DIY Investor Magazine

/

March 2017

24

Even the most carefully constructed portfolio will be

side-swiped by extreme market conditions; a 50:50

portfolio of UK equities and bonds went down by 58%

in 1973 and 1974 and no increase in the proportion of

government bonds was ever going to plug that gap.

Risk tolerance also changes over time and particularly

as the investor looks for more certainty as they

approach, or are in, retirement when they have more to

lose, and less time to make up any losses they incur.

It is important to remember the emotions of a big loss or

the euphoria of a continued purple-patch and aim for an

asset allocation that makes the former feel less onerous

and the latter all the more joyous; but neither out of the

ordinary.

Once at peace with your attitude to risk, it is important

not to let circumstances knock you off course; chasing

losses by opting for riskier investments is a sure fire way

to undo a lot of hard work – particularly when you are

closing in on your goal.

As you near the finish line, reducing the equity portion

of your portfolio will reduce your risk and if you need

all of your capital back within the next five years then

you probably shouldn’t be in equities at all; another rule

of thumb is that equities could lose half of their value

at any time, so see what such a loss would do to your

projections.

Regardless of your certainty that your risk assessment

is accurate, re-visit it over time, and be sure to do

so where you have signed up to a platform that has

no provision to change your asset allocation as

circumstances and attitudes change.

If your appetite to risk is correctly assessed and your

asset allocation is in tune with it, your investments

should give you no sleepless nights – DIY investing is

about accumulating and managing wealth over a long

time horizon; it is not about punting on binary options,

currently the bête noire of the money pages.

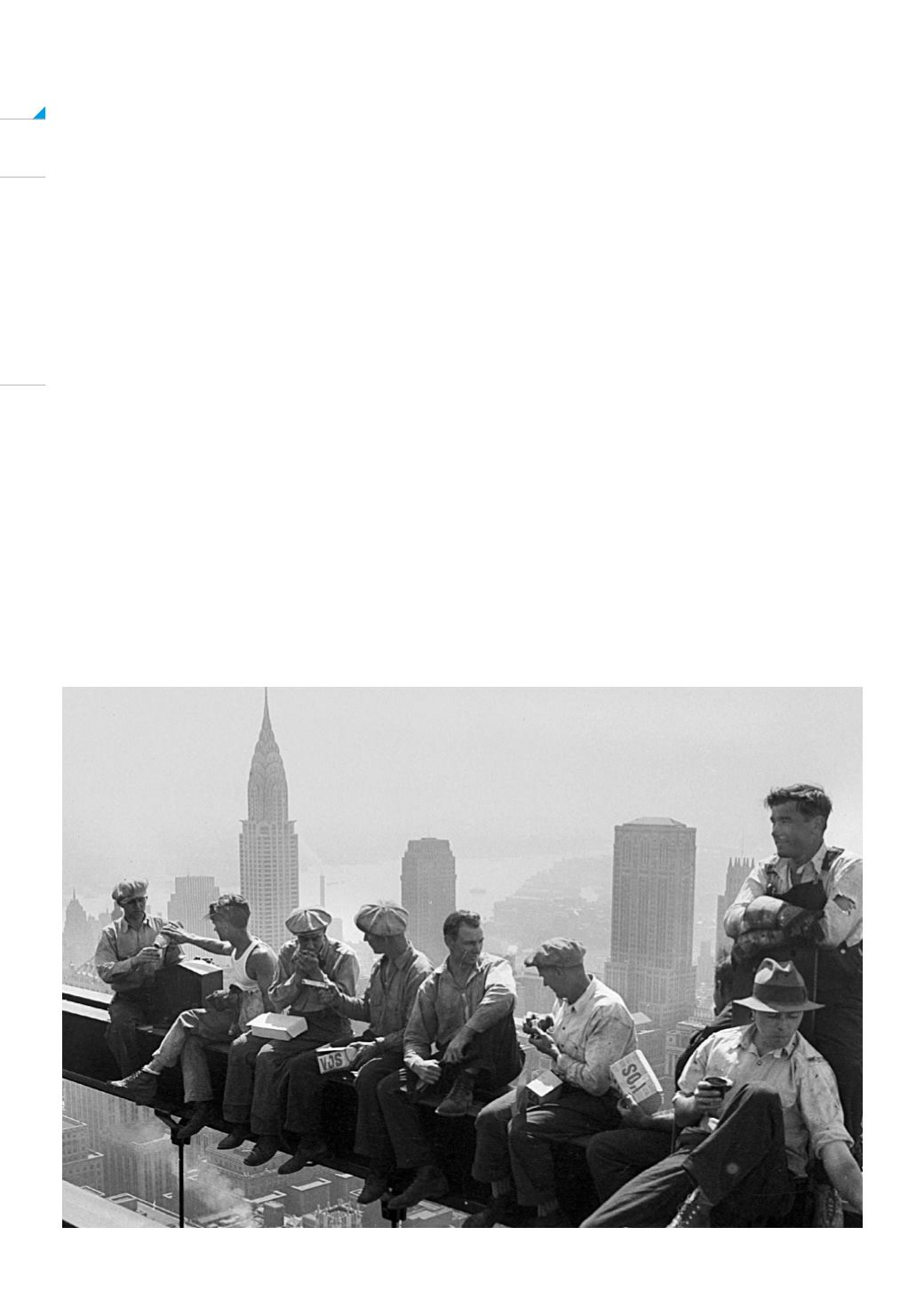

Because it’s a marathon and not a sprint, if your risk

assessed portfolio is well constructed, you should

be able to resist the temptation to sell cheaply when

markets inevitably nose-dive and be ready to capitalise

when the correction comes along.