DIY Investor Magazine

/

March 2017

40

Job Curtis

City of London Investment Trust, Henderson Global Investors

I’M STILL CONFIDENT IN UK DIVIDENDS DESPITE

UNCERTAINTIES

The main indices (a benchmark representing the value

of a market’s shares or bonds) of UK shares hit an all-

time high at the start of 2017. Many private investors

might be wondering where to use their ISA allowance of

£15,240 before the end of the tax year on 5th April 2017.

On the one hand, you would not want to forego the

significant tax benefits of the annual ISA.

On the other hand, is it prudent to put money in the

stock market after the recent surge in share prices?

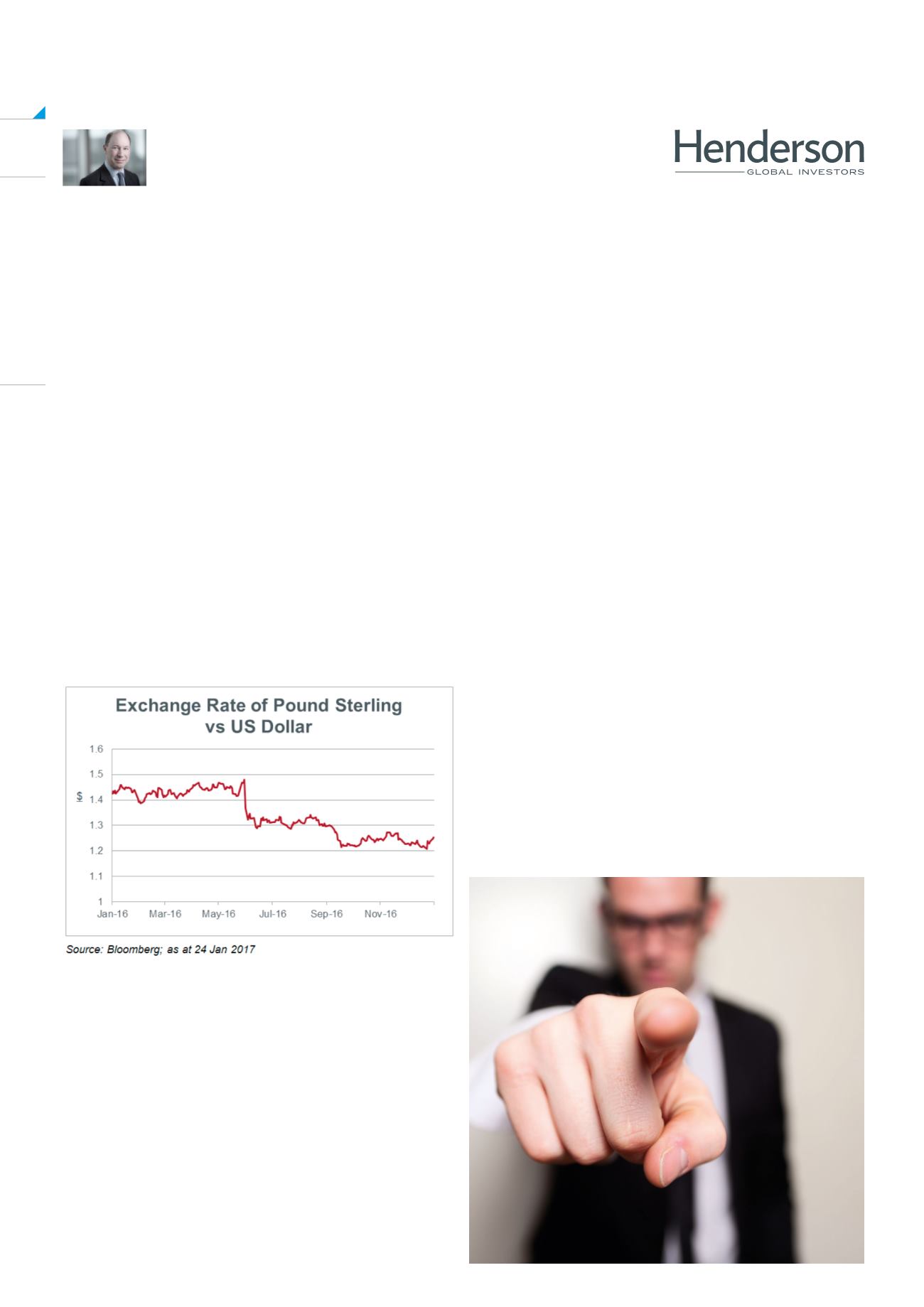

The rise in UK share prices since the referendum on

Brexit is logical. It reflects the fall in the value of sterling

or the British pound against overseas currencies. On

23rd June 2016, the exchange rate between the pound

and the US dollar was £1 = $1.49.There has since been

an appreciation of around 18% in the US dollar to leave

the exchange rate at £1 = $1.22. Against the Euro, the

fall in the pound has been 12%.

We believe the fall in the pound is beneficial for UK

shares because around 70% of the sales of quoted

UK companies come from overseas. The value of

these overseas sales (and profits) is boosted by the

devaluation when translated back into British pounds.

In addition, those British companies that export will

have their competitiveness improved although this is

partly offset by other companies, such as retailers, who

will have to pass on, at some stage, the higher cost of

imported goods to their customers.

Given the amount of sales and profits earned overseas

by UK listed companies, a significant number pay

their dividends in overseas currencies (mainly US

dollars). These tend to be the larger companies and

they account for 45% of total UK dividends paid last

year. The value of these dividends paid in overseas

currencies from UK listed companies has risen in

sterling terms as a result of the fall in the pound.

According to the strategy team at Baden Hill Sanlam, a

research provider, ordinary dividends for the UK’s FTSE

All Share Index rose by 4.2% in 2016 over the previous

year. However, without the currency devaluation, total

dividends would have fallen by around 1%.

The other key factor that underpins greater confidence

in UK dividends is the recovery in the prices of

commodities (physical goods such as oil, gold or

wheat). Metal prices rose in 2016 with better than

expect economic growth in China.

Mining companies are likely to restore dividends in

2017 that had been cut in 2016. The oil price benefited

both from global growth and also from determination

of OPEC to restrict some supply of oil production. BP

and Royal Dutch Shell’s dividends are considerably

more secure with the oil price at over $50 BBL when

compared with below $30 BBL reached in the first

quarter of 2016.