DIY Investor Magazine

/

2015 Issue

6

I have no doubt that investors always think the times

they are living through are astonishing. But just examine

what financial markets are telling us today and you will

agree that these conditions are as unusual as they are

remarkable.

While such markets might make life difficult for

investors, they also present great opportunities and my

approach is to concentrate on diversification, selectivity

and dynamism to get the best results.

The 2008 global financial crisis shocked financial

markets, taking them to the brink of a meltdown. But it

is the market dynamics following the great recession

that have led us to the current situation, packed with

record-breaking extremes.

Following the crisis central banks across the

globe, in the US, UK, Japan and Europe, launched

unprecedented measures of unconventional monetary

policies in the form of quantitative easing (QE). The

task was nothing less than saving the financial system

by relating fragile economies and pulling them out of a

deep recession.

EASING

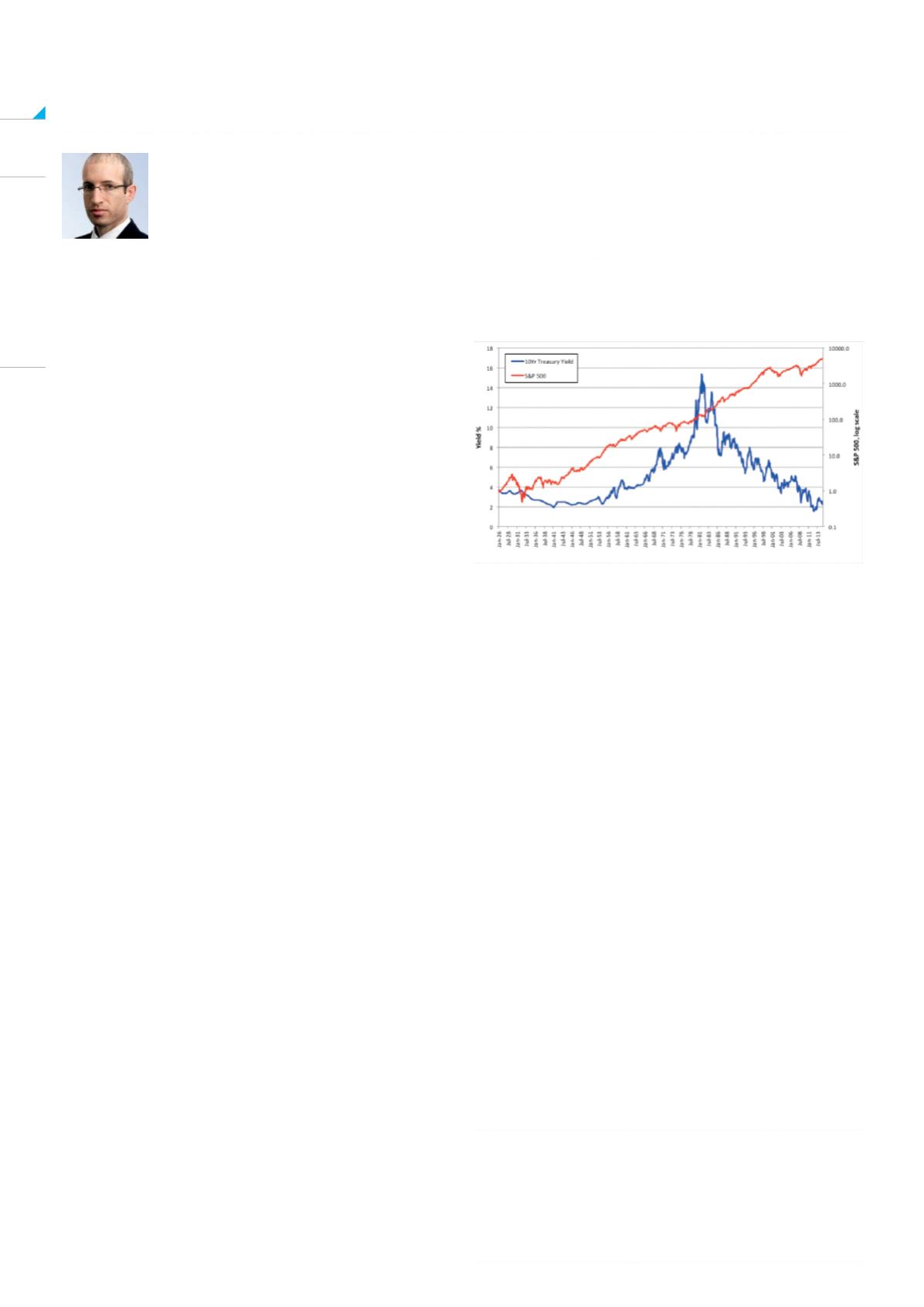

QE involved buying government bonds and pushing

their yields to record lows. And flushing markets with

liquidity also helped push some equity markets to

new all-time highs. Figure 1 correlates the US 10-year

Treasury yield with the performance of the S&P going

all the way back to 1926.

As policymakers aggressively cut short-term rates,

sometimes into negative territory, the new environment

pushed some real estate markets upwards, reaching

bubble conditions. Whether QE was the cure or another

disease is yet to be seen, but undoubtedly it created

financial extremes.

FIGURE 1: DROPPING US 10-YEAR TREASURY

YIELDS & RISING US EQUITIES

We are experiencing extraordinary times in financial markets says

Yoram Lustig, author of The Investment Assets Handbook

DIVERSIFICATION, SELECTIVITY & DYNAMISM

ARE NEEDED TO TACKLE MARKET CHALLENGES

IN A WORLD OF EXTREMES AND UNCERTAINTY ABOUT

ECONOMIC GROWTH, CHANGING SENTIMENT AND

NEWS CAN CAUSE LARGE SHIFTS IN ASSET PRICES,

INJECTING VOLATILITY INTO THE SYSTEM

Source: Bloomberg, January 1926 to December 2014

CHANGING WORLD

However, it is not solely QE that brought with it the

extraordinary conditions we are facing today. The world

is a dynamic place that keeps on changing. China,

once the global growth engine, began its secular

decline towards what some would call a ‘normal

economic growth rate’.

The oversupply of petroleum, together with falling

demand, as well as some conspiracy theories of Saudi

Arabia against the US fracking industry and US against

Russia and Iran, pushed oil price off a cliff to a 50%

free fall. The dropping oil price has taken inflation down

with it, towards deflationary territory.

The desire to export deflation, reflate economies and

enhance competitiveness of exporters has meant a

series of global currency wars, seeing the US dollar

appreciating and some other currencies collapsing.

After decades of increasing globalisation, the world’s