DIY Investor Magazine

/

2015 Issue

29

WHY INVEST IN TRADE FINANCING?

Trade finance loans are historically considered safer

investments:

• Between 2005 and 2009, only 1,089 trade finance

transactions defaulted out of 5.2m transactions from nine

leading international lenders, for a default rate of about

0.02%, Source: International Chamber of Commerce and the

Asian Development Bank.

• This is comparable to the long-term average default

rate for companies rated AA by S&P, Source: UK

based Equity Development.

• Trade finance is resilient to crisis,:

• During the crisis of 2007-08 only 445 international

trade defaults were reported out of 2.8 million

transactions conducted over this period.

• Source: International Chamber of Commerce

• Essentially world trade continued to function financed

by the trade finance procedures defined over

hundreds of years.

• Even countries in default need to ensure that trade

finance obligations are completed in order to allow

supplies of food and other basic necessities to continue.

• Trade financing is secured: funds advanced to

producers are typically guaranteed by the goods

themselves. Furthermore, they are insured to

overcome weather issues, loss as sea etc.

• Duration; trade finance loans rarely exceed 120 days,

therefore the loan is self-liquidating

WHAT ARE THE RISKS?

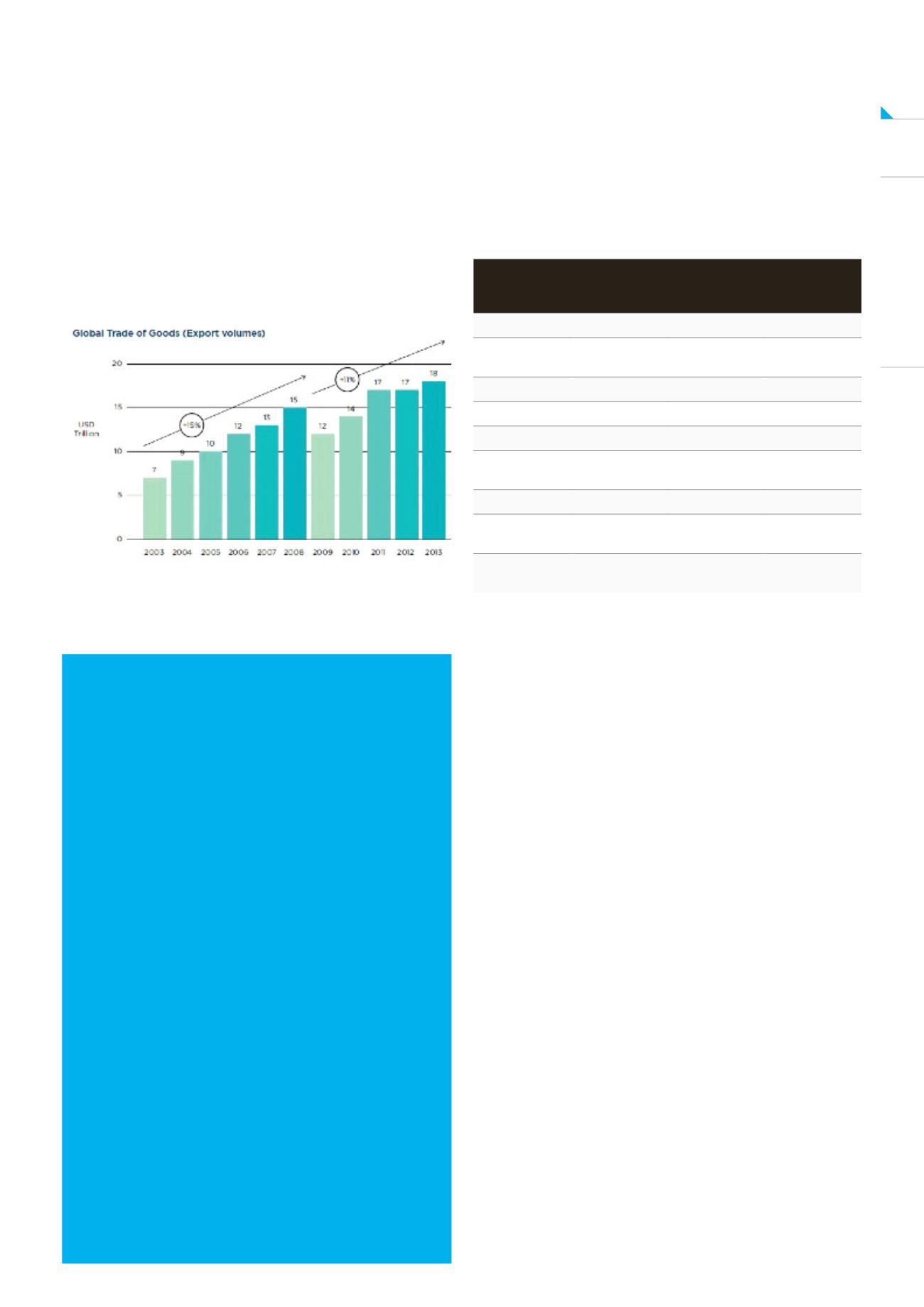

The financing of trade has historically formed a

core part of a bank’s own lending activities. Global

banks are active providers of revolving trade backed

financing. Set out below is a table produced by Bank

for International Settlements highlighting the trade

finance assets held by a number of banks in January

2014:

Total assets

(US$ bn)

Trade finance

assets (US$ bn)

Trade finance

as % of total

assets

HSBC

2,556

166

6.5

Standard

Chartered

599

110

18.4

Bank of China

1,878

107

5.7

ICBC

2,456

86

3.5

Deutsche Bank

2,800

74

2.6

JP Morgan

Chase

2,266

35

1.5

Unicredit

1,199

18

1.5

Banco do

Brasil

523

16

3.1

Intesa

Sanpaolo

827

8

0.9

THE REASON? IT IS INHERENTLY LOW RISK.

The loans are short term. The security of loan is

over collateralised against a real asset with real

value (goods). There is no market price movement

risk as the goods are pre-sold. The credit risk is

almost always to the bigger company in the chain

(money goes to a farmer but is owed from the mill,

for example).

•

Loss of goods? Theft? Fraud? Default of the

purchaser? These are the key considerations

in any trade deal. Insurance is normal on all

goods shipped (even e-bay suggests you

do this).

•

The difficult part is the credit checking of the

purchaser and this is where an experienced

operator is essential. Like a bank who collects

all that annoying information when you want a

mortgage, there are systems and people in the

world who are specialists in credit checking. The

right skills are key to reducing risk.

•

How can an investor be sure? Like any other

investment, you can ask for advice, read around

the subject, and look for a credit rating assessed

by an approved credit rating agency.

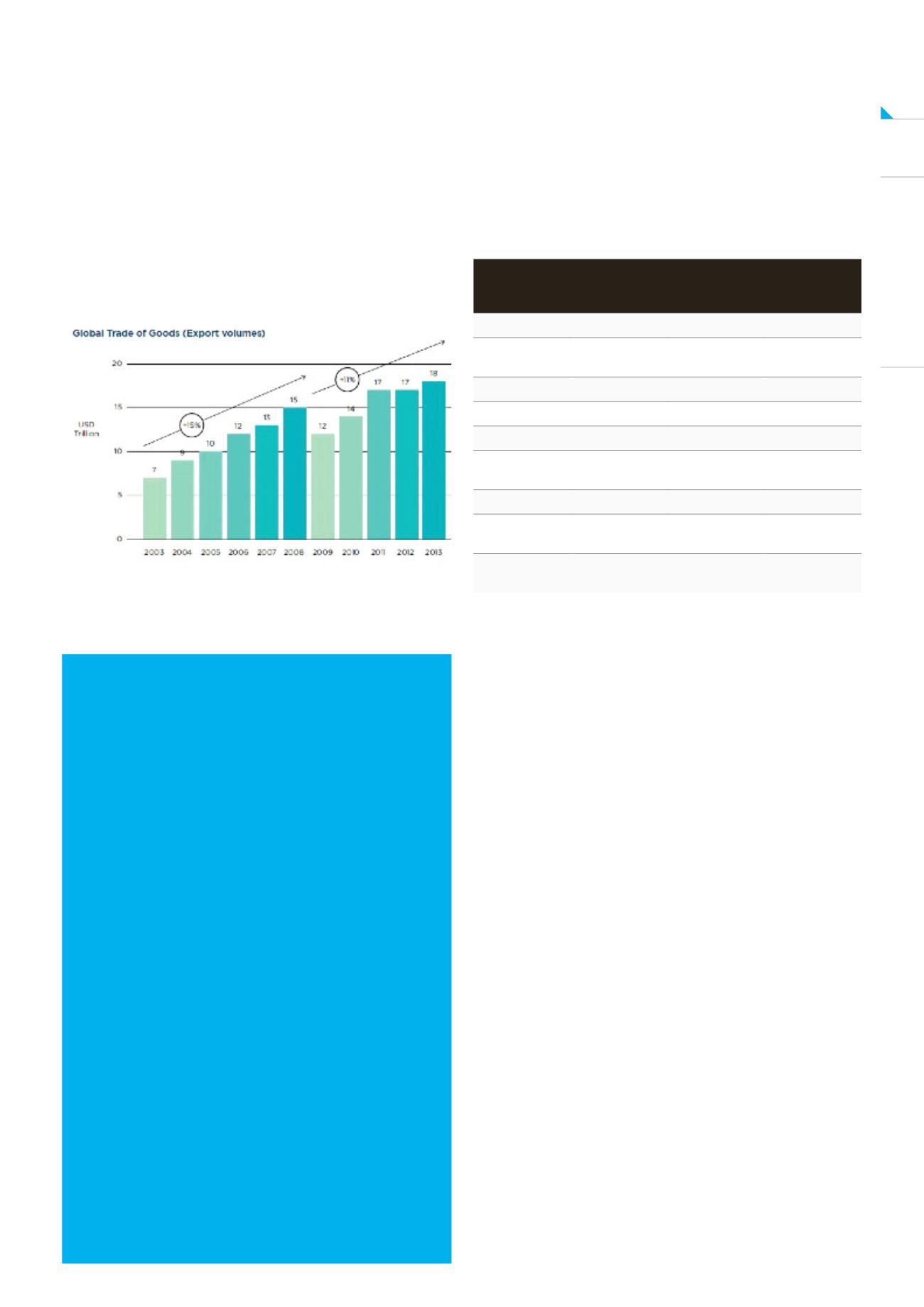

The impact of the Basel III global banking regulations

has reduced the ability of banks to meet the funding

required to match the predicted growth in international

trade. According to estimates from Standard Chartered

Bank, the new proposals will lead to an increase in

trade finance pricing of between 15% and 37%. This in

turn, according to the bank, could lead to a reduction

in trade finance volumes of 6%, which would also mean

a reduction in global trade by $270bn per annum, and

a 0.5% reduction in global gross domestic product.

Source: The Wall Street Journal, February 2011.

“I AM MORE CONCERNED WITH THE RETURN OF MY

MONEY THAT THE RETURN ON MY MONEY”