DIY Investor Magazine

/

2015 Issue

24

CLASSIC INVESTMENT

MISTAKES AND HOW TO AVOID THEM – PART 2

Frederik Vanhaverbeke

In this article we focus on three classic mistakes in

the last step of the investment process – buying and selling.

MISTAKE 1: TRYING TO SELL AT A PEAK OR BUY AT A

BOTTOM

Many investors think – wrongly – that successful

investors buy shares at their low point and sell them at

their peak. The idea that one can time buys and sells

with pinpoint precision is the product of a number of

psychological biases.

First of all, many think that stock markets are easier to

predict than they actually are. Second, human beings

tend to discern certain patterns in how share prices

move, whereas, in reality, most price movements are

more or less random. These convictions, coupled with

excess confidence, lead to the idea that it has to be

possible to apply some kind of method to time buys

and sells perfectly.

In a predictable world, timing would indeed be a matter

of logic; however, stock markets are anything but

predictable. Even the world’s most successful investors

think that perfect timing is impossible - who are we to

think otherwise?

Top investors don’t look for the perfect way to time

their purchases and sales, rather they are pragmatic

in making buy and sell decisions. They accept the fact

that a stock may go down after the purchase, or that a

stock may go up after a sale - their overriding concern

is whether the share is expensive or cheap compared

to its intrinsic value. They realise that it makes no sense

to keep an overvalued share, speculating that the price

could go even higher, and believe that it’s silly not to

buy a cheap share because the price might go down a

little bit more.

To avoid having to time purchases, top investors tend to

spread them over time and within a given price range.

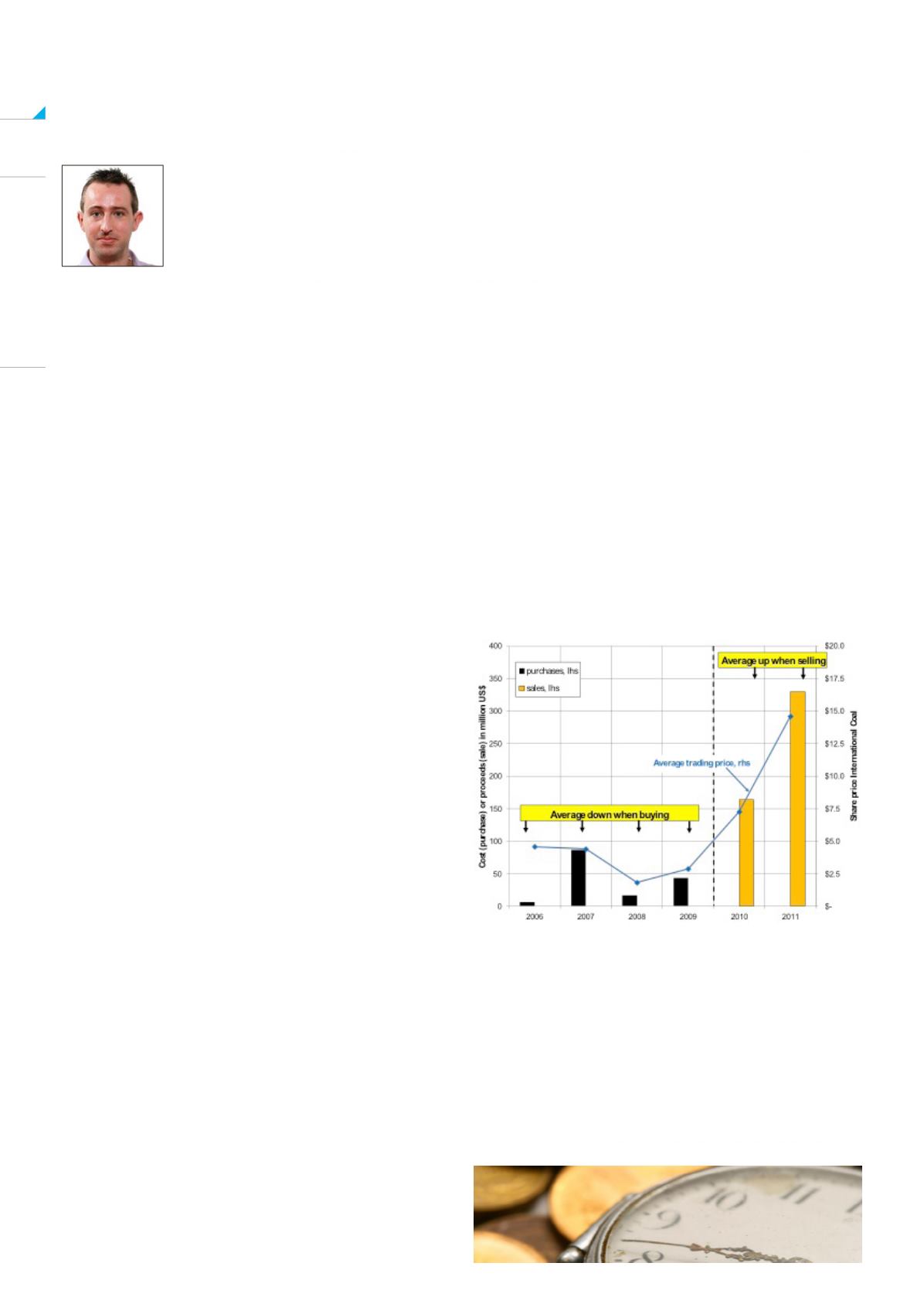

Figure 1 illustrates how Prem Watsa – nicknamed

‘the Canadian Warren Buffett’ because he’s achieved

investment returns similar to Buffett’s – bought and

sold shares in International Coal between 2006 and

2011.

Watsa bought an initial small position in 2006 at $4.6,

after which he seriously increased that position in 2007

at a somewhat lower price of $4.4. When the share

slumped in 2008 in the middle of the credit crisis, he

added to his position at a price of $1.8 and in 2009

he took advantage of the low share price, buying an

additional package of shares at $2.9. As the diagram

shows, the share recovered spectacularly in 2010 and

2011, allowing Watsa to sell the position off gradually

with high profit at $7.3 in 2010 and $14.6 in 2011.

Seasoned bargain hunters understand that it is their

common plight to sell stocks too soon, particularly as

they find cheaper bargains elsewhere. If you hold on to

your stocks as they rise above their estimated worth,

you are joining a game of speculation and have left the

sphere of investing.

John Templeton