DIY Investor Magazine

/

March 2017

36

Tim Stevenson

Director of Global Equities, Henderson Global Investors

EUROPE IN A WORLD OF ‘ALTERNATIVE FACTS’

These are interesting times. Suddenly everything is

different – populism has become protectionism under

the mantra of ‘Make America Great Again’ and Brexit is

set to lead the UK to sunnier climes. A few minor details,

such as the interconnected nature of global supply

chains and the relationships between companies and

regions, are being forgotten for now..

Europe is in many ways now in the eye of the storm.

The UK is stumbling along an undefined and unknown

path towards Brexit, with the government promising no

damage to the economy and full access to European

trade, while not paying any bills. A few nervous

dissenters, quickly shouted down by a partisan, right-

wing press, are quietly asking ‘how?’

Pragmatism still dominates European politics

The political backdrop in Europe outside the UK

continues to make everyone nervous. The Netherlands

will be first to the polls in 2017, and the Far Right party of

Geert Wilders will, like all European ‘alt-right’ parties at

present, probably poll a significant number of votes on

an anti-immigration bill. But Wilders will not be included

in a coalition government when it comes to running

the country. As an aside, if there is a referendum in the

Netherlands, the Dutch have made it quite clear that it

would be advisory only. It is a pity that now ex-Prime

Minister Cameron did not think through the potential

risks of the UK referendum in June 2016. This was a

point made by the Supreme Court in a recent ruling over

how the UK government can start the process to leave

the EU (Article 50).

France faces a key election in April and May, and

there is a growing opinion that, even if Marine Le Pen

of the extreme-right National Front party makes it

through to the second round of voting in May, she will

probably lose out to either François Fillon (Republican)

or Emmanuel Macron (Independent) in a repeat of the

2002 election, when her father lost convincingly to

Jacques Chirac. Autumn sees the German elections,

where it looks like Chancellor Merkel will be re-elected.

Is regional recovery taking hold?

The suggestion is that populism will not overthrow

the European path of ‘boring but reliable’ economic

progress. That may enable investors to look again at

out of favour European markets and the improving trend

in profits. Given that Europe’s gross domestic product

(GDP) is expected to grow by about 1.5% in 2017, and

that an improving economic climate is leading to more

relaxed government spending, there is every reason

to hope that Europe is now in a virtuous, rather than

vicious, circle.

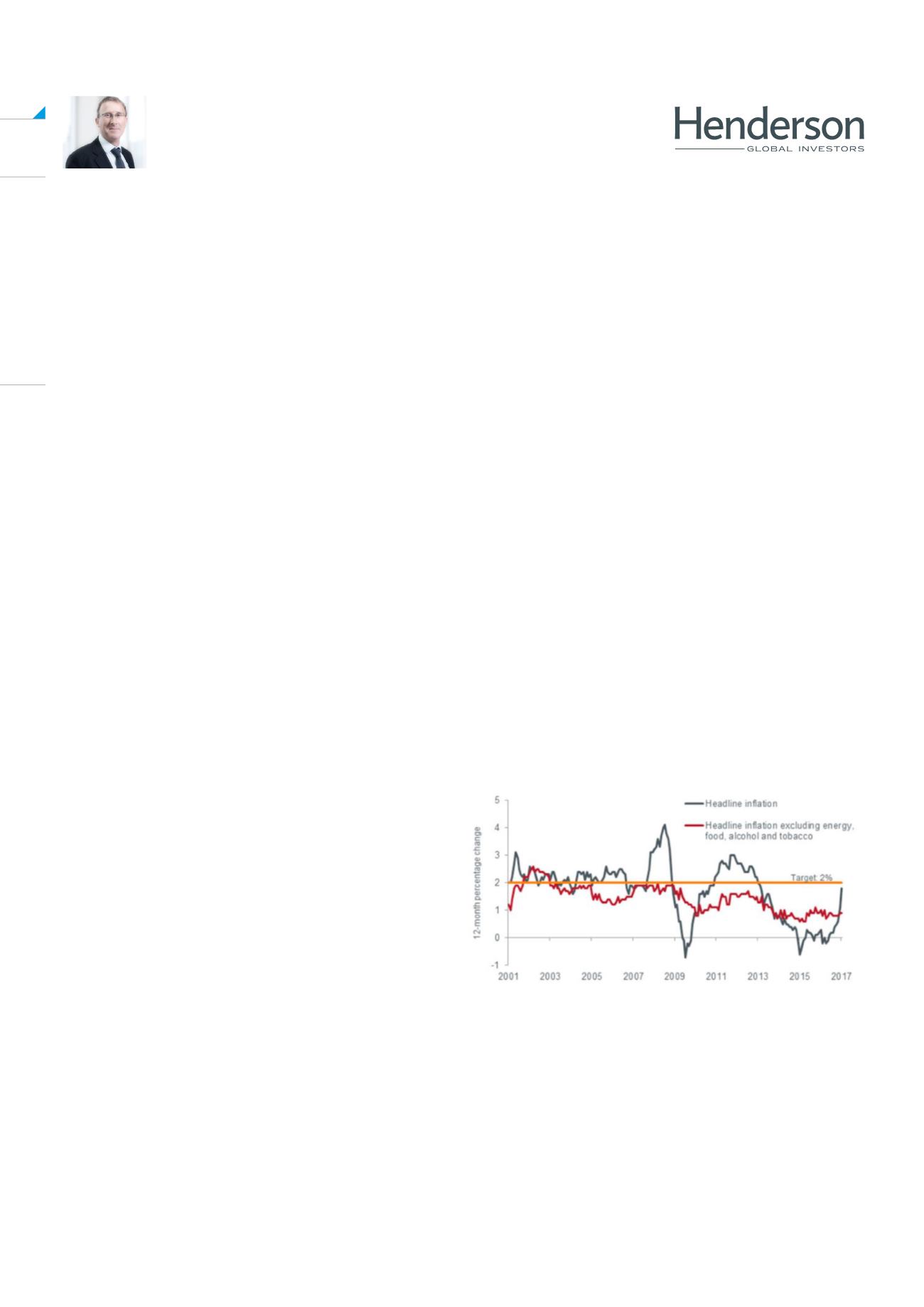

With a combination of better growth and emerging

inflationary pressures (chart 1), yields on 10-year

bonds have risen to over 0.3% in Germany and over

2.3% in the US, as at 8 February 2017. This has major

implications for banks and recovery names. It is clear

that, regardless of intense global political uncertainty,

the market has chosen to believe in the hope of

economic recovery.

Chart 1: Inflationary pressures picking up in euro

area ‘haystacks’, is known as Passive Investing.

Source: Thomson Reuters Datastream, Fathom

Consulting. ‘Headline inflation’ is percentage year-on-

year change in the Euro area, as at 9 February 2017.

The European monetary policy committee (MPC) has a

target of near or below 2% for headline inflation.

It remains to be seen how strong this recovery turns

out to be, or how long it lasts, but it would be wrong to

ignore it. Companies more sensitive to changes in the