DIY Investor Magazine

/

Jan 2017

15

These pressures would be compounded by Trump’s

negative stance on immigration and plans to lower taxes

and increase spending. Hence “Trumpflation” enters the

lexicon.

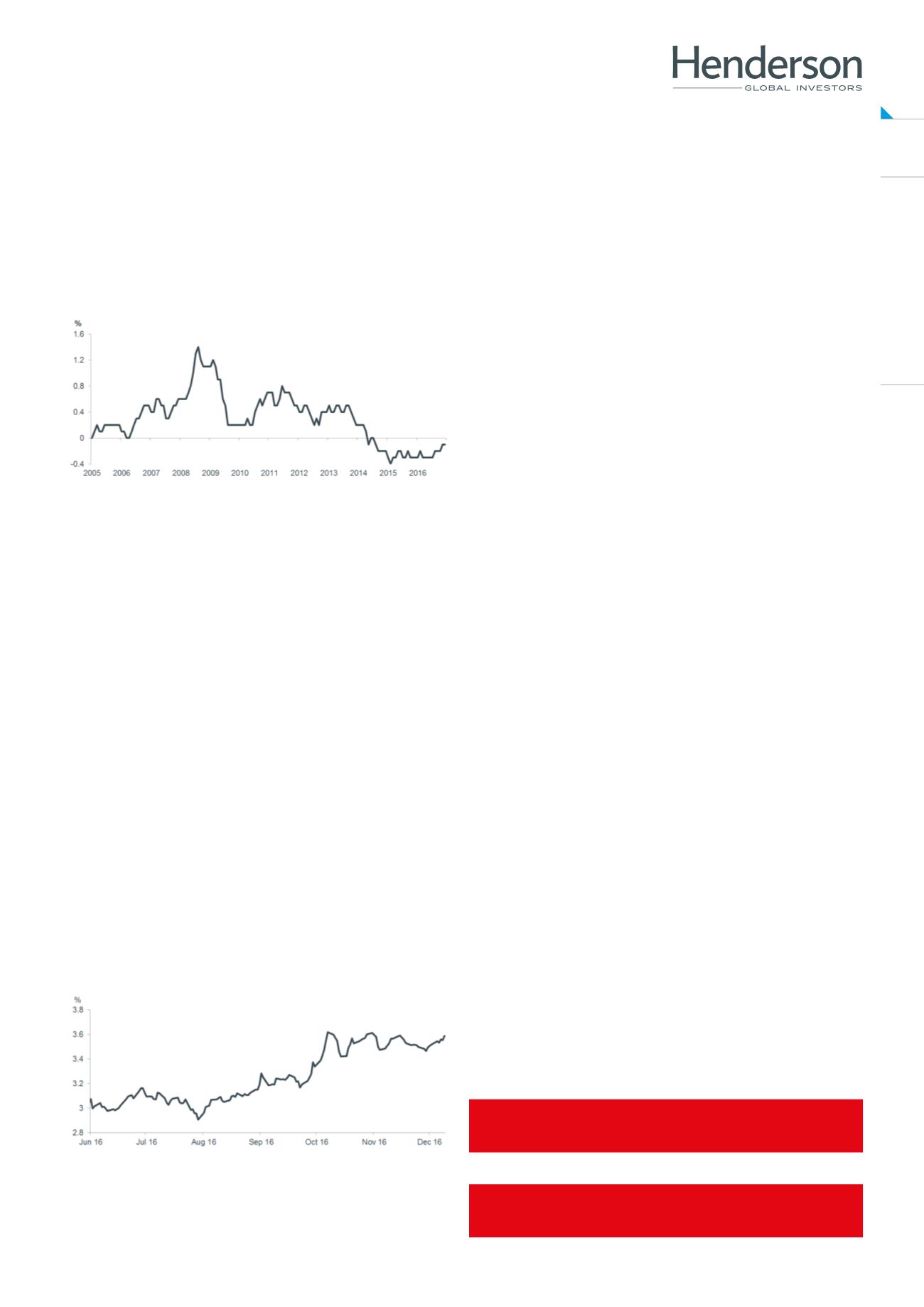

Chart 2 – Falling food prices have weighed on

inflation

Source: Thomson Reuters Datastream, as at December 2016. Food & beverage

contribution to CPI inflation.

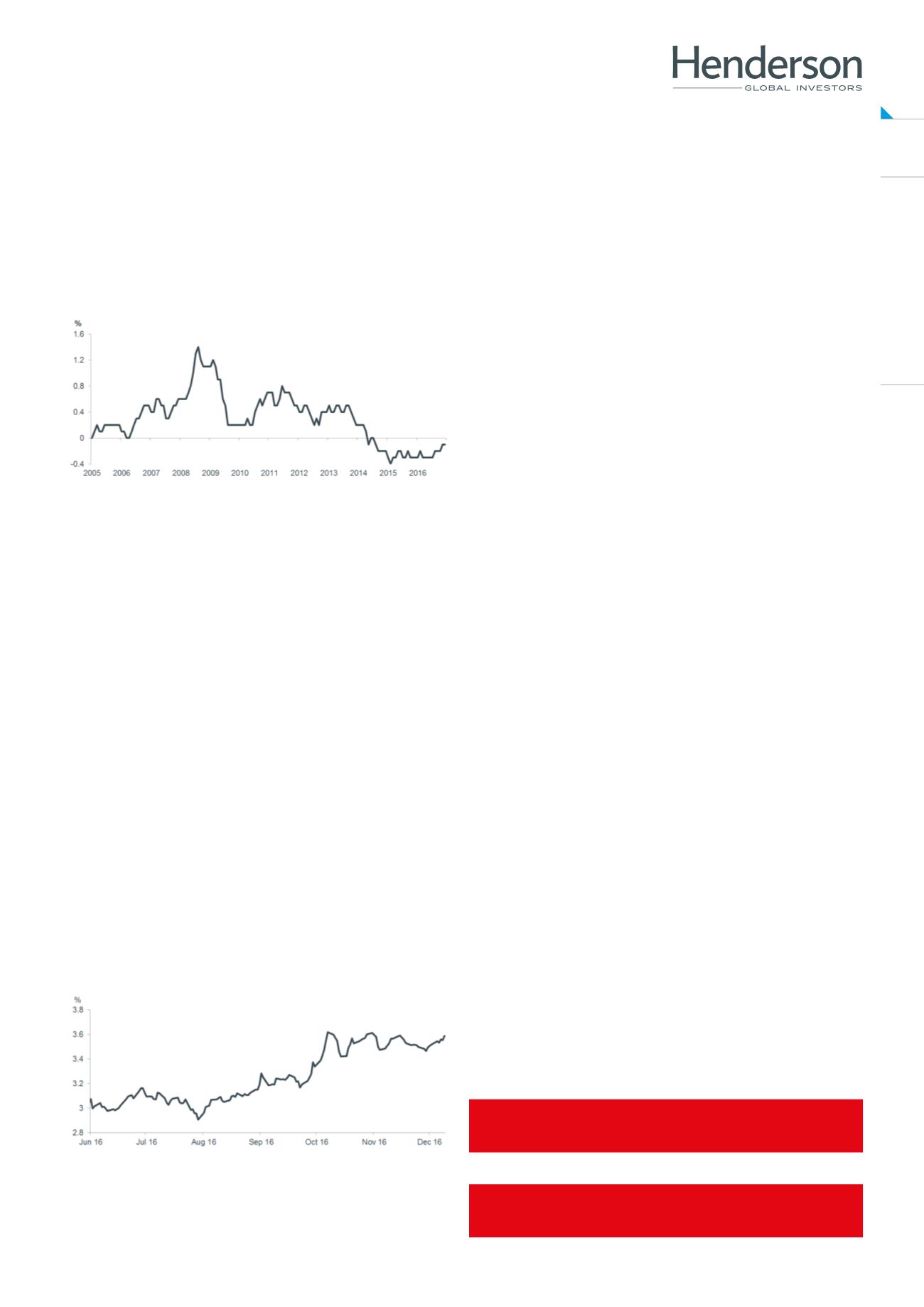

ource: Thomson Reuters Datastream, as at 9 December 2016. Chart shows the UK

5-year/5-year inflation swap rate. Used as an indicator of medium-term inflation. The MPC

is the Bank of England’s Monetary Policy Committee and is responsible for setting interest

rates, with the aim of keeping inflation at – or close to – their current target of 2%.

What about Brexit?

In the UK, Brexit – be it ‘soft’ or ‘hard’ – is likely to have

similar trade-related inflationary effects. Add to that

the impact of sterling’s devaluation, which plunged

dramatically following the Brexit vote, and imported

inflation should reach the high street (or out-of-town

shopping centres these days) as cost increases are

passed to consumers.

Marmite and Toblerone have been in the headlines

already on that subject. While this should have a more

transitory impact, higher headline inflation figures will

bolster wage negotiations.

Chart 3 – Medium term inflation expectations above

MPC’s 2% target

Markets are reflecting these changes. Bond markets

are selling off and forecasts suggest a belief that higher

inflation will come through over the next few years, as

chart 3 shows.Yield curves are steepening, indicating

the expectation of high interest rates, and index-linked

bonds, which can provide some protection from

inflation, have benefited from strong investor interest.

Central banks have subtly changed their tune; they

are now willing to accommodate or even encourage

inflation. We see these trends continuing as inflation

moves from its current very low base; ‘normalisation’ still

has some way to go.

Portfolio implications

In terms of what the return of inflation means for the

fund, the bond portfolio can be protected to some

degree by keeping low duration and holding index-

linked bonds. The latter currently represents a third of

the fixed income portfolio. We also continue to hold a

relatively large exposure to UK equities – an area of the

market that might be expected to benefit as investors

switch from bonds. Higher inflation should also increase

nominal returns (the total rate of return, including

inflation), although this is a debatable point. We must

accept that there may be negative consequences for

stock prices if inflation is seen to be dangerously high.

We are invested in a number of domestic sectors which

should perform relatively well if inflation does indeed

pick up as expected, including travel and leisure,

retail, banks, insurance and support services. Banks,

for example, would be expected to benefit from rising

inflation via higher rates on lending, while retailers are

generally able to pass on higher costs to consumers –

up to a point. In our view, bank note printer De La Rue,

currently in the portfolio, should be one of the more

obvious beneficiaries from higher inflation.

Past performance is not a guide to future performance. The value of an investment and

the income from it can fall as well as rise and you may not get back the amount originally

invested. The information in this article does not qualify as an investment recommendation.