DIY Investor Magazine

/

December 2015

12

THE UK STOCK MARKET

ALMANAC 2016

Seasonality effects and

anomalies in the UK stock

market

Those looking for a stocking

filler for the trader in their

life could consider a gift that

keeps on giving. The latest

edition of Stephen Eckett’s

fascinating reference work

delivers a comprehensive guide to the next financial

year and vital information for all investors and traders

looking for the little edge that could make a big

difference.

Herein are a flavour of some of the trends that are

identified in the latest edition which also considers the

potential ‘Sell in May’ effect, Chinese New Year and the

Olympics.

THE JANUARY EFFECT

In 1976 a study of equally weighted indices of

stocks on the NYSE had significantly higher

returns in January than in the other 11 months

over the period 1904-1974, indicating that small

capitalisation stocks outperformed larger stocks in

January.

In 2006 what is now known as the ‘January Effect’

was tested on data from 1802 which found the

effect was consistent up to the present time.

SO, DOES THE JANUARY EFFECT WORK FOR

UK STOCKS?

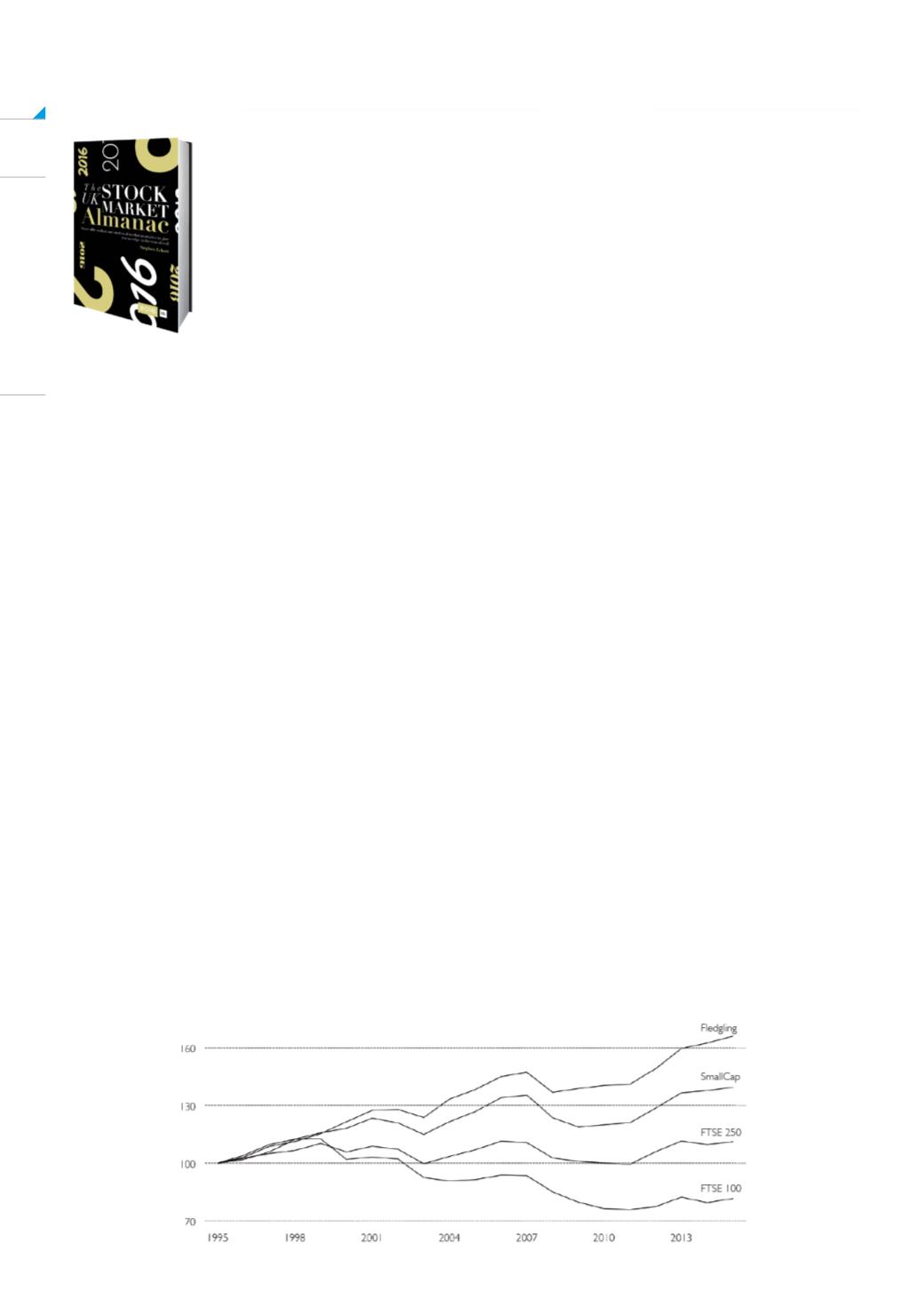

The following chart shows the cumulative

performance from 1995 to mid-2015 of four stock

indices in just the month of January, from FTSE

100 to Fledgling. A portfolio investing in the FTSE

100 in just the Januaries since 1995 would have

fallen 18.4% in value by mid-2015. By contrast,

similar portfolios investing in the FTSE 250, Small

Cap and Fledgling indices would have returned

11.2%, 39.5% and 66.1% respectively.

This suggests that not only does the January Effect

hold for UK equities but also that performance in

January is inversely proportional to company size.

Elsewhere, analysis suggests that if January

market returns are positive, then returns for the

whole year will be positive (and vice versa). This

is sometimes called the January Predictor or

January Barometer. A variant of this effect has it

that returns for the whole year can be predicted by

the direction of the market in just the first five days

of the year.

US PRESIDENTIAL ELECTION YEARS

The UK and US markets are very closely

correlated and, as a result, the most important

predictable event affecting the UK market in 2016

will be the US presidential election.

The Almanac highlights the performance of the

FTSE All-Share index over the 12 months of a US

election year and shows that since 1948, the UK

market has risen 14 times out of 17 (82%) in US

election years, with a rather extraordinary average

annual return in those years of 32.7%.

Generally, the UK market tends to rise in the few

weeks leading up to the election.