DIY Investor Magazine

/

2015 Issue

30

HOW DO I INVEST IN TRADE FINANCE?

As a result of the Basel III regulations, a number of

global banks including Santander, Citibank, and BNP

Paribas have issued bonds secured by trade loans.

This type of transaction is referred to as securitisation,

and the security is referred to as collateral. Essentially,

the interest on the trade finance loans services the

bonds coupons, at maturity investors capital is returned

as the loans are self-liquidating.

Whilst this sounds complicated a parallel can be

drawn with a previous retail bond issued by Bruntwood

Investments, which was secured on a portfolio of

commercial properties. A bond based on trade finance

would be secured (collateralised) on a portfolio of trade

financing agreements covered by way a 100% first lien

on the underlying commodities.

As with Bruntwood, the issue could be over-

collateralised, e.g. Bruntwood issued £50m worth of

bonds which we secured over £70m worth of property,

protecting investors against potential falls in asset

prices. However, as trade finance loans are of short

duration, typically <100 days, and self-liquidating this

can be less of an issue for investors in that underlying

collateral.

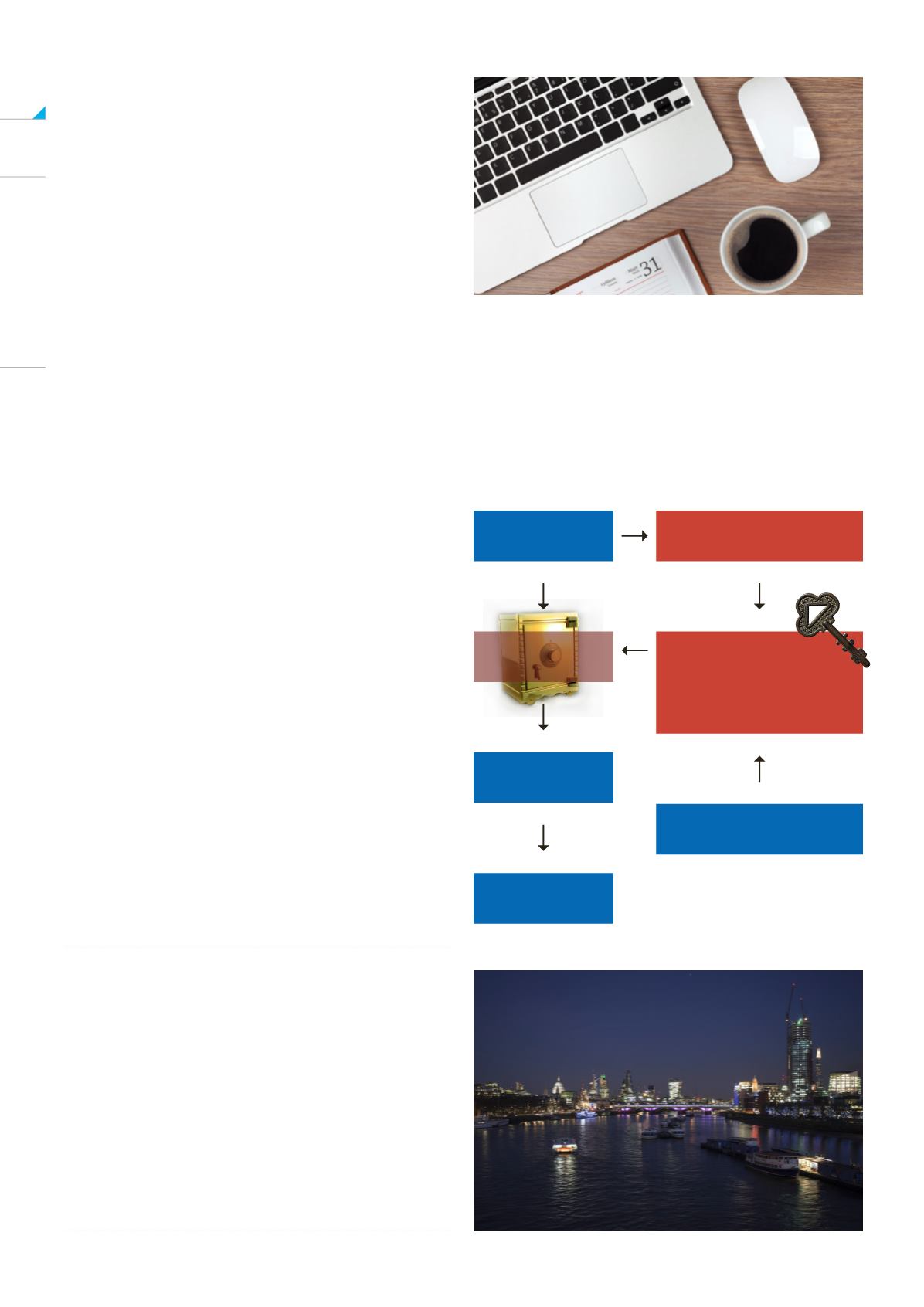

HOW SECURE IS THE SECURITY (COLLATERAL)?

The answer is simple it ‘very secure’. The beneficial

owner of the first lien on the goods is the Trustee on

behalf of Bondholders. All assets of the Issuer will be

held within the Security Trust. Bondholders will have a

direct first legal/security charge over the assets of the

Issuer, via the Security Trust.

INVESTOR/

BONDHOLDER

TRADE FINANCE

CONTRACT

COMMODITY -

THE COLLATERAL

COLLATERAL

ADVISER

FIRST CHARGE OVER

THE COLLATERAL

THE ISSUER

SECURITY TRUSTEE

BENEFICIAL OWNER

OF EVERYTHING THE

ISSUER OWNS

TRADE FINANCE IS A LOAN THAT FUNDS THE SALE OR

PURCHASE OF GOODS, OFTEN ACROSS BORDERS.

THE STRUCTURE OF THAT LOAN MIGHT BE A LETTER

OF CREDIT, FACTORING AND DIRECT LENDING, AND,

IN RECENT YEARS, SUPPLY CHAIN FINANCE - BUT THE

PRACTICE IS AS OLD AS BANKING ITSELF”

“TRADE FINANCE LOANS ARE OFTEN SHORT TERM,

DECREASING THE DURATION RISK FOR INVESTORS.

DEPENDING ON THE SECTOR, THE AVERAGE FINANCE

PERIOD RUNS BETWEEN 90 TO 120 DAYS

Essentially, the assets, either cash waiting to be lent or

re-lent, or the first charges over the assets are locked in

the Security Trust which acts like a safe; the only person

with the key to the safe is the security trustee who is

the beneficial owner of behalf of the bondholders. The

Security Trustee is usually a global institutional such as

US Bank Trustees, Citigroup, etc.