DIY Investor Magazine

/

December 2015

8

Job Curtis

Manager

THREE REASONS TO CONSIDER

THE CITY OF LONDON INVESTMENT TRUST

AN INVESTMENT TRUST ADVANTAGE

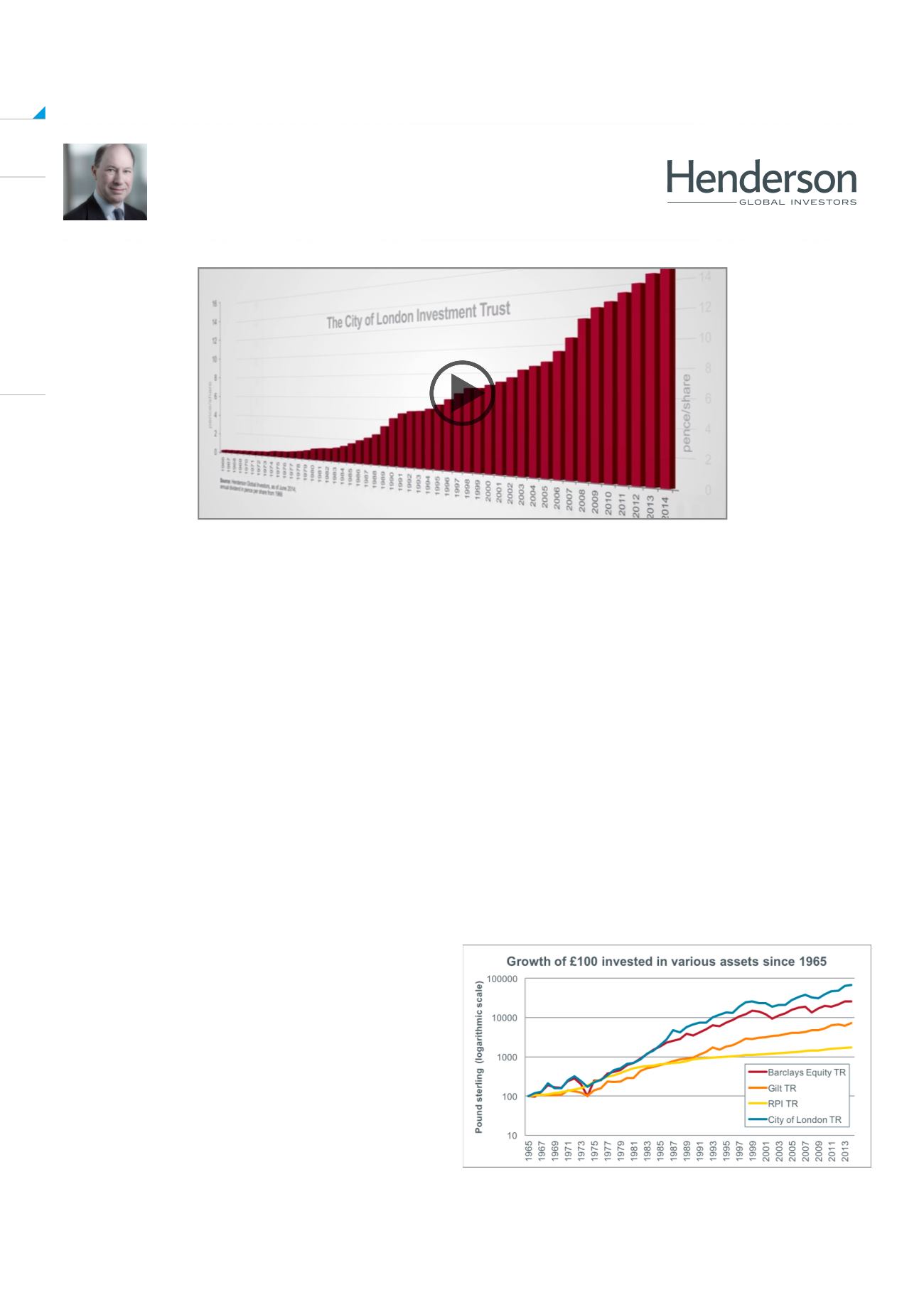

One of the Trust’s strategic aims is to provide a

growing stream of income for its investors by investing

in companies that are well financed, offer a strong

competitive advantage and demonstrate a history of

stable cash-flows and rising dividends.

The investment trust structure helps to achieve this aim:

unlike open-ended vehicles which must pay out all of

the income they receive from underlying holdings, a

UK-domiciled investment trust is permitted to retain up

to 15% of its annual income and pay it into a reserve

account. It means that during more plentiful years a

small percentage of the dividend payments can be put

aside, so that during lacklustre years, for example in an

economic downturn, the fund manager is able to use

the reserve to top-up the dividend it pays investors and

smooth the income stream over time. While not a guide

to the future, this has enabled City of London to grow its

dividend every year since 1966 - the longest record of

any investment trust!

Job Curtis has been managing the Trust since 1991.

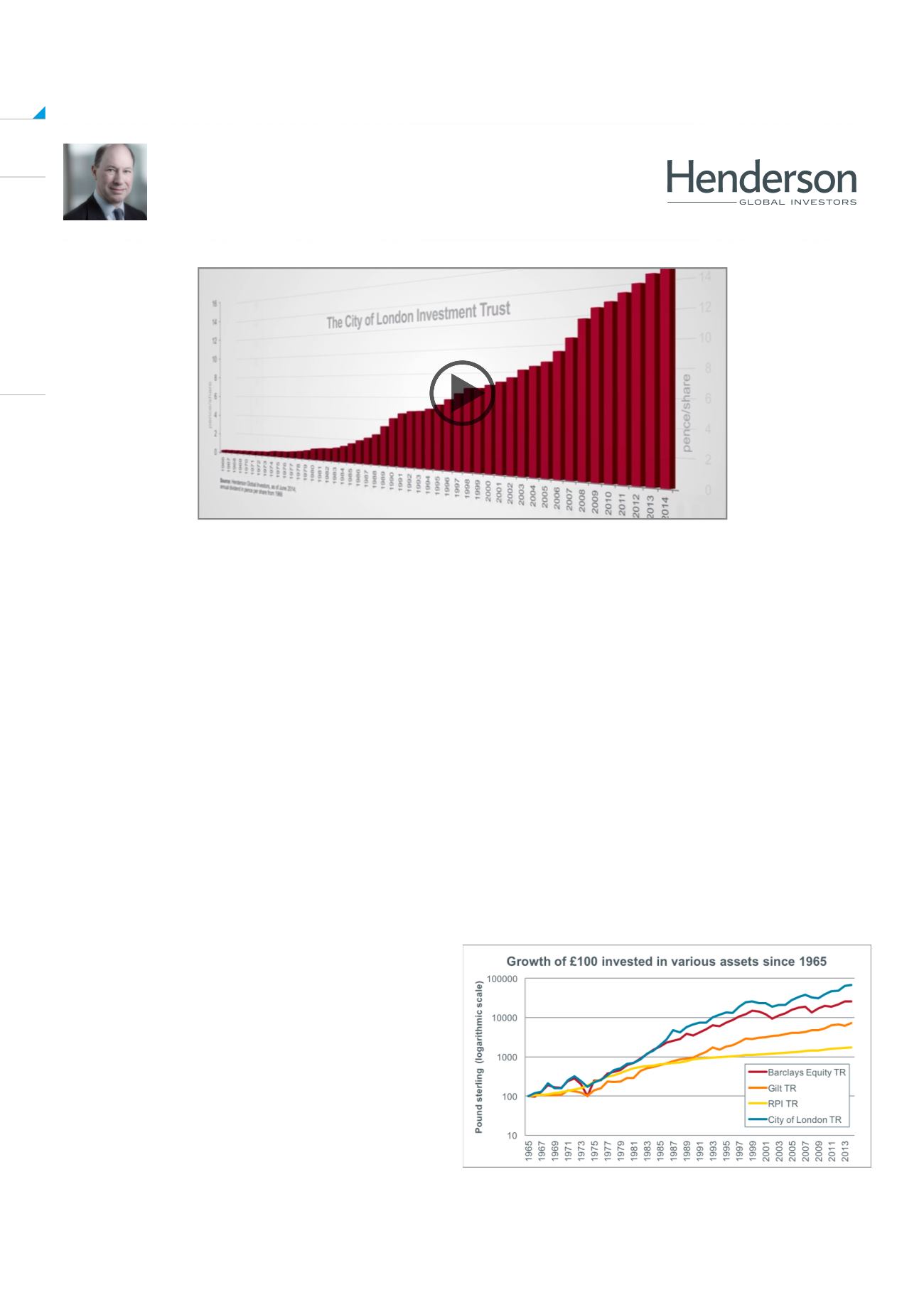

A GOOD INVESTMENT FOR THE LONG TERM?

We believe investing over the longer term serves to

mitigate some of the short-term risks and volatility

inherent in equity markets, and can maximise your

potential returns. The City of London Investment

Trust aims to unlock value in equities on a medium to

long-term basis, and may be of interest to investors

looking to gain UK stock market exposure through a

broad, conservatively managed portfolio of blue-chip

investments. Looking back over the past 50 years,

short term investors may have been unnerved by any

number of macroeconomic events: the 73/74 bear

market, the winter of discontent, severe unemployment,

interest rates hikes to 15%, ‘Black Monday’, ‘Black

Wednesday’, The Asian Financial Crisis, the dotcom

crash, or the Global Financial Crisis; all potentially

leading to performance damaging withdrawals in

the process. The chart below demonstrates the

performance of £100 invested 50 years ago in various

assets, including The City of London, and run through

to the present day.

Source: Henderson Global Investors, Barclays; as of July 2015. Top to

bottom: Barclays Equity Index Total Return; Gilt Total Return (UK government

bonds); the Retail Prices Index (a measure of inflation); and City of London

Total Return.