DIY InvestorMagazine

/

March2014

30

7. USESANDTRADING STRATEGIES

SL ETPs can be used by a wide range of investors for

many different trading strategies:

•

Treble daily returns, positive or negative

(excluding fees and adjustments).

•

Hedge existing positions in one simple trade

•

Use in a long-short strategy using both a leverage

ETP and a short ETP

•

Use in a pair trade to take advantage of

undervalued assets

•

Short themarket/asset class quickly, efficiently

and cost-effectively

•

Short ETPs allows the investor to profit in a falling

market

•

Use tactically within a broad portfoliowhere an

investor holds strong short term convictions

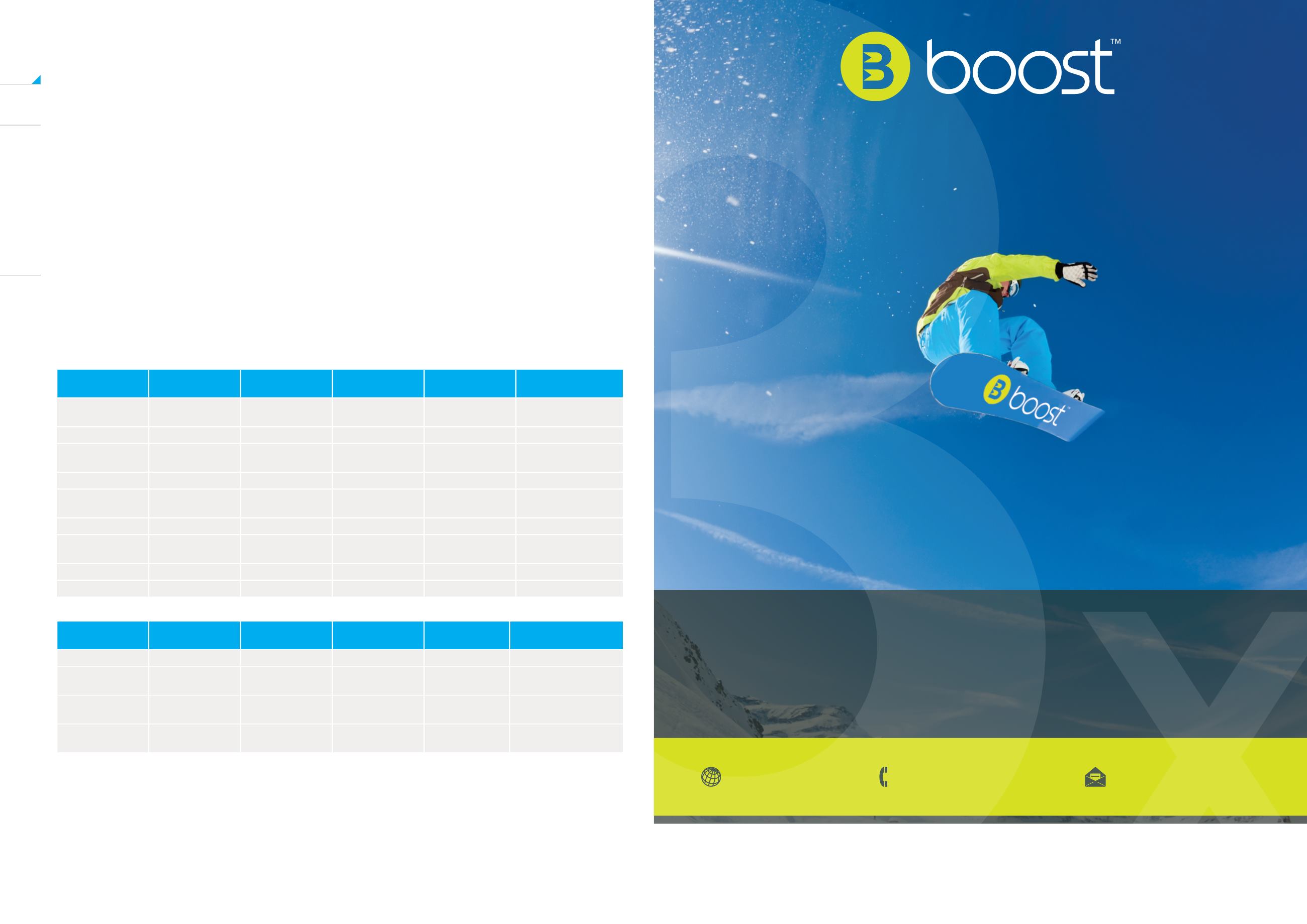

BOOST ETP

STRUCTURED

PRODUCTS

ETFS

CFDS/ SPREADBET FUTURES/OPTIONS

Underlying / asset

classes

Equities,

Commodities

Many

Single commodities

not possible

Many

Many

Leverage

Yes

Yes

Yes (onlyup to2x)

Yes

Yes

Losemore thanyour

invested capital

No

No

No

Yes

Yes

ExchangeTraded

Yes

No

Yes

No

Yes

MultipleMarket

Makers

Yes

No

Yes

No

Yes

Arbitrageable

Yes

No

Yes

No

Yes

Unsecured credit

risk

No

Yes

No

Yes (MFGlobal &

World Spreads)

No

OverCollateralised Yes

No

Usually

No

No

High fees

No

Yes

No

Yes

No

BOOST ETP

STRUCTURED

PRODUCTS

ETFS

CFDS/ SPREADBET FUTURES/OPTIONS

Transparent

Yes

No

Mostly

No

Yes

Highly liquid and

trade in large size

Yes

No

Yes

No

Yes

Margin calls& close

out

No

Yes

No

Yes

Yes

Short termdated No

Yes

No

Yes

Yes

(rolls& exercise dates)

N.B The information contained in this article is not intended to represent all the risks associatedwith Leverage and Short ETPs, nor does it list

all the important factors one should consider when reviewing whether a Boost ETP is appropriate. Investors should review and understand the

Prospectus including the ‘Risk Factors’ section before any investment into Boost ETPs.

This communication has been provided by Boost ETP LLP which is an appointed representative of Mirabella Financial Services LLP which is

authorised and regulated by the Financial Conduct Authority. Please read our full disclaimer at

before

considering an investment in Boost ETPs.

8. LEVERAGEETPSAND POSSIBLERISKS

Leverage ETPs have been fiercely debated in investor circles

as towhether they are risky and/or complex investments.

Leverage has been around for many centuries and a

multitude of financial products exist to enable investors

to gain leverage and/or short exposure. An investor should

understand the benefits and risks of each leverage product

and see which one suits their goals and circumstances for

the specific trade being considered. SL ETPs increase the

tools available to investors, and used in the right way, can

enhance returns.

Boost considers its products provide a robust, transparent,

exchange-traded, collateralised, secure and relatively cost

efficient tool for a wide range of investors to gain leverage

or short exposure, through their normal brokerage or

investing channels.