DIY Investor Magazine

/

Jan 2017

7

IN THE UK THERE IS LITTLE EXPECTATION OF

BASE RATE INCREASING THIS YEAR

THERE ARE FEW WAYS INVESTORS CAN MITIGATE

THE EFFECT OF INFLATION ON THEIR PORTFOLIOS

This currency weakness should continue to suit many

FTSE100 companies, several which earn and report in

US$. One that springs to mind is HSBC who not only

works in US$, but should additionally benefit as rates

start to rise. Whilst HSBC shares did well last year,

closing at c.660 off a low of c.401, they were c.1000

when they issued their profit warning, caused by losses

at Household in the US, in Q1 2007.

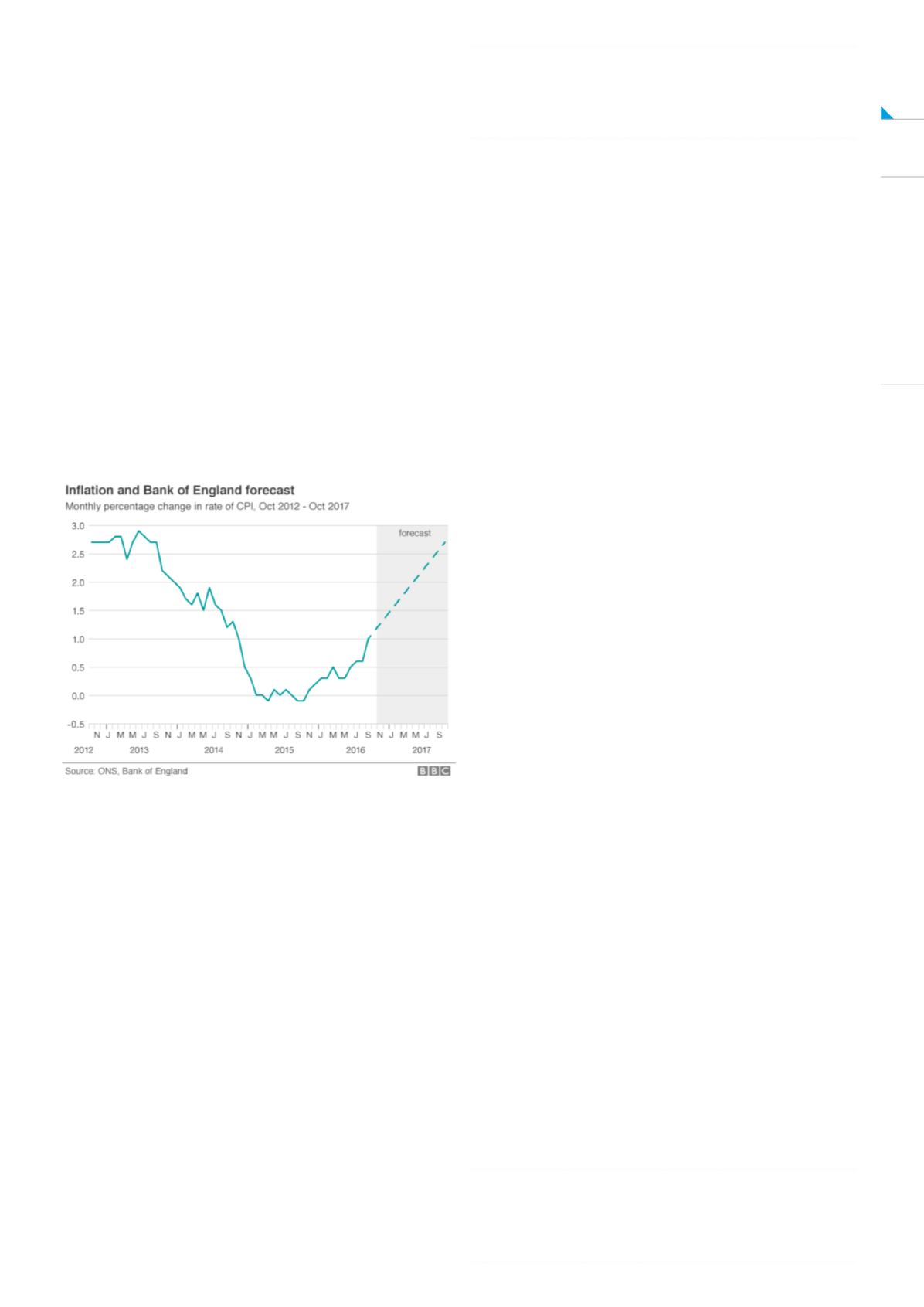

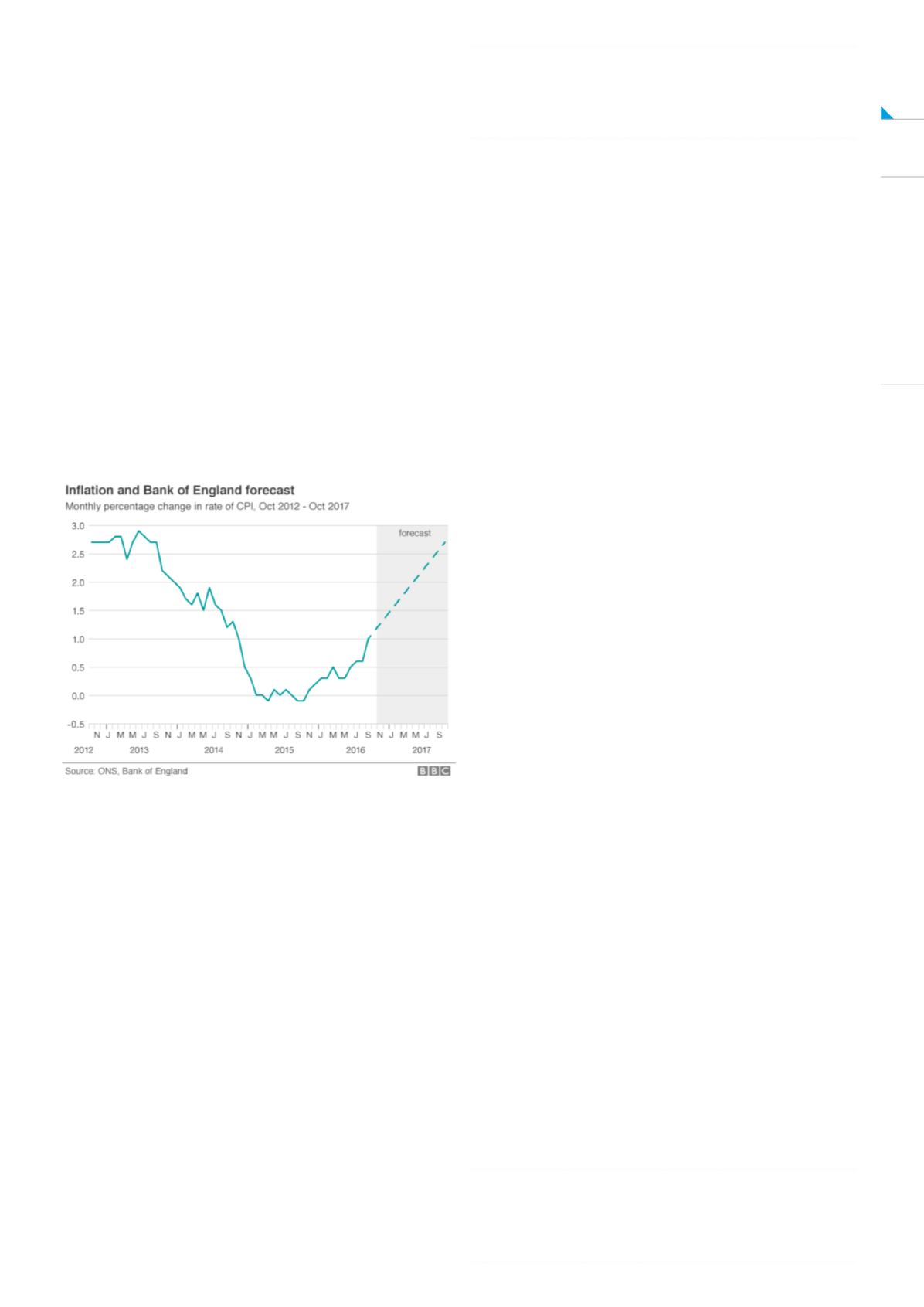

For many investors income is a key requirement, with

inflation predicted to almost triple to 2.7% this year (see

Graph 1) finding suitable investments will become more

challenging for investors to seeking a real return on their

assets. By real, I refer to the rate of growth after inflation

has been stripped out.

Graph 1

There are investment options that allow investors to

mitigate the effect of inflation on their portfolios, the most

obvious being Index-Linked Gilts which have continued

to rise in-price, likely driven by insurance companies

seeking to match their long-term pension liabilities.

This has had a commensurate impact on yields, for

example the 0 1/8% IL Gilt 2024 currently has a yield

of c.-2%.Looking at where long-term inflation-linked

income might be sourced, one area that interests me is

that of Housing Associations (‘HA’s’), which are private,

non-profit bodies that provide low-cost ‘social housing’.

Although HA’s are independent, they are regulated by

the state and receive public funding.

Their aim is to provide affordable housing for people

with lower-incomes, they also provide supported

accommodation, e.g. for people with mental health or

learning disabilities.

Altogether, housing associations provide about

two million homes for five million people across

England.

A recent equity issue that provided access to this

sector was Civitas Social Housing PLC, the IPO raised

£350m and trading started mid-November. The target

yield is c.5%, possibly linked to CPI. The attraction of

investments such as this is based on the following:

•

The issuer, e.g. Civitas, owns the freeholds meaning

they have hard assets on their balance sheet.

•

The underlying leases to the HA’s are linked to CPI

•

The leases are usually fully repairing and insuring,

putting the responsibility onto the HA

•

The leases are long-term, 20yrs+ isn’t unusual

•

Yields on the leases vary regionally but 4% plus is

expected

•

Some HA’s have strong credit ratings

•

HA’s have predictable cash flows through direct or

indirect capital grants, strong regulatory oversight,

and the likelihood of extraordinary support of

government in periods of financial distress. For

example, the Housing Community Agency provided

£ 2.8bn of grants to support housing association

during the recession in 2009.

-

28bn-in-four-months/6504708.article

Whilst being a bear is often unfashionable caution is

sometimes required. It doesn’t take an expert to see

how uncertain the geopolitical situation is, and I haven’t

even considered Brexit and the situation within the EU.

In times like this, companies who have high demand for

their services, whose balance sheet owns hard assets,

and who have consistent cash-flows linked to inflation,

might be an appealing investment, especially for those

seeking income.

I wish all readers a healthy and prosperous New Year.