DIY Investor Magazine

/

March 2016

48

Q&A

IN CONVERSATION WITH DIY INVESTOR

Artisan Baker Invests as he Kneads the Dough

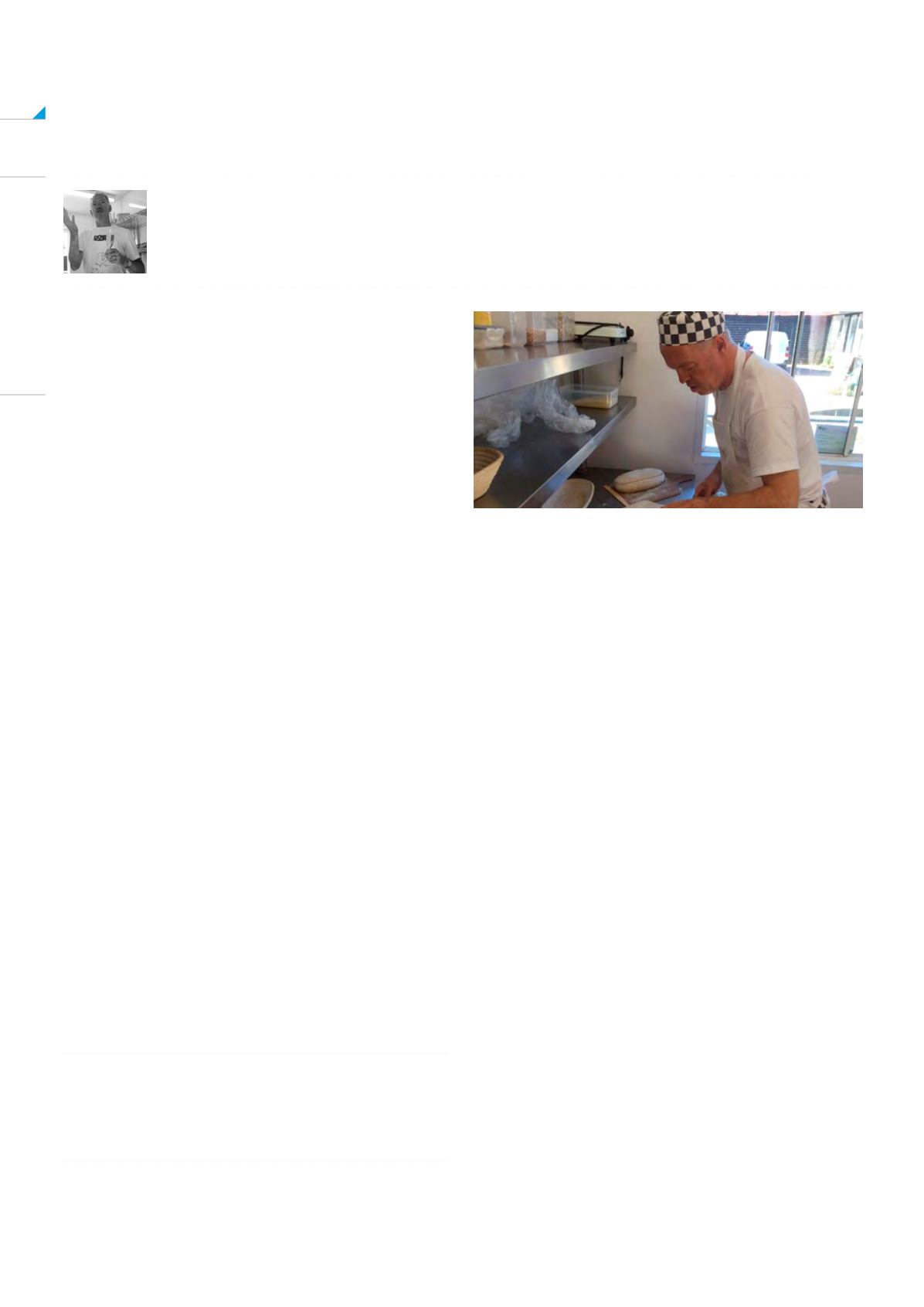

Richard Hutley, 52, worked for many years in the

Oil Industry. Just recently he gave it all up to follow

his passion and become a baker. His new artisan

business Lazy Bakery, based in Rye, East Sussex, has

already gained a great reputation with frequent media

coverage.

DIY Investor Magazine asks him about his attitude

towards savings and investments and if the launch of

has impacted on his investing.

1. HOW LONG HAVE YOU BEEN A DIY INVESTOR?

In various ways, off and on for quite some time;

when ISAs were first introduced I mixed and

matched with Cash and Unit Trust ISAs and as

my disposable income increased in recent years

expanded into individual shares and funds.

2. WHAT TYPE OF INVESTOR ARE YOU?

I’ve definitely moved into cautious territory. I’ve

recently given up my job in the Oil Industry to

become a self employed baker so with my drop in

income I can’t afford to be quite so buccaneer with

my savings!

My investments are now spread across various

funds, with a fairly even mix veering to the

conservative end. I’ve also moved some of my

money out of the market into peer to peer lending to

give me a balanced risk approach.

3. WHAT ARE YOUR KEY CONSIDERATIONS

WHEN MAKING AN INVESTMENT?

Don’t lose money! Given my change in situation

I can’t afford to be too cavalier, baking does

not bring in as much as The Oil Industry so my

investments now are pretty much it, they have to

make themselves pay without much chance of

topping them up in case of losses.

4. ISA OR PENSION?

Always been both, I have been lucky in that all the

companies I have worked for over the years have

contributed to pensions for me, I was a little late

in adding my own contributions but have been

catching up in recent years - especially as my last

company had a salary sacrifice scheme which

maximised the value of my contributions by taking it

before tax or NI had been taken.

I’ve also made a point of not combining the various

schemes in order to spread the risk between the

various investment companies and avoid putting

all my eggs in one basket! Re ISAs, be it cash or

investment ISAs they have been the cornerstone of

my non-pension saving.

MY BEST INVESTMENT WAS NOT AN INVESTMENT AS

SUCH BUT MOVING COMPANIES TO ONE WITH A FINAL

SALARY PENSION SCHEME FOR A GOOD FEW YEARS!