DIY Investor Magazine

/

Jan 2017

28

SHAKEN & STIRRED: 2016 WAS TRICKY FOR BONDS & EQUITIES -

WILL THE ‘TRUMP EFFECT’ CREATE A CASINO ROYALE IN 2017?

Mike Franklin,

Chief Investment Officer

Beaufort Securities

Donald John Trump is to be inaugurated as the 45th

President of the United States on 20th January and

the world feels a very different place from a year ago –

writes Mike Franklin, Beaufort Secuities.

With Brexit and the US Presidential Election, history may

record 2016 as a year of peculiarly ‘left field’ events’; it

was the ‘year of two halves’ we predicted, with the date

of the United Kingdom’s EU Referendum not revealed

by David Cameron until late-February, marking the

midpoint in late-June 2016.

After generally optimistic forecasts for the markets in

2016, a reality check came in the form of short, sharp,

equity market sell-offs in mid-January (-10%) and mid-

February (-12%) on the back of a 25% drop in the price

of crude oil to the $27 per barrel level.

In the event, this was the cathartic end to the downtrend

in the oil price since June 2014. While these sell-offs

undermined start-to-end year forecasts for 2016, they

provided ideal conditions for timed investments.

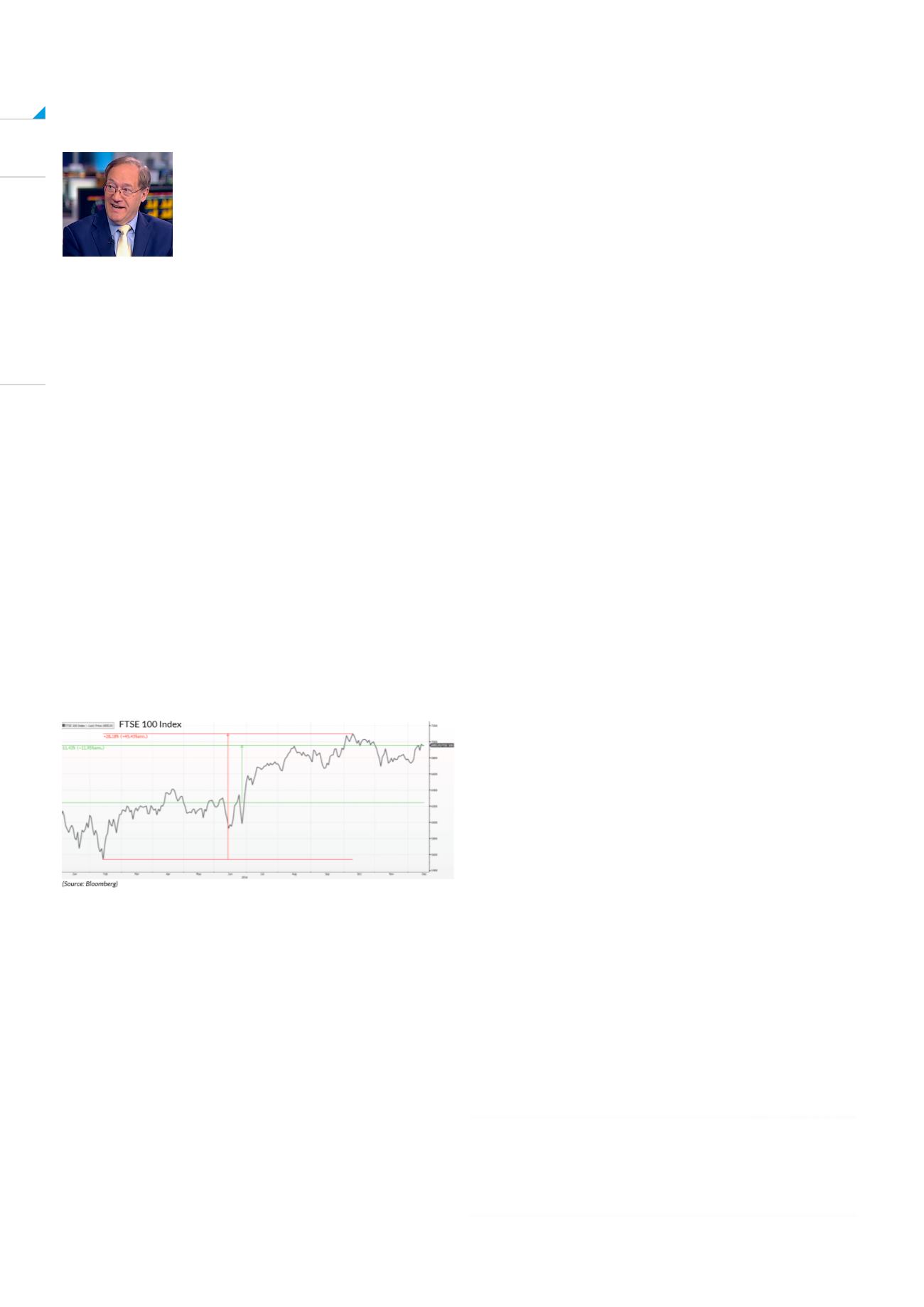

FTSE 100 index ended the year at a record high of 7142

– up 14.4% - but the low-to-high has been almost 30%

and the moves in several of the constituent stocks have

been even greater.

The performance range of the FTSE 100 Index stocks

has been plus 294% (miner Anglo American) to minus

62% (services provider Capita) while that for FTSE 350

Index constituents has been plus 398% (Peruvian gold

and silver miner Hochschild) to minus 56% (technology

solutions provider Laird).

The year’s most significant challenge was the sharp

drop in the value of Sterling on the 24th June; against

the US$, the pound fell 11% from $1.49 to the $1.32 level

and now stands 16% lower at $1.25.

Perversely, after its initial 9% ‘shock reaction’ drop, the

FTSE 100 Index rallied strongly, fuelled by the fact that

around 70% of the index revenues are derived from

non-Sterling sources – a classic example of ‘bad’ news

being ‘good’ news – depending, on the currency of your

investment exposure.

Bonds have had a roller coaster year; US bond prices

began to fall from July on the prospect of higher

interest rates from the Federal Reserve later in the year,

subsequently compounded since Trump’s election

victory as fears of inflation increased.

Sterling’s sharp fall will lead to a rise in import costs and

higher UK inflation in the coming months; BoE forecast

for CPI was a rise from an estimated 1.3% at end-2016

to 2.7% by end-2017. This has had some impact on

UK Bond prices but a rise in UK interest rates is not

generally regarded as likely during 2017.

‘a rise in UK interest rates is not generally regarded

as likely during 2017’

Lower bond prices has caused adjustment in

traditionally higher-yielding equities such as utility

shares; ‘high yield’ equity portfolios, favoured by longer

term investors in turbulent times, have seen some

price deterioration, but if dividends can be maintained,

investors could afford to be patient for share prices to

recover.

BREXIT CREATES THE PROSPECT OF FUNDAMENTAL

CHANGE, NOT JUST FOR THE UK.