DIY Investor Magazine

/

December 2015

13

SUMMER SHARE PORTFOLIO

Avoiding debate around whether Summer should

be defined according to the astronomical or

meteorological calendar, for the sake of this

analysis the performance of the FTSE 350 was

monitored for the ten years between 2005 and

2014 from the summer solstice (June 21st) until the

autumn equinox (September 22nd)

On average over the last ten years, the market

has risen 2.4% over the summer, but an equally-

weighted portfolio of these eight stocks rose an

average of 8.8% in each summer.

An equally-weighted portfolio of these eight

companies would have outperformed the FTSE

350 in nine of the past ten years; the average out

performance each year would have been 6.4%

percentage points.

In the last ten years there are no stocks that have

consistently underperformed the market in the

summer.

AN AVERAGE MONTH

What does an average month for the FTSE 100

look like? The Almanac has charts that show the

average cumulative behaviour of the market by

calculating the daily mean return for each day

in the trading year from 1984. They then show

the average behaviour of the market for the 12

calendar months for each day of the month, and

the average behaviour of the market on each day

in any month.

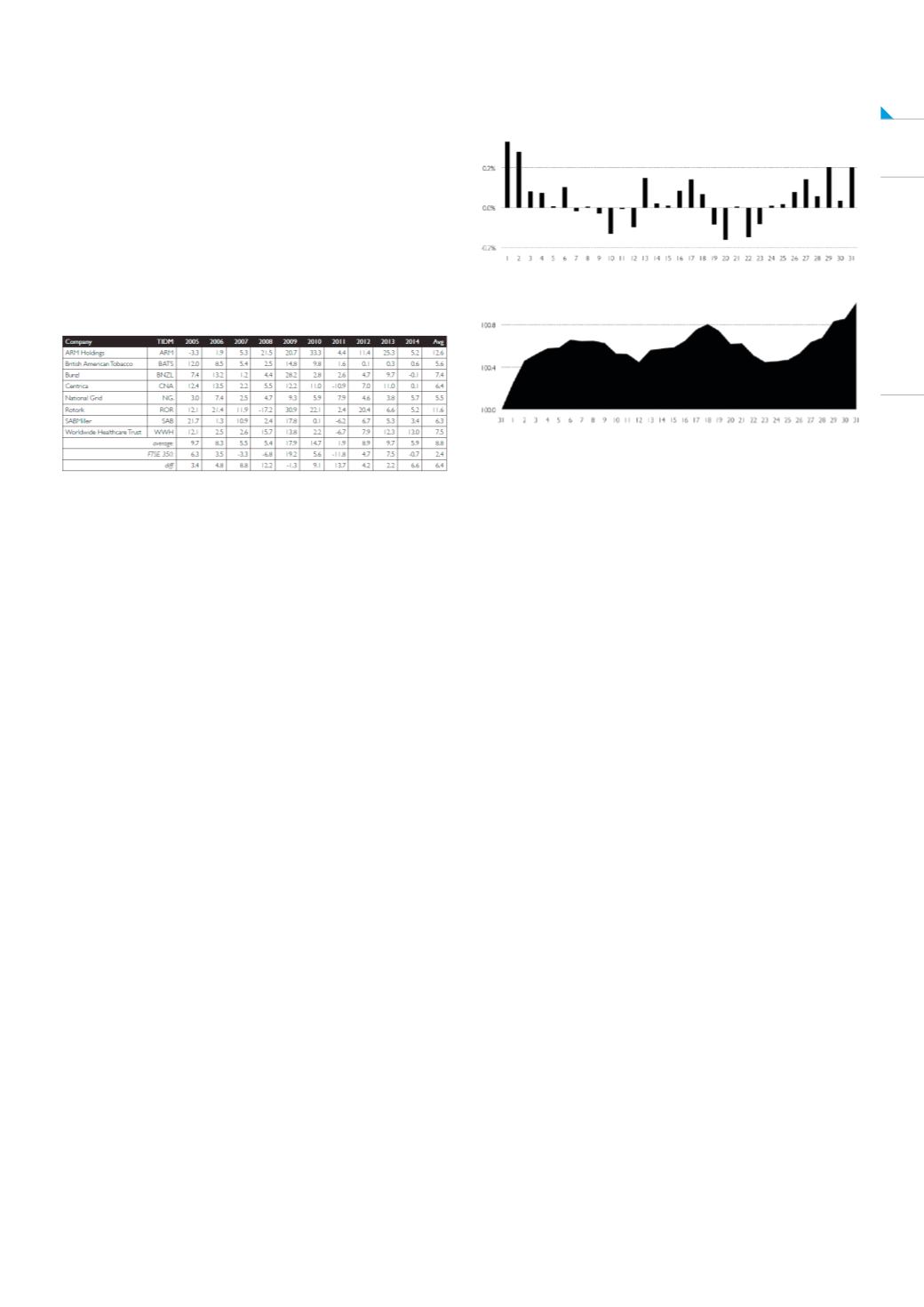

The following chart plots the average daily returns

for each day in the month for the FTSE 100 over

the period 1984-2015.

For example, since 1984 the market has traded

236 times on the first calendar day of all the

months, and the average return of the FTSE 100

on those 236 days has been 0.25% (the first data

point plotted in the chart).

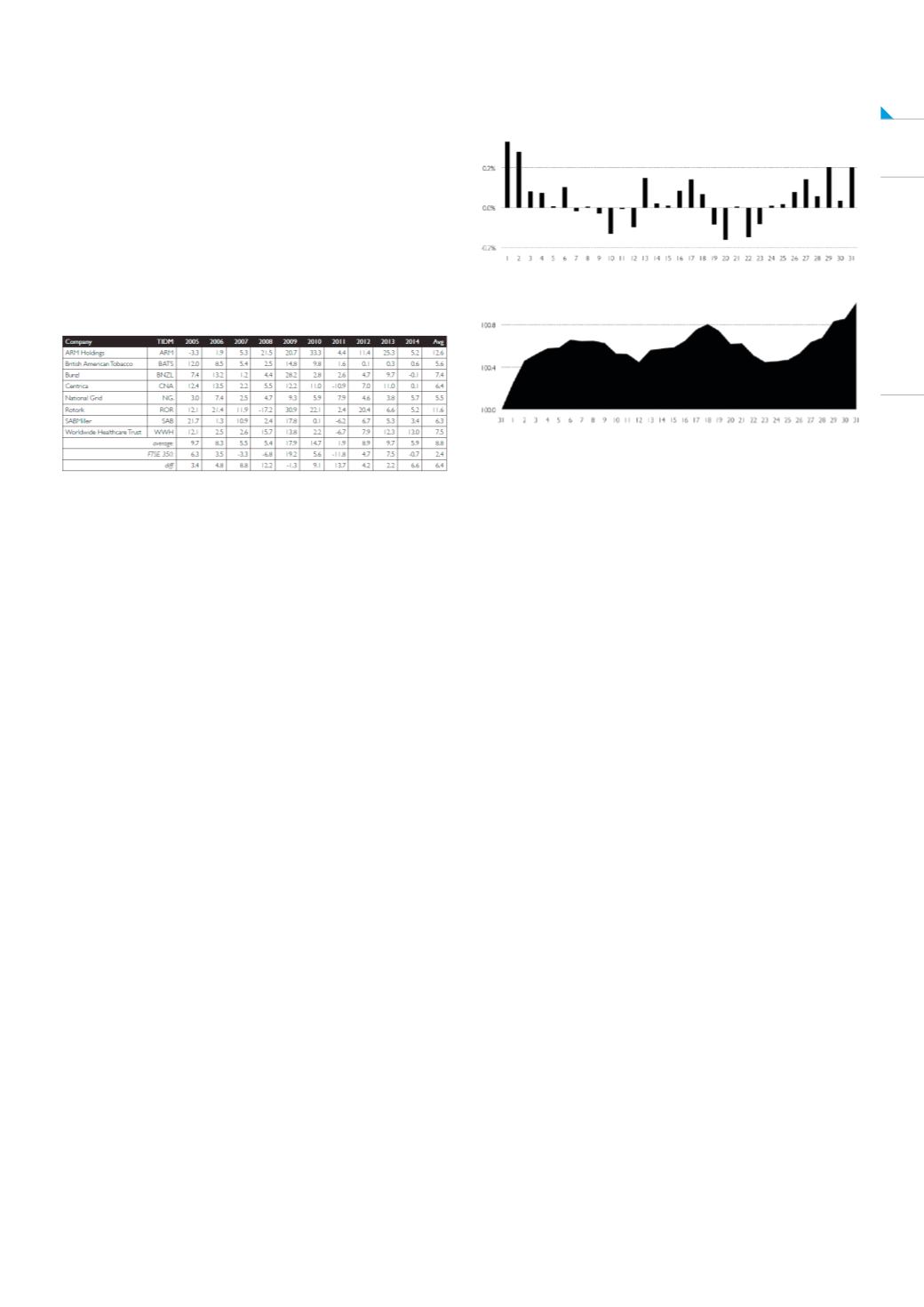

From this data the average cumulative

performance of the FTSE 100 in a month is

presented based on each day’s average gain/loss:

So, in an average month the FTSE 100 rises to

the 5th of the month, then falls back until the 12th.

It then increases again briefly to the 18th, before

falling back and then finally bottoming on the 23rd,

then rising quite strongly from there to the end of

the month. A rather remarkable fact is that 76% of

all the index gains in a month come from the first

and last six days of the month.

Some other trends that are identified indicated that

around the Turn of the Month - analysis since 1970

shows a clear pattern whereby five days before the

end of the month performance is weak (-0.03%)

but then rallies three days before the end of the

month before falling away again. Markets then start

the new month strongly - since 2000 the market

has risen on 64% of the first days in a new month,

with an average change of 0.28% (nine times the

average change on all trading days).

This is a book that may have you scratching your

head in search of a rational explanation for what is

presented, but one thing is for sure, you’ll return to

it again and again as 2016 unfolds.

TO PURCHASE THIS BOOK FOR THE SPECIAL

DIY INVESTOR PRICE OF £18 + P&P (RRP £25)

USE THE FOLLOWING PROMOTIONAL CODE

WHEN CHECKING OUT AT THE HARRIMAN

HOUSE ONLINE BOOKSHOP: DIYEE15