DIY Investor Magazine

/

March 2014

21

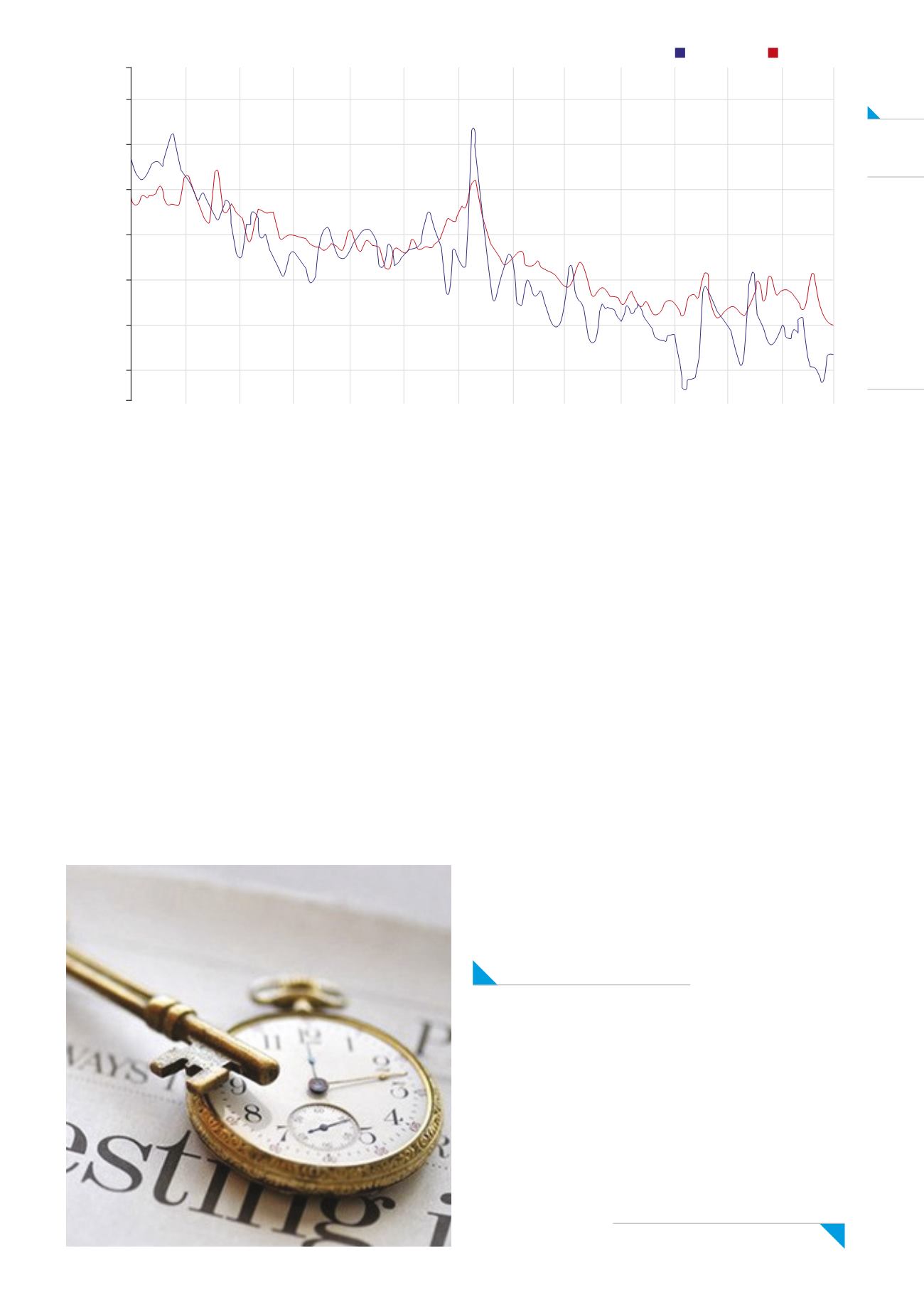

Initial Claims Unemployment Insurance (Thousands)

University of Michigan Social Media Job Loss Index

Sources: Initial Claims Unemployment Insurance (seasonally adjusted), U.S. Department of Labor, Prediction, University of Michigan Social Media Job Loss Index

440

420

400

380

360

340

320

Jul 16, 2011

Oct 01, 2011

Dec 17, 2011

Mar 03, 2012

May 19, 2012

Aug 04, 2012

Oct 20, 2012

Jan 05, 2013

Mar 23, 2013

Jun 08, 2013

Aug 24, 2013

Nov 09, 2013

Jun 25, 2014

Apr 05, 2014

Initial Claims

Prediction

The above image shows how twitter sentiment is

currently being used to predict US unemployment

claims, a major macro economic indicator.

By processing millions of tweets and calculating the

sentiment of the general public The University of

Michigan has started to show a correlation with the

official figures being released.

Other companies, such as Heckyl, have taken on these

challenges and are refining the process still further to

calculate even more accurate forecasts of US Jobless

Claims.

SENTIMENT ANALYSIS: THE

WAY FORWARD

Many companies have started to adopt Sentiment

analysis in taking key decisions and it is now becoming

accessible to retail investors also. State of the art

algorithms are continuously being researched and

implemented to improve the efficiency of Sentiment

analysis.

These will only get better as they are refined and the

number of users and content from the sources, such

as twitter and blogs, continue to increase. We are

in middle of an era of information explosion, where

assimilating all the information is no longer feasible.

Sentiment quantification is the answer to this and the

applications of sentiment analysis are infinite.

SENTIMENT IS A VERY VERSATILE TOOL,

WHICH CAN ADD NEW DIMENSIONS TO

BOTH FUNDAMENTAL AND TECHNICAL

ANALYSIS. WHILE DOING FUNDAMENTAL

ANALYSIS, SENTIMENT EQUIPS THE

INVESTOR WITH USEFUL PRIOR

KNOWLEDGE ABOUT THE SECTOR.