DIY InvestorMagazine

/

March2014

DIY InvestorMagazine

/

March2014

20

21

IN ISAs

1

Stocks and Shares ISA allowance 2013/2014

£11,520

1

THE GOVERNMENTALLOWS YOU FORA STOCKS& SHARES ISA INA SINGLE TAX

YEARCOULDWELLMEAN THEMAKINGOF SIGNIFICANT FUTURE FINANCIAL RETURNS

WETRUST

ISA season is upon us andmany a fundmanagement

house will be paying testament to the tax wrapper’s

advantages. We agree. At Henderson Global Investors

we view it as one of themost efficient ways to invest

for your future and if managed well the £11,520 the

government allows you for a Stocks & Shares ISA

in a single tax year could well mean themaking of

significant future financial returns.

Deciding what to put in it is difficult though and we do

not deny the sea of choice out there. Because of this,

Henderson brings you one (largely unknown) corner of

the investment market that we think may be perfect

for your ISA: investment trusts. Investment trusts are

closed-ended investment companies; they have a fixed

amount of money to invest for their particular mandate

i.e. growth, income, or amix of both; from a wide range

of geographical or sector specialisations. Investors

wishing to buy into them buy shares in the investment

trust company, as you would BP or Barclays. This differs

from open-ended funds; if they experience sudden and

significant redemptions the fundmanagers may find

themselves selling positions on the basis of liquidity

rather than preference, whichmay less profitable. The

effect is to constrain, both in terms of liquidity and

the time horizon for the investments. Investment trust

managers do not need to concern themselves with

maintaining a level of liquidity to fund redemptions;

the number of shares in issue stays put, allowing them a

longer-term investment viewwheremore opportunities

may exist as well as the option to buymore esoteric

or illiquid assets. Because ISAs are about investing for

the long-termwe think this makes investment trusts a

sensible choice in your ISA.

There are further advantages.

Usually, the decision surrounding where to invest your

money is based on two broad outcomes: do you want

to grow your capital or do you wish to preserve it and

gain an income. Investments in ISAs in general do not

attract any income tax on dividends paid-out by the

investment vehicle. Investment trusts offer a further

advantage: themanager is able to save up to 15% of

the pot of income received from the underlying assets,

whereas managers in open-ended funds do not have this

privilege. Because investment trust managers can retain

earnings, usually during buoyant economic periods, when

less favourablemarket conditions arise they are able to

dip into their reserve account and keep-up payments.

It makes for a smoother income flow and, as such, can

make investment trust payments less volatile. The City

of London Investment Trust, for example, has achieved 47

years of consistently rising dividends, although investors

should note past performance is not a guide to future

performance.

THE VALUEOF AN INVESTMENTAND THE

INCOME FROM IT CAN FALL ASWELL AS

RISE ANDYOUMAYNOTGET BACK THE

AMOUNTORIGINALLY INVESTED.

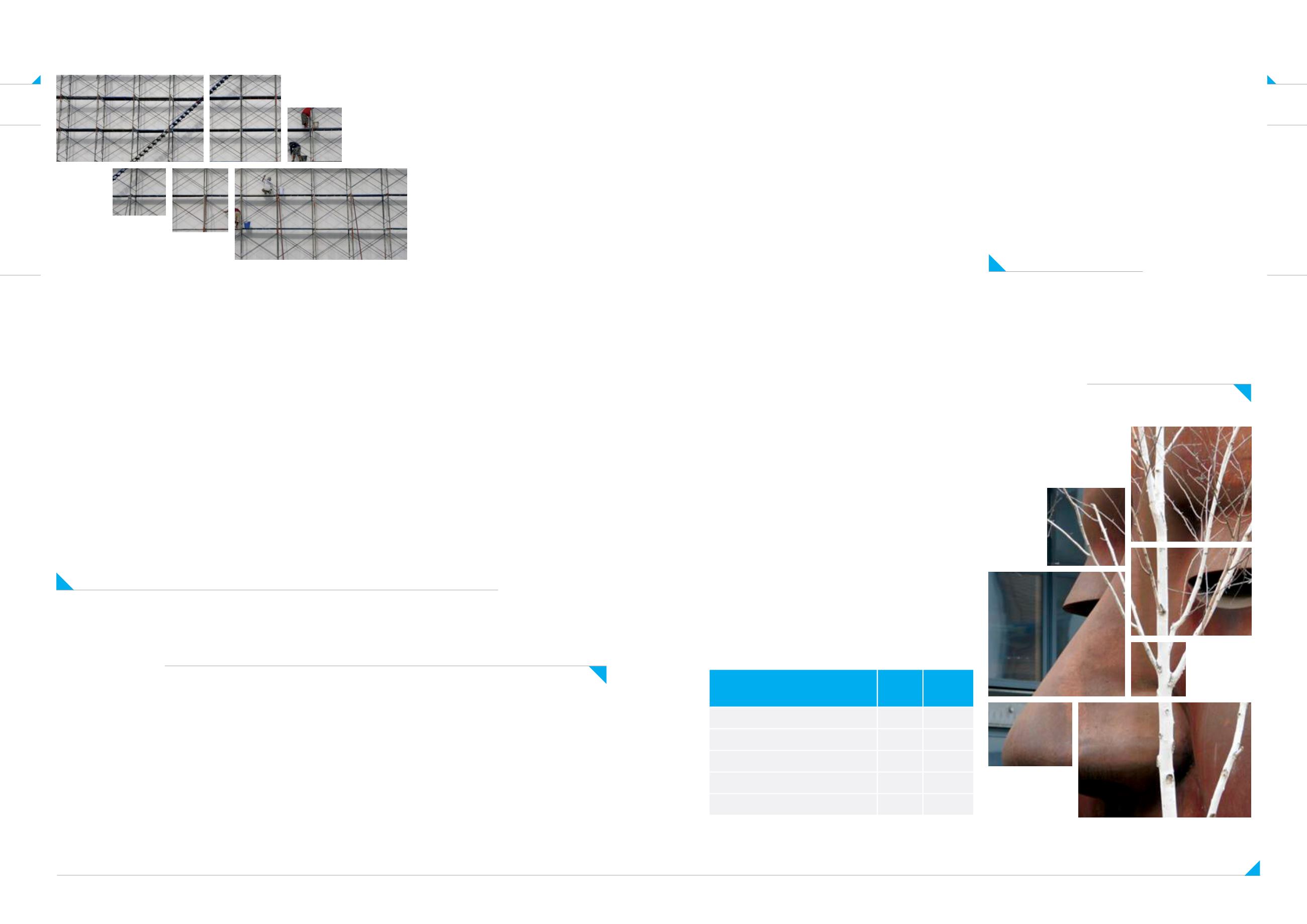

DISCRETEYEAR PERFORMANCE

%CHANGE (UPDATEDQUARTERLY)

PRICE

NAV

31/12/2012 to31/12/2013

24.1

26.1

30/12/2011 to31/12/2012

16.6

16.2

31/12/2010 to31/12/2011

2.1

3.2

31/12/2009 to31/12/2010

24.7

16.5

31/12/2008 to31/12/2009

24.1

23.4

ANNUAL PERFORMANCE

(CUM INCOME) (%)

For capital growth seekers, investments in ISAs also

avoid Capital Gains Tax (CGT). Investment trusts again

offer a further advantage to aid capital growth: they

have the option to borrowmoney with the aim of

enhancing returns over and above its costs.

This feature – known as gearing - enables themanager

to purchase a greater number of stocks during bullish

market periods, such as the one we are now, utilising a

potentially greater number of opportunities and adding

to any capital gains made.

It’s a double edged sword though: it may also serve to

enhance loss’s if amanager does not see an economic

down-turn coming.

For those with the cash, £11.5k is certainly a significant

sum to consider investing. Monthly payment options,

however, mean you need not necessarily invest it all

at once, removing the dilemmamany face: “When is

the best time to deal?” Some providers allow as little

as £20 per month. And the efficiency of the wrapper

means its exclusion from tax returns, so it requires

little thought at the end of the tax year.

If you have an investment strategy, adding investment

trusts to your Stocks & Shares ISA should be a part of

it. The value of an investment and the income from it

can fall as well as rise and youmay not get back the

amount originally invested.

Tax assumptions and reliefs depend upon an investor’s

particular circumstances andmay change if those

circumstances or the law change. For capital growth

seekers, investments in ISAs also avoid Capital Gains

Before investing in an investment trust referred to in

this document, you should satisfy yourself as to its

suitability and the risks involved, youmay wish to

consult a financial adviser.

Nothing in this document is intended to or should

be construed as advice. This document is not a

recommendation to sell or purchase any investment.

It does not form part of any contract for the sale or

purchase of any investment.

BYHENDERSONGLOBAL INVESTORS