DIY Investor Magazine

/

September 2016

28

As part of its ongoing campaign to see investors better

educated, Retail Bond Expert’s Mr Bond lifts the lid on

some of the markets worst excesses.

The previous article,

mentioned the Prospectus Directive, the basic rule

book governing the issuance of new securities to

investors. Under the PD there are two types of bonds,

Corporate Bonds and Asset Backed Securities

(‘ABS’).

•

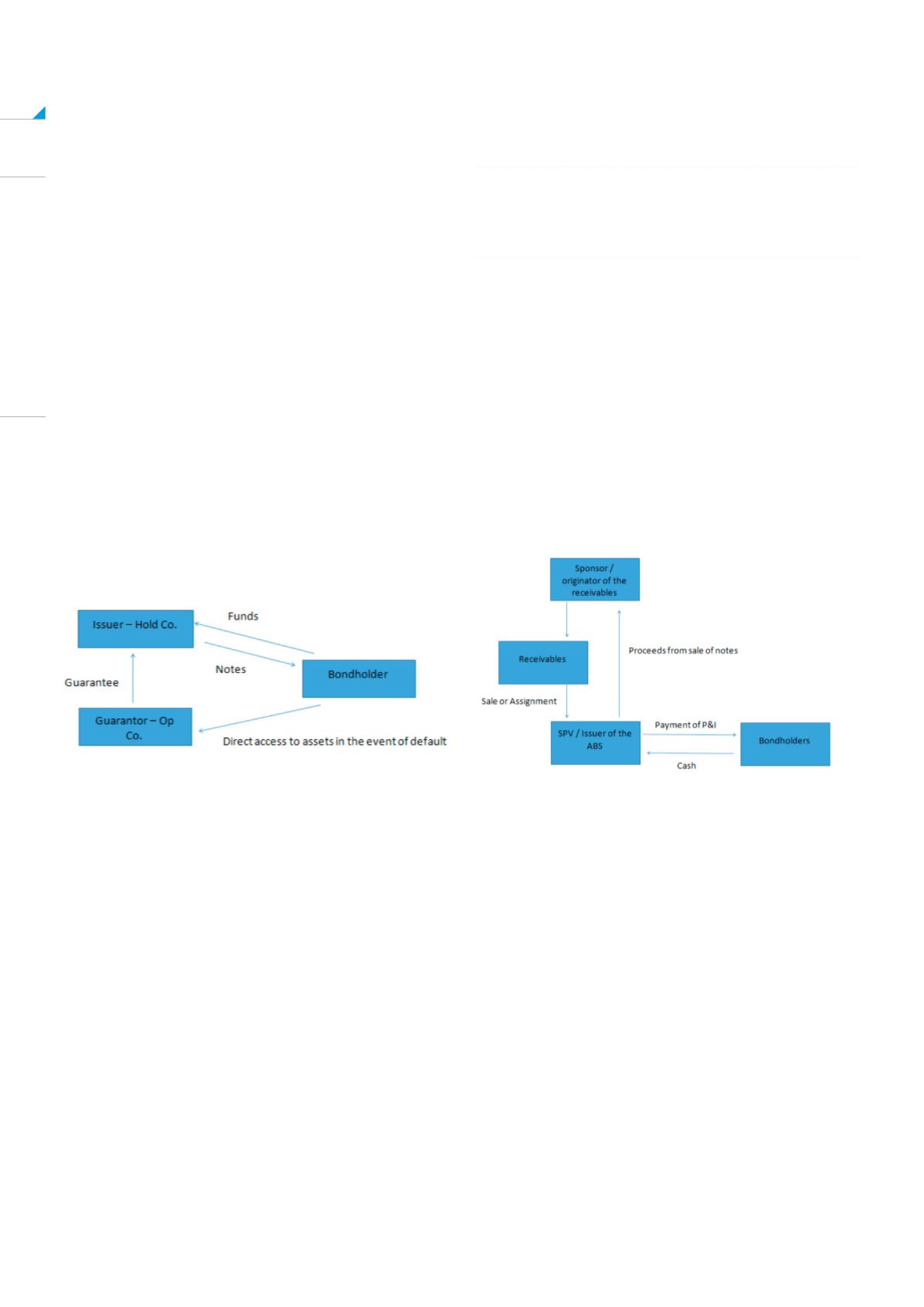

A Corporate Bond can be issued by any type

of non-government entity. The issuer will be a

PLC, or the overseas equivalent, and will have two

years audited accounts. In some instance the

issuer will be a new company, likely a holding

company, in which case the two years accounts

will be provided by an operating company beneath it:

ARE SOME BONDS ISSUES EQUITIES

MASQUERADING AS DEBT?

The key points here are:

-

The accounts provide information that allows

investors to judge the risks inherent in an issue, and

provides the numerical raw material for the financial

covenants.

-

Should there be a default investors have access to

the issuer assets, except those specifically excluded by

pledges, e.g. bank guarantees, or mortgages.

•

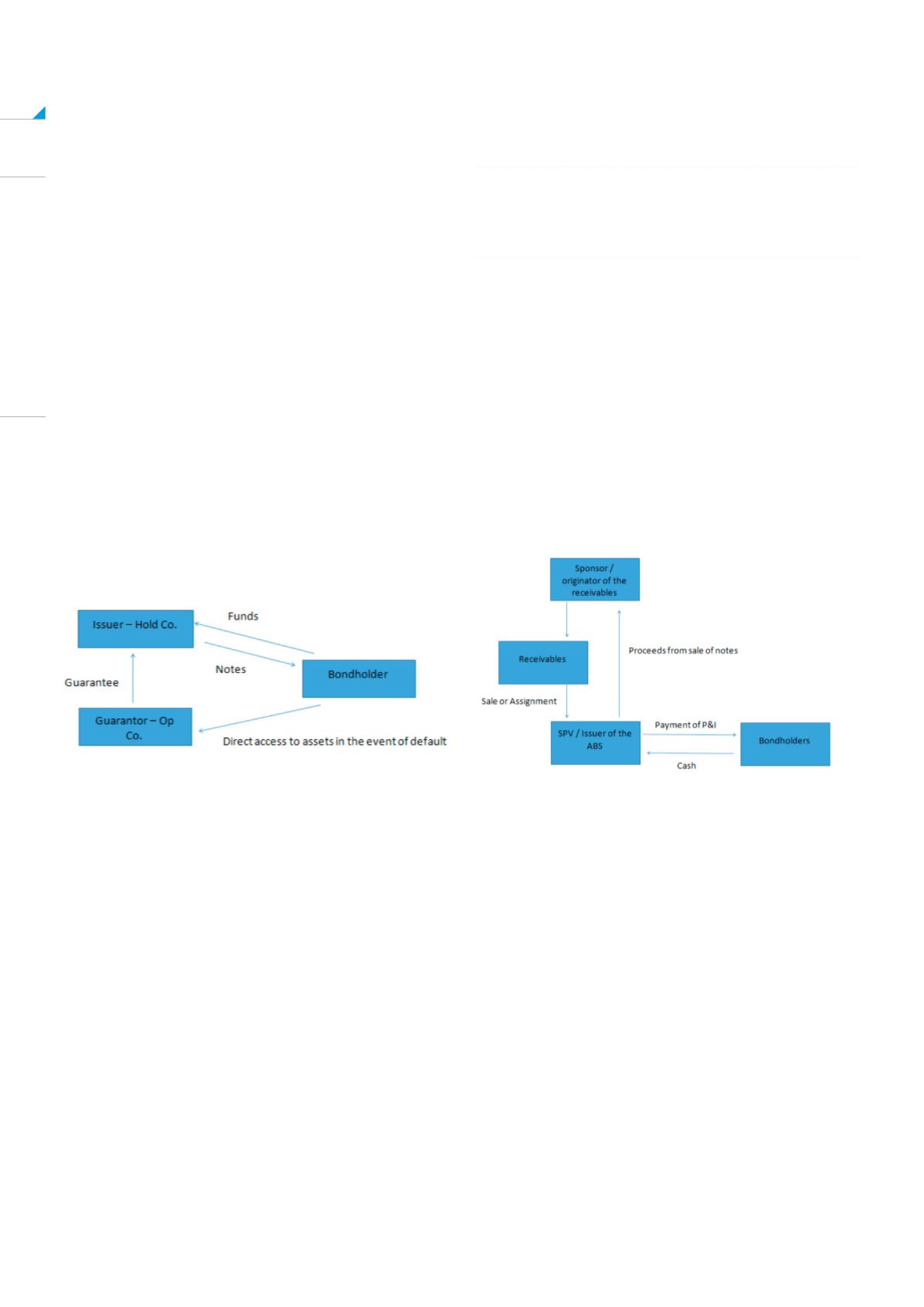

Asset Backed Securities (‘ABS’), are notes backed

by financial assets. Typically these assets consist

of receivables such as mortgages, credit card

receivables, or auto loans. ABS differ from most

other kinds of notes in that their creditworthiness

derives from sources other than the paying ability of

the originator of the underlying assets

Financial institutions that originate loans—including

banks, credit card providers, auto finance companies

and consumer finance companies—turn their loans

into marketable securities through a process known

as securitisation. The loan originators are commonly

referred to as the issuers of ABS, but in fact they are

the sponsors, not the direct issuers, of these

securities.

These financial institutions sell pools of loans to a

special-purpose vehicle (SPV), whose sole function

is to buy such assets in order to securitise them, the

SPV is the actual issuer of the bonds.

MR BOND SAYS, ‘NO COUPON CAN COMPENSATE FOR

THE RISK YOU ARE BEING ASKED TO TAKE’

The key points are:

•

Bondholders have access only to the SPV’s

assets, i.e. the securitised loans, referred to as

collateral, which are the only assets of the issuer.

You should expect credit enhancement by

over-collateralisation

•

Bondholders are wholly dependent on the cash-

flows from the collateral to service coupons and

the repayment of the loans underlying the collateral

to repay principal.

As a simple summary, a corporate bond has two

years accounts to support it, an ABS has hard assets,

collateral, to provide the cash-flows to service coupons;

the collateral is self-liquidating which provides the

capital to redeem the bonds.