DIY Investor Magazine

|

June 2017

51

The interaction between the pension and IHT tax

regimes, the need for long-term income, the potential

need for long term care, the need for a diversified

asset mix of real assets inside your pension fund (not

just owning a residential property outside your pension

fund), the tax effectiveness of investing inside a pension

wrapper, the triple lock (or even double lock) on state

pension benefits, the enhanced death benefits and

IHT planning under pension freedoms all serve to

highlight the critical need for professional advice when

considering a full or partial transfer of DB scheme

benefits.

THE STATE OF DB SCHEMES

When planning to transfer from a DB scheme it is worth

considering the health of the scheme and the risk of

it failing to meet some or all of its future liability; the

current level of UK DB scheme deficits is c£300bn.

The Pension Protection Fund (PPF) only covers

pensions to a cap which from 1 April 2017 is £38,505.61

per year (£34,655.05 when the 90% level is applied);

PPF has approximately £3.5bn of assets and receives

c £540m a year in levies so lags the deficit by a wide

margin.

The true long term security of any DB scheme is very

difficult to assess - current funding, future shocks to

liabilities, strength of employer (risk of failure), costs,

long term returns and asset liability mix are all factors;

as BHS, Tata and a myriad of smaller scheme failures

show that DB schemes are no longer absolutely

‘guaranteed’ as they once were.

With most schemes closed to new members, benefits

being paid out are higher than contributions in, and the

move to reducing ultimate benefits (career average vs

final salary definition for pension purposes), many will

see great value in ‘personal ownership’ of their pension

rather than ‘fractional ownership’ in an opaque pooled

DB vehicle.

WHY NOW?

A decade of low inflation may be coming to an end –

there are signs of global growth and the UK is seeing the

first signs of imported inflation caused by the falling value

of sterling post Brexit. Asset managers are warning about

the risk to capital of holding bonds in the expectation of

growth and thus inflation and interest rates picking up.

If inflation rises, and / or bond liquidity dries up, the fall in

bond values may be sharp (lower interest rates increase

bond duration making them even more sensitive to yield

changes).

Some investors will take the view that a DC ‘pot’ in

their own name is more secure than a ‘promise’ in a

DB scheme: larger deferred DB pensioners have less

protection under the Pension Protection Scheme, the

costs of a DB scheme are impossible to assess and

the long duration of DB schemes bond assets can

cause very sharp changes in solvency. A rise in interest

rates would be good for an annuity purchase from DC

schemes, and the same would be true of a buyout from

a DB scheme – except that the rise would have impacted

the asset valuation of the DB scheme – whereas an

appropriate asset allocation in a DC scheme could

mitigate this.

HIGH CETVS.

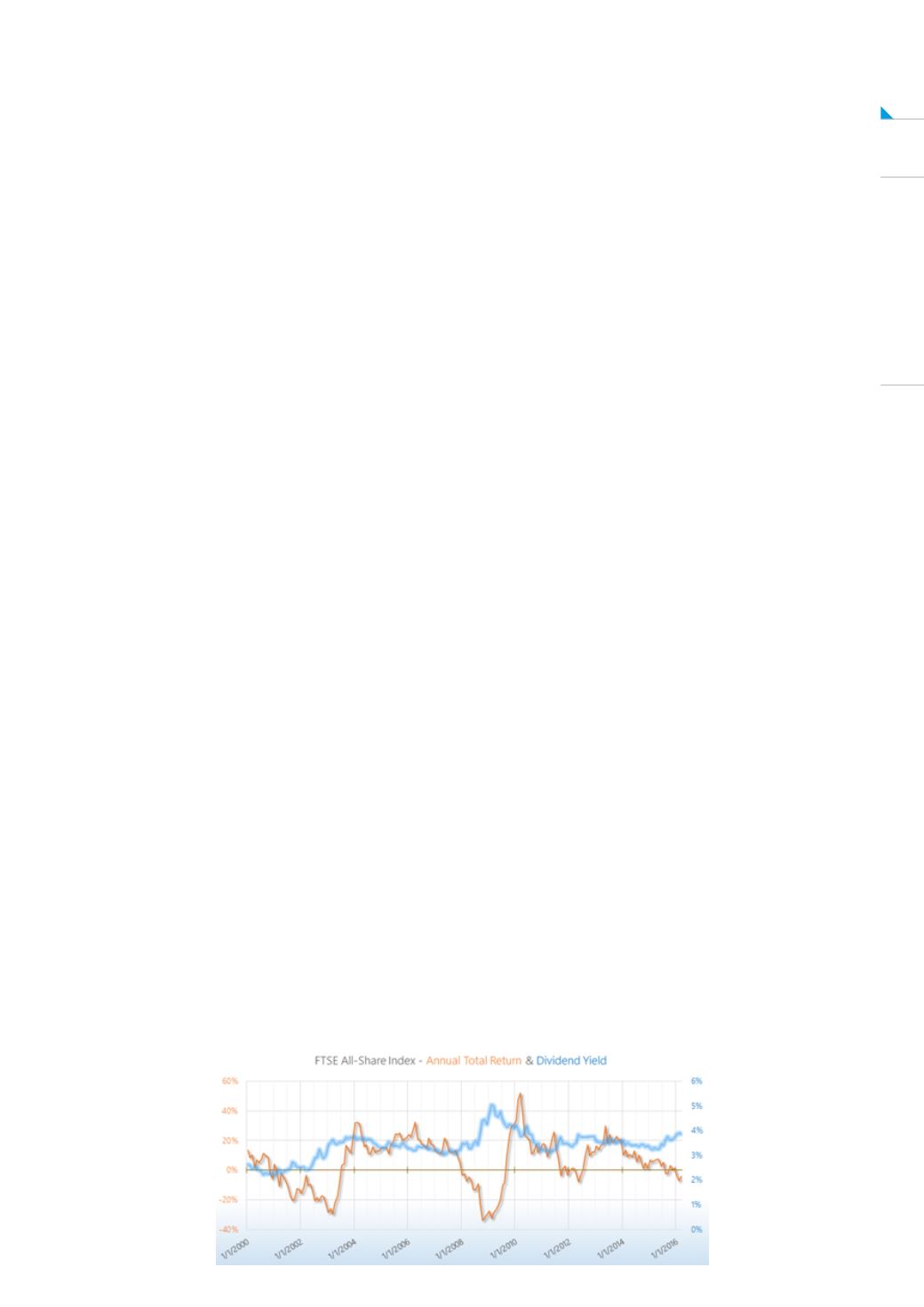

It is easy to see why a transfer value, based on bond

yields of less than 1%, invested in a broad equity

portfolio, with a 3-4% dividend yield could make a move

from DB to DC worthy of consideration at least from a

long-term investment return perspective; witness how

steady the dividend yield has been from FTSE ALL Share

companies - Figure 4.

Figure 4. FTSE All-Share Index Dividend Yields (blue)

and Annual Total Returns (red). Source: Siblis Research