DIY Investor Magazine

/

2015 Issue

23

the US market is harder than it was when HINT was

launched; for these reasons the Trust is underweight

the region.

SO WHERE IN THE GLOBE ARE YOU FINDING

VALUE?

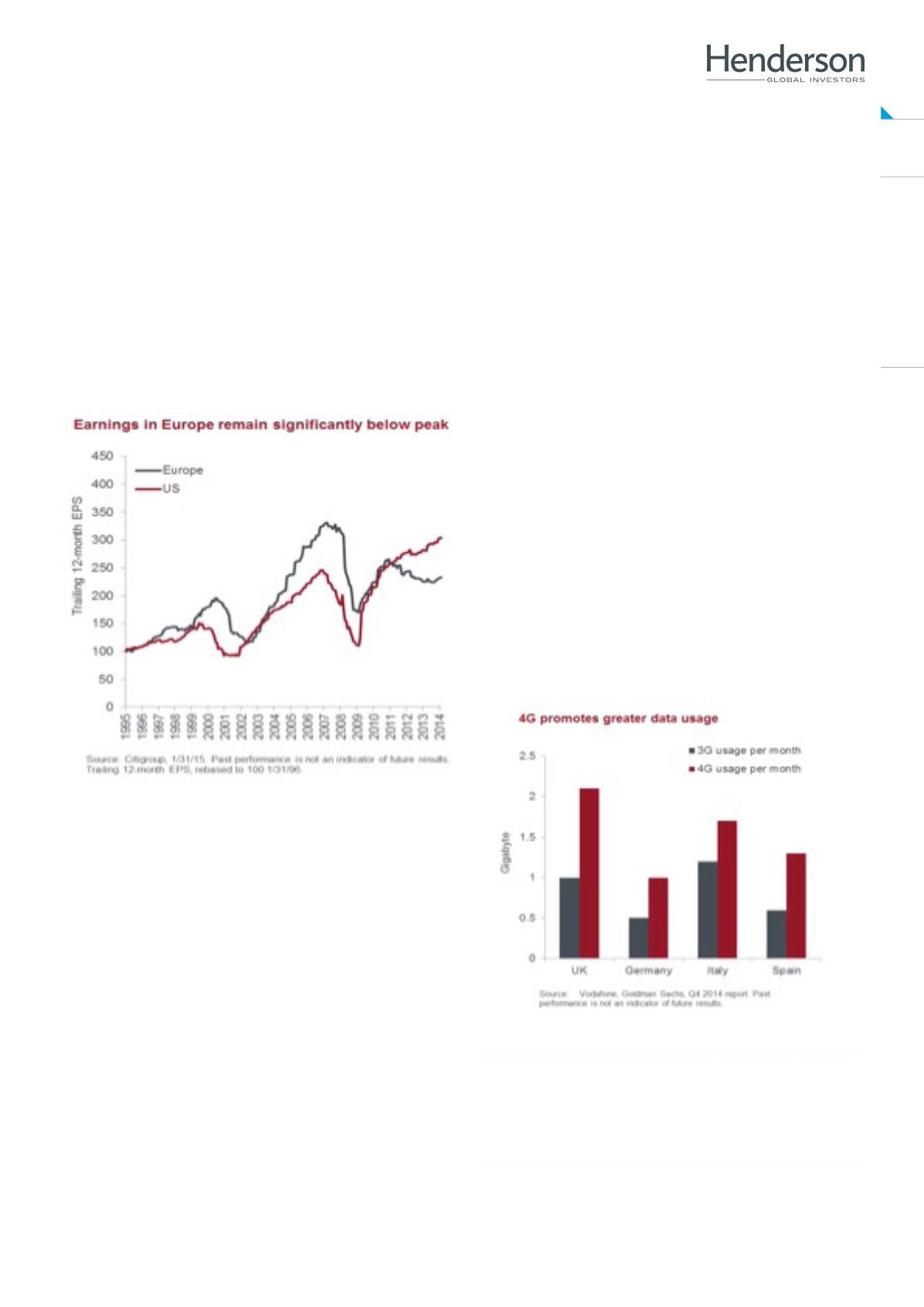

I’d say Europe and Asia are currently offering attractive

valuations. In Europe quantitative easing (QE) from

the European Central Bank has certainly grabbed

investor attention, but the investment case goes further

than this. Earnings, for one, are only just beginning to

recover; a stark comparison to the US (see below).

The euro is weakening on account of QE, providing

a boost to exporters. We’ve seen a reduction in fiscal

drag, as public sector cuts have been reducing

and receipts from tax revenues increasing. Coming

alongside a recent drop in ‘effective’ interest rates

and cheap oil, this is all putting money in consumer’s

pockets.

In Asia we are particularly encouraged by the

increasing focus on shareholder returns. In China

the fight against corruption and the shake-up of

state-owned enterprises (SOEs) is improving capital

distribution. Capital and labour movement are freer

than before and the People’s Bank of China (PBoC) is

providing stimulus in selective areas. Expectations and

earnings are also low which means the Trust is finding

some great buying opportunities on a case-by-case

basis.

ARE YOU FINDING ANY SECTORS OR THEMES

PARTICULARLY ATTRACTIVE?

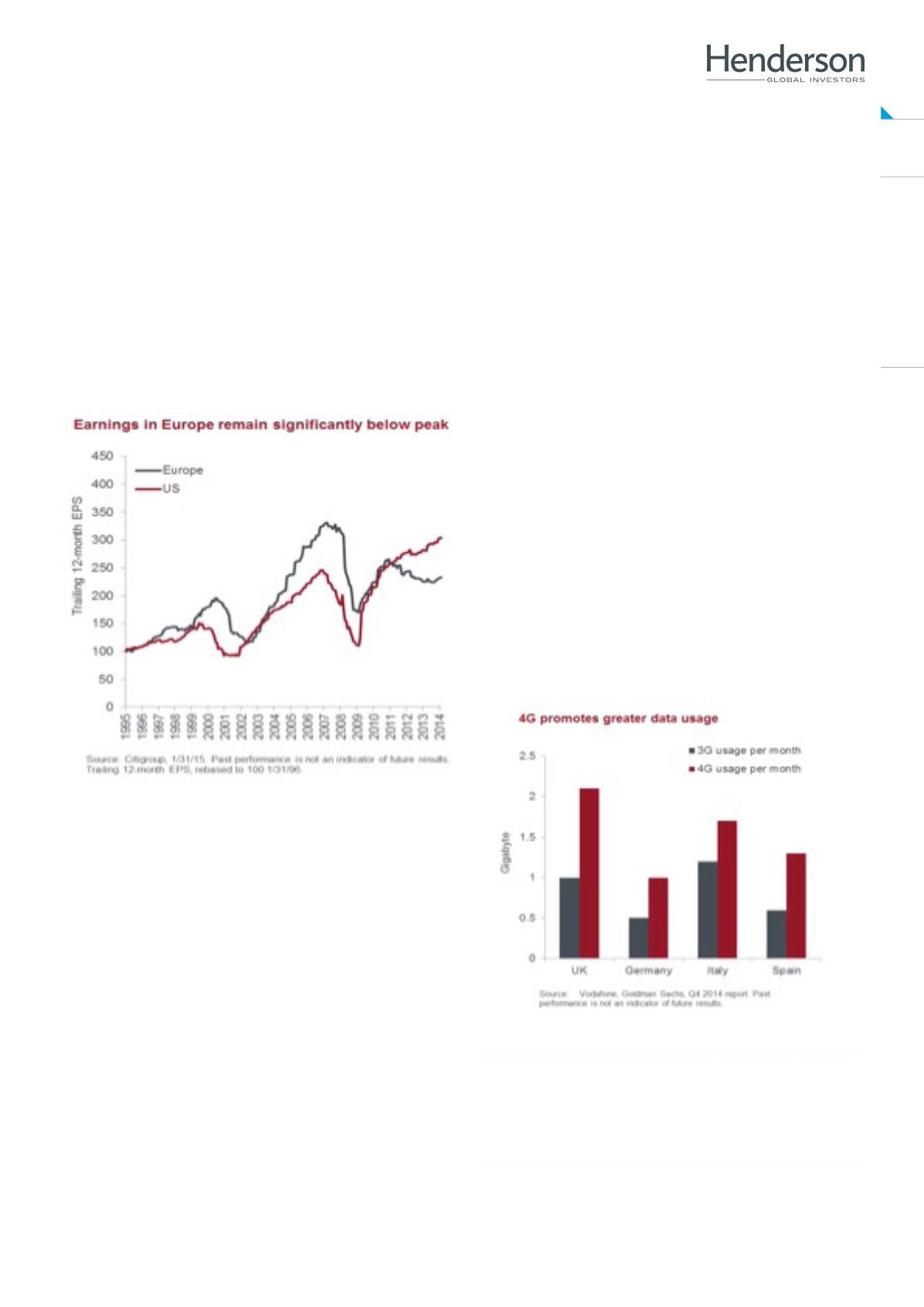

Telecommunications is one area we like. At the end

1990’s many of the big players in this space were very

profitable. Foreseeing the rise of mobile internet as

the next earnings driver they invested heavily in data

licenses for their networks. They were correct, but

communications technology took longer to develop

than expected which meant that effective mobile

internet did not become a reality until 2007 upon

the invention of the smart-phone by Apple, and has

only recently started to drive incremental revenues.

Regulators around the world added to the technological

headwinds: attacking the tariffs operators charged,

driving down returns.

Following a period out in the cold we think two

important drivers are now in place for revenues to

start growing again. Firstly, increased pricing power

is coming with increasing data. For those that have

invested heavily in 4G networks this is translating into

growing profitability as customers become more likely

to use more data if its access is quicker.

FORESEEING THE RISE OF MOBILE INTERNET AS THE

NEXT EARNINGS DRIVER THEY INVESTED HEAVILY IN

DATA LICENSES FOR THEIR NETWORKS.