DIY Investor Magazine

|

June 2017

48

SAVING UP AND DRAWING DOWN; WITH VALUATIONS AT

RECORD HIGHS, SHOULD YOU CASH IN A DB PENSION?

David A. Norman

CEO, MAPS and TCF Investment

Falling bond yields have driven up transfer values from

final salary or defined benefit (DB) pension schemes.

Some of these lump sums are life changing amounts

of money and, particularly after the introduction of

pensions freedoms (removal of the need to buy an

annuity), may look compelling; but transfers are not

without risk.

GROWTH AND INCOME

Key to making the decision to transfer from a DB

scheme is future returns; there are two different

elements to consider – the growth phase (accumulation)

and the drawdown / income phase (decumulation).

Clients and their advisers will have experience of

the growth phase (from ISA and SIPP investing

when maximising growth and contributions are key

- investment risk (volatility) and returns are primary

concerns with longevity risk, inflation risk, levels of

income and liquidity lower down the list of priorities.

In the income phase, returns are still important, but

longevity risk (living longer than the funds will last),

liquidity risk (access to income) and matching liabilities

(the long-term need for an inflation ‘protected’ income)

come more to the fore.

A sustainable level of income while maintaining an

appropriate level of capital is key; rather than simply

trying to maximise returns, investors are trying to

maximise ‘durability’ of income - exactly what the

trustees of the DB scheme have been trying to achieve

for years! Few investors may be equipped with the skills

and knowledge to manage this successfully.

In the long run

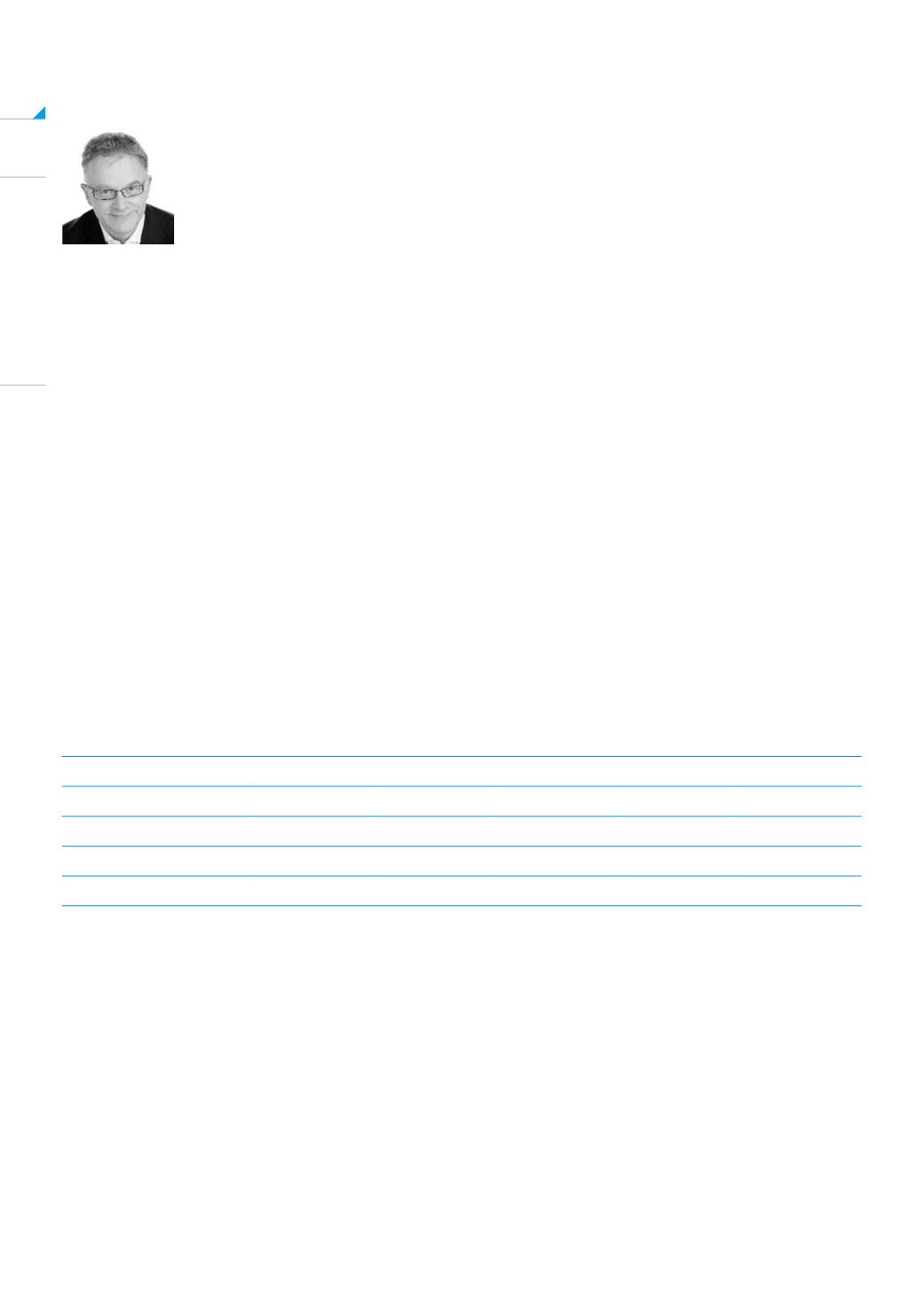

Figure 1. Long term annual real returns from UK assets

classes. Source: Barclays

In the long-run, equities have handsomely beaten

bonds, but over the last 10 and 20 years this trend has

been reversed; returns from bonds (post financial crisis)

have been driven up as interest rates and bond yields

fell and stayed low, and from the impact of Quantitative

Easing (QE).

The fall in bond yields has driven transfer values from

DB schemes up (cash equivalent transfer values /

2017

2016

10 years

20 years

50 years

117 years

UK Equity

13.5

2.5

3.7

6.0

5.1

UK Gilts

8.7

4.3

4.5

3.1

1.4

UK Corp Bonds

9.5

3.1

UK Index Linked

16.6

4.3

4.4

Cash

-2.1

-1.3

0.6

1.3

0.8

CETVs); as the discount rate for future returns has fallen,

the cash required today to cancel out a given future

liability has risen.

Note: CETVs are driven by the discount rate (usually

long dated bond yields adjusted for the scheme

asset allocation mix), inflation rates and the scheme

demographics. Rising inflation and falling long dated

bond yields typically increase transfer values.