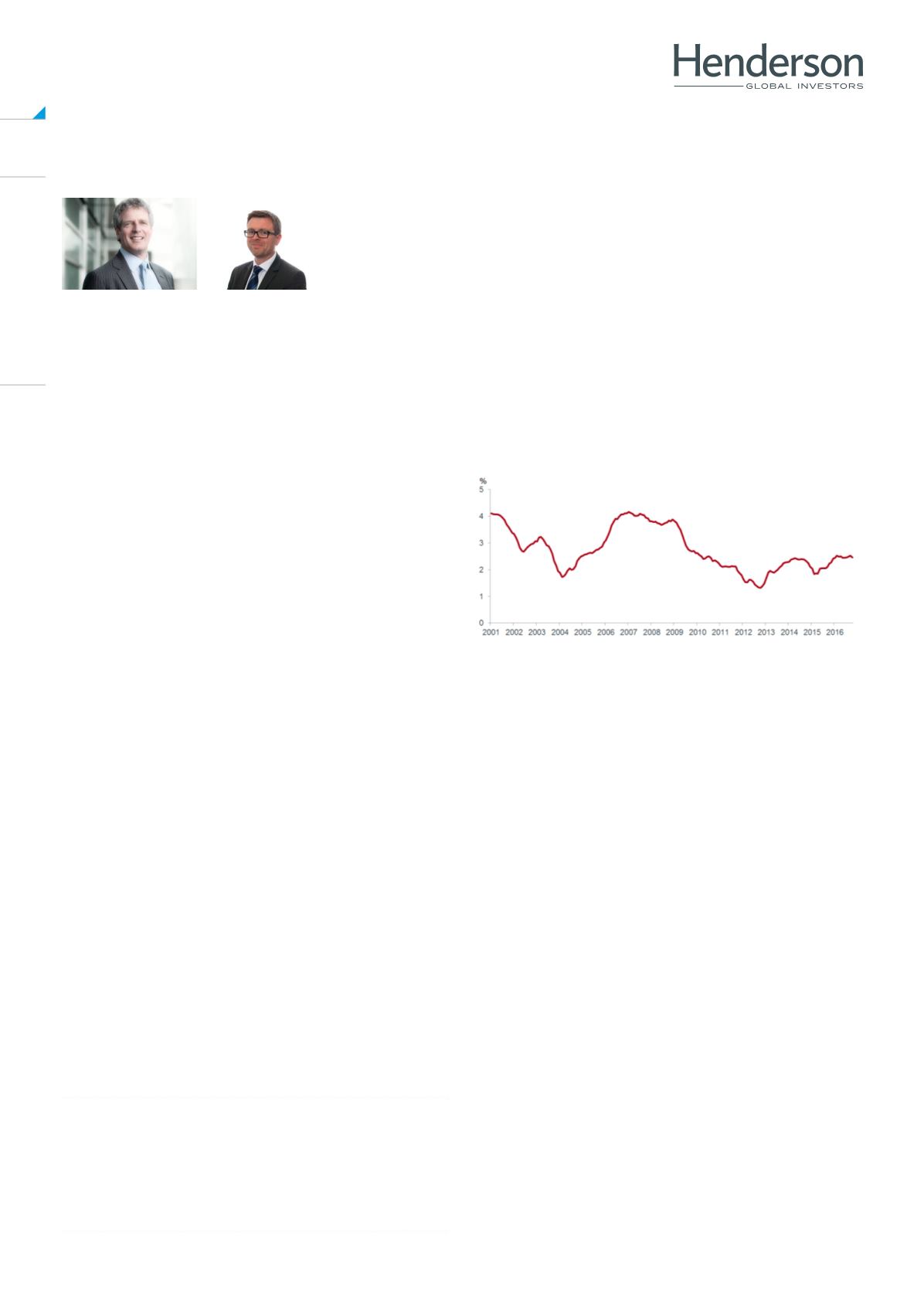

In the US, wage inflation is already on the rise, see

chart 1, while here in the UK, employment is at record

levels. Economies are close to full employment, a

situation where anyone who is able and willing to

work is employed. And this is before the squeeze on

immigration comes into play, following Donald Trump’s

election and Brexit.

Add in demographic shifts as the number of retirees

rises relative to the number of people actively in work

and the stage is set for persistent wage inflation after

many lean years.

Chart 1 – US wage inflation is increasing

IN THE WEST, WE HAVE ALREADY SEEN THE

BACKLASH AGAINST THE POLITICAL ESTABLISHMENT

THROUGH THE RISE OF POPULISM

The making of Trumpflation

Another key disinflationary pressure has been

globalisation; free trade has increased the volume and

variety of goods available, but has also suppressed

prices. Chart 2 shows the impact on the price of food

and drinks in the UK.

We in the West have benefitted as consumers, but have

lost out as wage earners.

China has been exporting deflation to the world by

devaluing its currency, although this is changing as the

supply of cheap migrant labour to the country’s cities

slows.

Wages have soared in China, and debt, which has

subsidised the increase in production capacity, has

ballooned.

Trump’s proposed protectionist policies in the US are

a reaction to China’s actions, but putting restrictions

on trade and adding import tariffs adds to inflationary

pressures.