DIY Investor Magazine

/

2015 Issue

16

These quotations from Seth Klarman, one of today’s

most respected hedge fund managers, and Jesse

Livermore, a legendary momentum trader of the 20th

century, leave nothing to the imagination. Investors

– whether private individuals or professionals –

repeatedly make systematic mistakes on the stock

market. And many of these mistakes are caused by

unconscious psychological forces that impel investors

to take irrational actions. The relatively recent academic

discipline of ‘behavioural finance’ focuses on analysing

the many psychological forces or biases that lead to

investment mistakes but decades ago, countless top

investors had already discovered the destructive power

of the human psyche, and learned how to deal with it.

In my book Excess Returns: A Comparative Study of

the Methods of the World’s Greatest Investors, I explain

how the world’s most successful investors set about

beating the stock market and how they try to avoid

the errors that other investors make. They emphasise

that successful investors (i) proceed through a superior

investment method, (ii) implement that investment

method consistently and with great discipline, and

CLASSIC INVESTMENT

MISTAKES AND HOW TO AVOID THEM – PART 1

(iii) know how to cope with all sorts of (unconscious)

psychological forces that steer them repeatedly on to

the wrong course. In Part 1we look in more detail at a

number of classic mistakes along the investment chain.

Classic Mistakes Across the Investment Chain

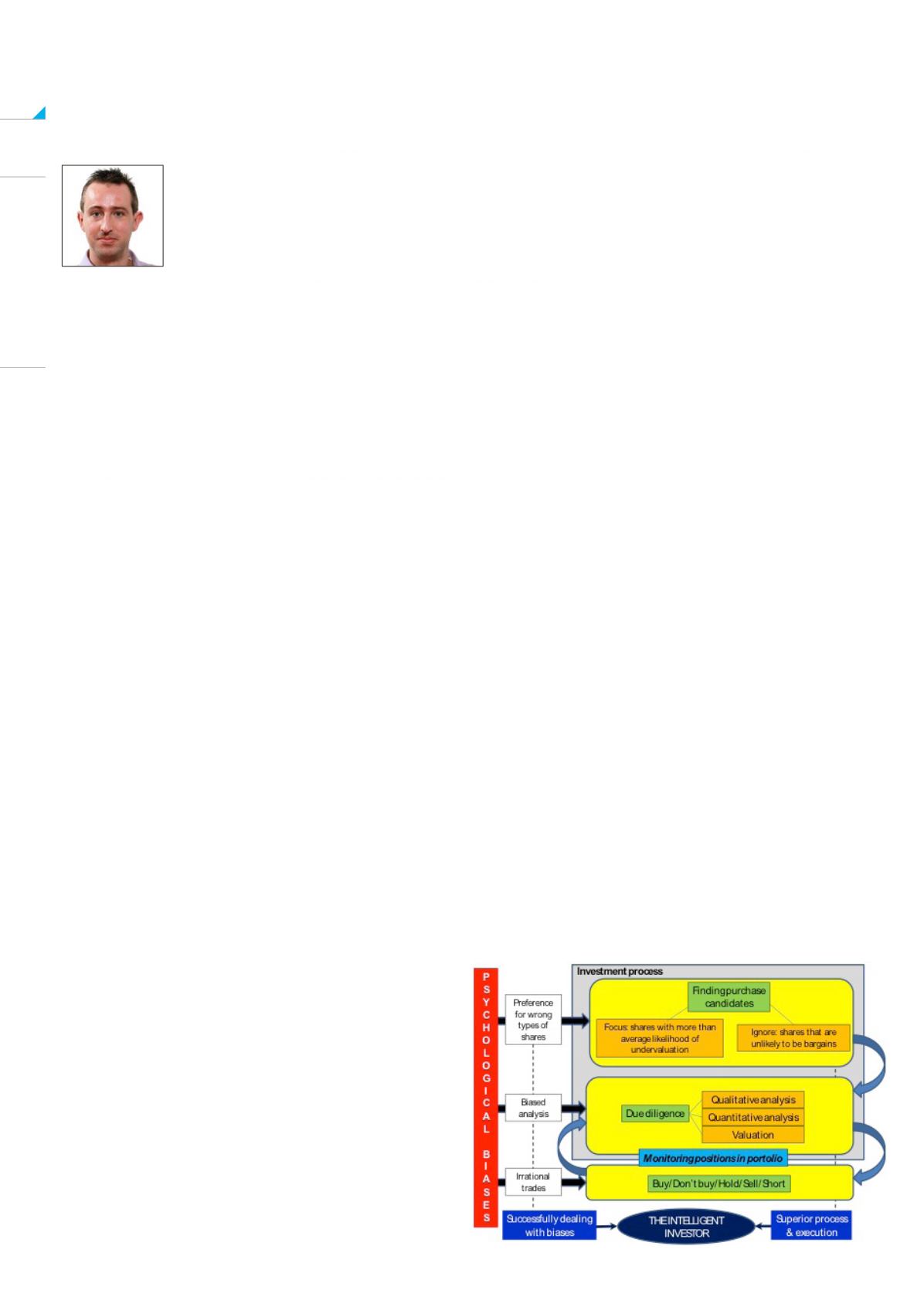

In figure 1, I illustrate the various steps in the investment

chain, and the steps at which things can go wrong:

STEP 1: SELECTING SHARES FOR FURTHER ANALYSIS

Investors must use their time efficiently; it is impossible

to analyse the many thousands of shares on the stock

market so intelligent investors focus their efforts in

the first place on analysing shares that have a greater

chance of being undervalued than other stocks.

Unfortunately, as illustrated in figure 1 there are a

number of (psychological) forces that steer people to

precisely the wrong shares. For instance, many people

seem to find it logical to put their money in shares that

figure prominently in the media, that do something

spectacular, that come to the market for the first time

or that are ‘hip’. Unfortunately, these sorts of shares are

often expensive or over-hyped; top investors find the

most interesting shares are actually those that people

aren’t looking at, that aren’t popular or that people

have an aversion to.

Frederik Vanhaverbeke

Excess Returns: Bond Manager at KBC Asset

Management author of A Comparative Study of the Methods of the

World’s Greatest Investors

A country of security analysts would still overreact.

In short, even the best-trained investors would make

the same mistakes that investors have been making

forever, and for the same immutable reason – that they

cannot help it.

Seth Klarman

There is nothing new on Wall Street or in stock

speculation. What has happened in the past will

happen again and again and again. This is because

human nature does not change, and it is human

emotion that always gets in the way of human

intelligence.

Jesse Livermore