Page 25 - DIY Investor Magazine | Issue 31

P. 25

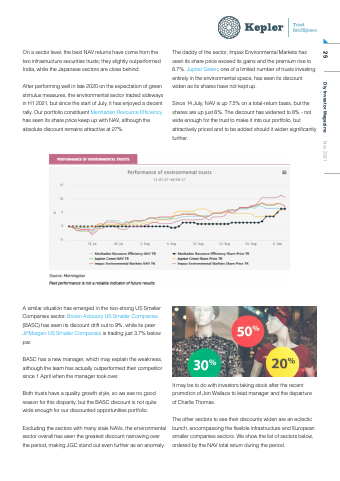

On a sector level, the best NAV returns have come from the two infrastructure securities trusts; they slightly outperformed India, while the Japanese sectors are close behind. After performing well in late 2020 on the expectation of green stimulus measures, the environmental sector traded sideways in H1 2021, but since the start of July, it has enjoyed a decent rally. Our portfolio constituent Menhaden Resource Efficiency has seen its share price keep up with NAV, although the absolute discount remains attractive at 27%. The daddy of the sector, Impax Environmental Markets has seen its share price exceed its gains and the premium rise to 6.7%. Jupiter Green, one of a limited number of trusts investing entirely in the environmental space, has seen its discount widen as its shares have not kept up. Since 14 July, NAV is up 7.5% on a total-return basis, but the shares are up just 6%. The discount has widened to 8% - not wide enough for the trust to make it into our portfolio, but attractively priced and to be added should it widen significantly further. A similar situation has emerged in the two-strong US Smaller Companies sector. Brown Advisory US Smaller Companies (BASC) has seen its discount drift out to 9%, while its peer JPMorgan US Smaller Companies is trading just 3.7% below par. BASC has a new manager, which may explain the weakness, although the team has actually outperformed their competitor since 1 April when the manager took over. Both trusts have a quality growth style, so we see no good reason for this disparity, but the BASC discount is not quite wide enough for our discounted opportunities portfolio. Excluding the sectors with many stale NAVs, the environmental sector overall has seen the greatest discount narrowing over the period, making JGC stand out even further as an anomaly. It may be to do with investors taking stock after the recent promotion of Jon Wallace to lead manager and the departure of Charlie Thomas. The other sectors to see their discounts widen are an eclectic bunch, encompassing the flexible infrastructure and European smaller companies sectors. We show the list of sectors below, ordered by the NAV total return during the period. 25 Diy Investor Magazine · Nov 2021